By RoboForex Analytical Department

EUR/USD starts this new week of January in a strong position. It is mainly fluctuating near 1.0855, which is very close to five-month highs. After the market got at hand some facts about a slow-down of the US inflation, dollar got under fierce attacks. This time, investors abandoned the “but on rumors, sell on facts” strategy and went on getting rid of the USD.

Market participants suppose that some positive signals from the background will let the Fed launch the final phase of the tight monetary policy.

Investors estimate the increase in the interest rate, expected by the market in February, as 25 base points. This is forecast by almost 92% of the poll participants.

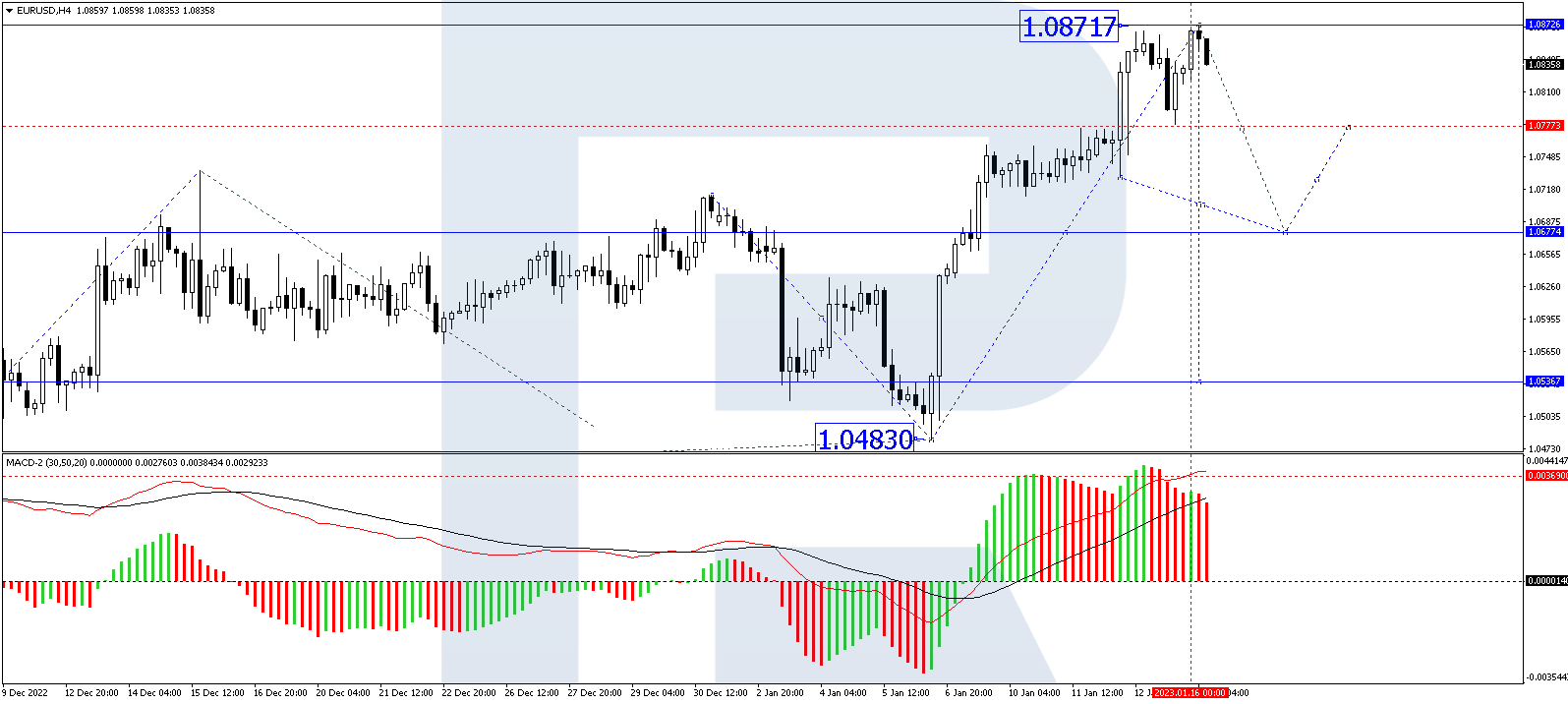

On H4, EUR/USD has completed a wave of growth to 1.0871. Today the market is forming an impulse of decline to 1.0777. Practically, a consolidation range is likely to develop at these levels. With an escape downwards, a wave of decline should continue to 1.0677. Technically, this scenario is confirmed by the MACD: its signal line is at the highs, getting ready for a decline to zero.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

