Article By RoboForex.com

EURUSD, “Euro vs US Dollar”

EURUSD is rebounding from Kijun-Sen. The instrument is currently moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the bullish channel’s upside border at 1.0040 and then resume moving downwards to reach 0.9780. Another signal in favour of a further downtrend will be a rebound from the descending channel’s upside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 1.0165. In this case, the pair may continue growing towards 1.0250. To confirm a further downtrend, the price must break the bullish channel’s downside border and fix below 0.9985.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is testing Tenkan-Sen and Kijun-Sen. The instrument is currently moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test the cloud’s upside border at 133.25 and then resume moving upwards to reach 140.35. Another signal in favour of a further uptrend will be a rebound from the rising channel’s downside border. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 133.45. In this case, the pair may continue falling towards 132.55. To confirm a further uptrend, the price must break the bearish channel’s upside border and fix above 137.45.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

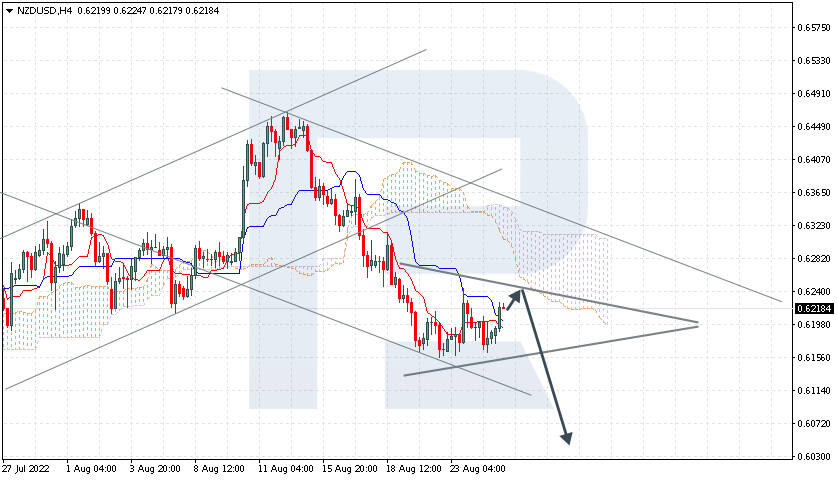

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has fixed below the support area. The instrument is currently moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the cloud’s downside border at 0.6235 and then resume moving downwards to reach 0.6035. Another signal in favour of a further downtrend will be a rebound from the upside border of the Triangle pattern. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 0.6355. In this case, the pair may continue growing towards 0.6445. To confirm a further downtrend, the price must break the pattern’s downside border and fix below 0.6135.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024

- Bitcoin hits an all-time high above $88,000. Oil remains under pressure Nov 12, 2024

- Brent Crude Stumbles as Market Sentiments Turn Cautious Nov 12, 2024

- Bitcoin hits new record high just shy of $82,000! Nov 11, 2024

- The Dow Jones broke the 44 000 mark, and the S&P 500 topped 6 000 for the first time. The deflationary scenario continues in China Nov 11, 2024