As mentioned in our Week Ahead outlook (posted on Fridays), gold was expected to rise on a souring outlook for the global economy.

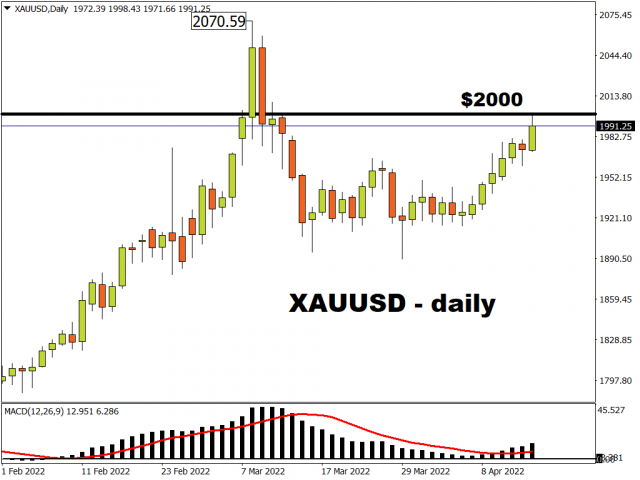

The precious metal duly started off the week by rising to within a whisker of the psychologically-important $2000 mark.

Gold’s climb is all the more remarkable in light of the advances seen in the US dollar and Treasury yields.

Typically, gold has an inverse relationship with those two (when the Dollar/yields rise, gold falls, and vice versa).

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Instead, the precious metal has been able to break off the shackles from that inverse relationship to climb alongside the greenback as well as Treasury yields.

Why is gold climbing again?

A big reason for this surge in gold prices is due to investors sending money into exchange-traded funds (ETFs) that track gold.

With such inflows, the ETF then buys up more gold, driving prices higher.

So far this year, bullion-backed ETFs have made net purchases of 8.77 million ounces of gold, which is 9% more since the start of the year. At 106.6 million ounces, that’s the most amount of gold being held by these ETFs since February 2021. Last week alone, the amount of money sent into ETFs that track commodities (including gold) have tripled, with most of that money going into precious metal ETFs.

In short, there’s a lot of money chasing after bullion.

Why are investors/traders flocking to gold?

1) Demand for safe havens amid fears of a recession

Just a couple of hours ago, the World Bank revised downwards its global GDP forecast to 3.2% for 2022. That is lower than its previous 4.1% forecast made in January, and also slower than 2021’s 5.7% growth.

This past Sunday, Goldman Sachs, a highly influential bank on Wall Street, forecasted a 35% chance of a recession in the US over the next two years. Such headlines across the financial news wires fuelled more demand for safe havens – assets which can protect investors’ wealth in times of great fear and uncertainty.

READ MORE: What are safe haven assets?

Also, markets are concerned that the prolonged lockdowns in China could mean a challenging 2022 for the rest of the world, despite China announcing a better-than-expected Q1 GDP print earlier today.

Then there’s also the war in the Ukraine that’s driving up global inflation and investors’ fears. With inflation already at eye-watering heights, a drastic pullback in spending (because consumers can no longer afford those sky-high prices) could mean slower economic growth, or worse, a recession.

2) Gold as an inflation hedge

Gold has long been seen as a way to preserve investors wealth against rising consumer prices. In light of the red-hot inflation figures seen around the world, this narrative is getting louder and attracting more believers, which is sending gold prices higher.

READ MORE: Inflation everywhere! What does it mean for markets?

Where to next for gold prices?

$2000 seems imminent for gold.

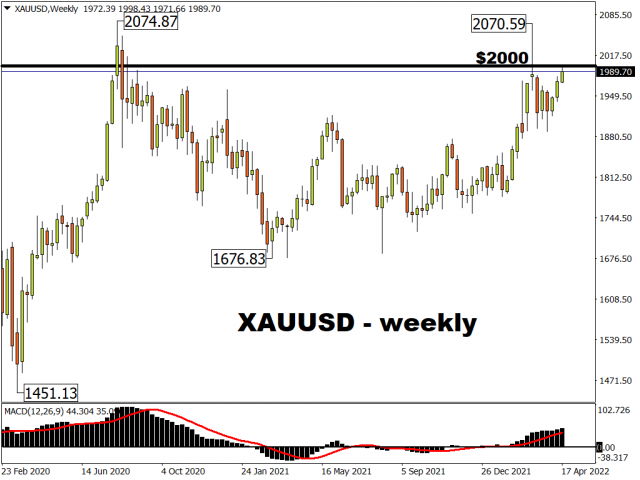

If it crosses above that psychologically-important mark, which appears likely at this stage, then there’s little resistance on the way back to the $2070 region.

