By Orbex

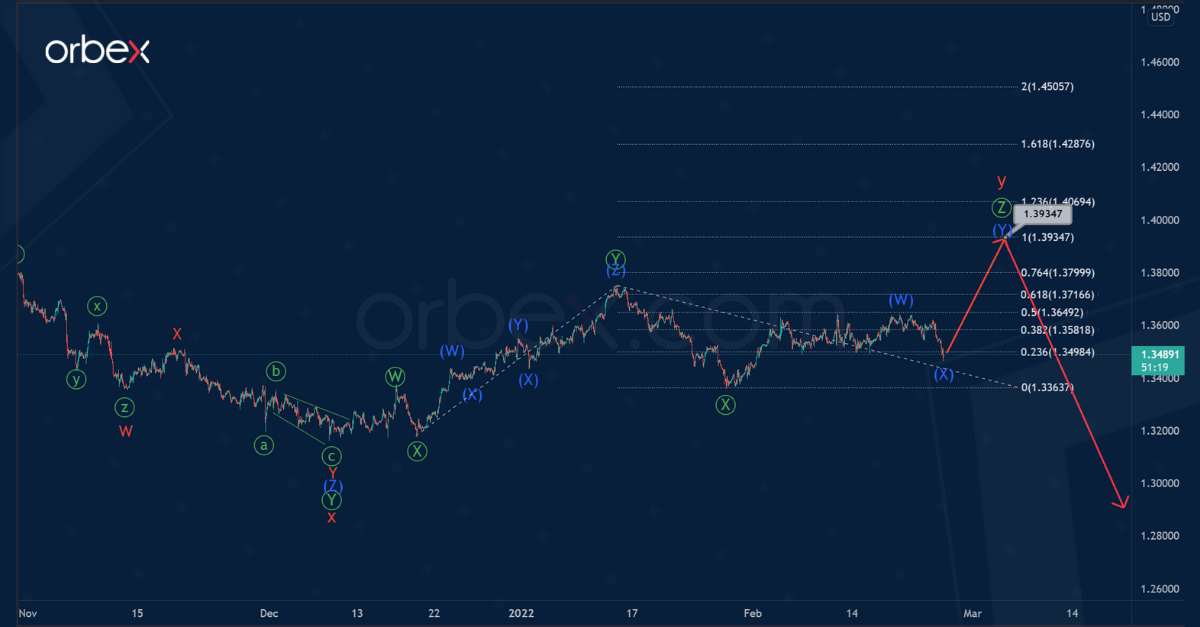

The current formation of the GBPUSD currency pair suggests the development of a large intervening wave x of the cycle degree. This most likely takes the form of a triple zigzag Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ of the primary degree.

The first four primary sub-waves seem complete. It is likely that the growth in the second intervening wave Ⓧ came to an end near 1.3748. It is similar to a double zigzag (W)-(X)-(Y) of the intermediate degree. Then the development of the primary wave Ⓩ began.

In the near future, the price is likely to continue to decline in the wave Ⓩ. This likely takes the form of an intermediate zigzag (A)-(B)-(C), as shown on the chart. The end of the market decline in this wave is likely to reach the 1.3117 area. At that level, wave Ⓩ will be at 76.4% of primary wave Ⓨ.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Let’s consider an alternative scenario, where the primary double zigzag Ⓦ-Ⓧ-Ⓨ ended. Now a cycle actionary wave y is developing.

Most likely, the wave y takes the form of a primary triple zigzag. In the upcoming trading weeks, we can expect an increase in the rate in the final double zigzag (W)-(X)-(Y). In turn, this can complete the wave Ⓩ near 1.393

At the specified price point, wave Ⓩ will be at 100% of wave Ⓨ.

Article by Orbex

Article by Orbex

Orbex is a fully licensed broker that was established in 2011. Founded with a mission to serve its traders responsibly and provides traders with access to the world’s largest and most liquid financial markets. www.orbex.com

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024