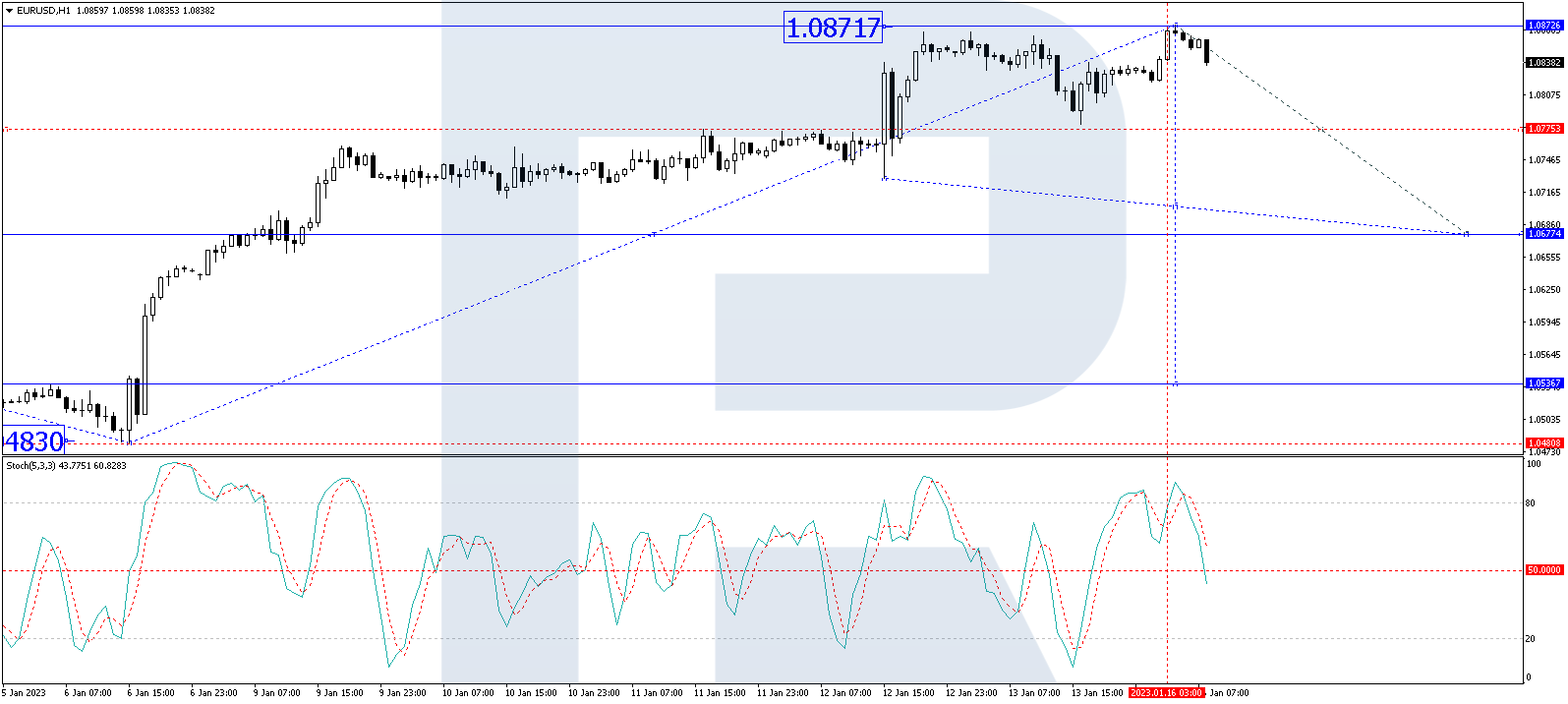

On H1, the pair has formed a structure of a wave of growth to 1.0872. Today the market is developing the first wave of decline to 1.0775. After this level is reached, a link of correction to 1.0808 is not excluded, followed by a decline to 1.0677. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is above 80. A decline to 50 is expected. With a breakaway downwards here, a pathway for 20 will open.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024

- USDJPY bulls venture into intervention zone Nov 20, 2024

- The PBoC kept interest rates. The escalating war between Ukraine and Russia is negatively affecting investor sentiment Nov 20, 2024