Gold bulls will be looking to launch another assault at the $2074.87 record high that was recorded in August 2020. After all, they came tantalizingly close back in March, coming to within less than five dollars of the precious metal’s highest-ever peak.

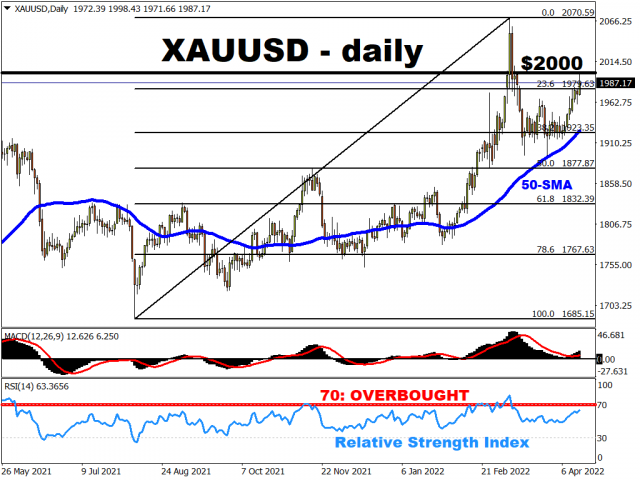

The fact that gold was able to punch past a key resistance level, being the 23.6% Fibonacci retracement line from the August 2021 through March 2022 ascent, may just have paved the way for $2000 gold this week.

However, a note of caution …

Looking at the past two times when gold broke above $2000, it wasn’t able to hold its head above that level for long.

And such an episode may play out again for a third time.

With the 14-day relative strength index looking to surpass the 70 threshold which typically denotes overbought conditions, such a technical event could trigger a swift pullback in gold prices.

What needs to happen this week to send gold prices …

- above $2000?

From a fundamental perspective, markets have to be fed even more negative headlines about a global economy or inflation that’s becoming worse.

The IMF (International Monetary Fund) is expected to make a downward revision to its forecast for how much the global economy can grow this year. This is due in part to the ongoing war between Russia and the Ukraine, which is keeping commodity prices elevated and threatening a recession in other countries.

More dire warnings about the global economy by the IMF could encourage gold bulls.

- back down to the mid-$1900s?

On the other hand, gold could be met with a moment of reckoning if we see even more hawkish talk out of Fed officials.

Note that these central bankers are about to enter a period of radio silence (no public statements) before the next FOMC meeting in the first week of May.

Hence, this week would be the last chance market participants can get more clues about whether the Fed will hike by 50-basis points in May, which would be double the usual adjustments of 25 basis points at a time.

If markets are surer that larger-than-usual Fed rate hikes are in store, that should send Treasury yields even higher, with yields on 10-year Treasuries moving even closer to the psychologically-important 3% mark.

Typically, the higher Treasury yields go, then demand for gold weakens.

This is usually because investors might pivot towards the higher yields that Treasuries offer compared to gold which offers zero yields (the precious metal doesn’t offer payments in return for holding it).

While as pointed out at the start of this report that the inverse relationship between Treasury yields/dollar and gold prices has been broken for a while, it could still come back with a vengeance and foil gold bulls’ attempt to post a new record high in the immediate future.

Such a pullback could see gold then retesting support around the $1980 mark, with stronger support potentially arriving at the February peak of $1974.42, followed by the previous cycle high of $1966.20.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024

- USDJPY bulls venture into intervention zone Nov 20, 2024

- The PBoC kept interest rates. The escalating war between Ukraine and Russia is negatively affecting investor sentiment Nov 20, 2024