As the fog of war rolls across global financial markets, global investors and traders will also be paying close attention to this week’s ECB policy decision and the latest US inflation data, and the latter’s impact on the Fed’s intended rate hikes.

Here are the key scheduled economic data releases and events slated for this week:

Monday, March 7

Tuesday, March 8

- EUR: Eurozone 4Q GDP (final)

- EUR: Germany January industrial production

- Apple’s first product unveiling of 2022

Wednesday, March 9

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Thursday, March 10

Friday, March 11

- EUR: Germany February CPI (final)

- GBP: UK January monthly GDP, industrial production, and March inflation attitudes

- CAD: Canada February unemployment

- USD: US March consumer sentiment

Traders are battling to process new information that is constantly coming out about the current environment. This includes the harshest geopolitical situation in decades, a melt-up in commodity and energy prices, an unfriendly U.S Federal Reserve who appear keen to commence policy tightening, and 40-year highs in inflation which will only go north in the current climate.

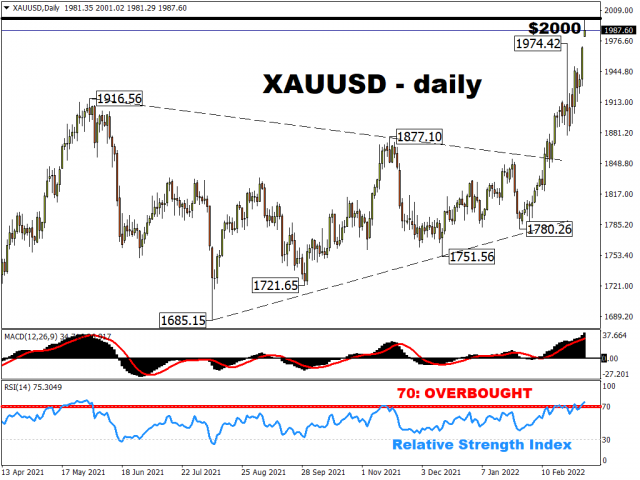

Certainly, safe havens are being sought with gold closing very strongly last week near its recent highs.

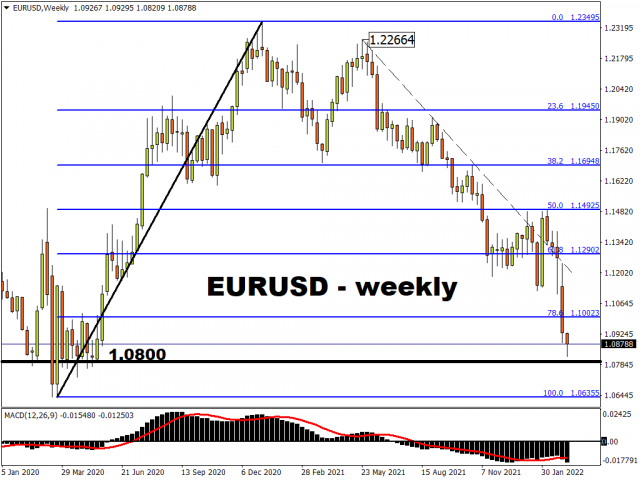

Interestingly, different regions are showing distinct levels of performance, especially among major currencies. Commodity-linked foreign exchange like AUD and NZD are clearly enjoying the parabolic moves in energy, agricultural goods and metals. Meanwhile, the euro and other European currencies are being sold very aggressively as the growth prospects look bleak. This sentiment looks set to continue, even if the charts of some of the crosses are hugely oversold on multiple timeframes and indicators, and due a rebound. But “catching a falling knife” springs readily to mind, as price action continues to travel way beyond most technical measures.

Fed Chair Powell recently delivered a vote of confidence in the U.S economy as he signalled the case for a 25bp rate hike at the FOMC meeting next week.

The market has priced back some of the policy tightening which had disappeared and still sees more than five rate hikes for this year. The dollar has happily assumed its status as a safe haven, notably pushing the oversold EUR/USD to 1.09. The March 2020 Covid-peak low at 1.0635 is a huge line in the sand.

We note that the Fed’s blackout period has started so there won’t be any further comments from Fed officials ahead of its 16 March meeting.

The US releases CPI inflation for February which will be a good gauge for current price pressures.

The annual rate is set to rise to multi-decade highs at 7.8% with the core reading at 6.4%. Prints beyond 8% are certainly on the radar in the coming months, putting more pressure on policymakers and underpinning the dollar.

The ECB meeting will be a huge focus as the major central bank with conflict on its doorstep.

The bank is set to strike a cautious stance between staying on track for policy normalisation and keeping maximum flexibility. The already-announced rotation of its bond buying programmes is expected to continue. With the market currently pricing in 25bps of rate hikes by year end, the fate of the battered euro in the near term will be in President Lagarde’s hands.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024

- USDJPY bulls venture into intervention zone Nov 20, 2024

- The PBoC kept interest rates. The escalating war between Ukraine and Russia is negatively affecting investor sentiment Nov 20, 2024

- AUD/USD Consolidates After Recent Gains Nov 20, 2024

- The RBA will maintain a restrictive monetary policy until the end of the year. Nov 19, 2024

- Safe-haven assets rally on nuclear concerns Nov 19, 2024

- Gold Rebounds Amid USD Weakness and Geopolitical Uncertainties Nov 19, 2024