Get ready for a (potentially) tumultuous Thursday, especially for euro traders (which likely includes most FX traders, seeing as EURUSD is the world’s most popularly traded currency pair).

At 13:30 GMT today (Thursday, March 10th 2022), there are two major events that are set to happen simultaneously:

- The US February inflation (consumer price index) data is released

- European Central Bank President, Christine Lagarde, will be holding a press conference, about 45 minutes after the ECB announces its policy decision

What are markets expecting for the US inflation data?

The US consumer price index (CPI) is forecasted to grow by 7.9% last month compared to prices in February 2021.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

If so, that would be the highest CPI figure since January 1982.

NOTE: The CPI measures how fast consumer prices are changing.

If the CPI announcement at 13:30GMT today shows higher-than-expected inflation, that should also mean that the Fed has little choice but to raise interest rates in the US more frequently this year (markets are now forecasting 6 rate hikes for 2022), and even perhaps by a larger amount each time.

What are markets expecting out of ECB’s Lagarde?

Now this one is a lot trickier.

Back in early February, the European Central Bank had already announced to the markets that it intends to ease away from its supportive measures that had been rolled out amid the pandemic.

But that was before Russia invaded Ukraine.

Now, with war raging on and casting a dark cloud over how markets view the Eurozone’s economic performance in the months ahead, the ECB might have to reverse course and continue supporting the economy.

To be clear, the ECB isn’t expected to make any actual policy adjustments today.

However, given the forward-looking nature of markets, investors and traders are more concerned with what the ECB intends to do in the future.

Hence markets will be eager to know whether the ECB will press on with raising interest rates (perhaps in September) to combat inflation, knowing that such a move could unintentionally worsen the EU’s economic performance (higher interest rates tends to lower consumption spending as well) … or worse, trigger a recession.

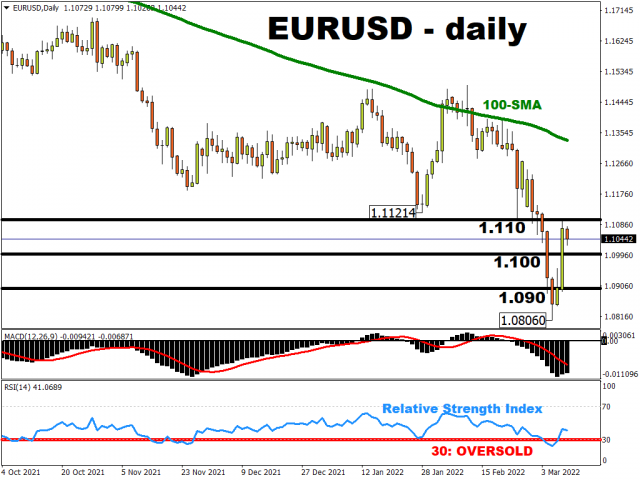

How might EURUSD react to ECB announcement + US inflation?

SCENARIO 1:

US inflation higher than 7.9% (that encourages the Fed to hike rates higher and faster)

+

ECB’s Lagarde saying there’s less chance of a rate hike

=

potentially EURUSD being dragged lower back towards 1.08.

———–

SCENARIO 2:

US inflation that’s substantially lower than 7.9% (that suggests consumer prices are cooling and the Fed can afford to be less aggressive with rate hikes)

+

ECB’s Lagarde saying that she and her colleagues will press ahead with rate hikes this year

=

potentially EURUSD being boosted back above 1.11, and testing the January-2022 low of 1.11214 for resistance.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- NZD/USD Hits Yearly Low Amid US Dollar Strength Nov 26, 2024

- Trump plans to raise tariffs by 10% on goods from China and 25% on goods from Mexico and Canada Nov 26, 2024

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024