Gold bulls went into hiding on Wednesday as investors awaited the outcome of the Federal Reserve meeting this evening.

It has been a choppy week for the commodity so far with price down almost 0.2% since Monday. When looking at gold, it remains the same old story with bulls and bears engaged in a tough tug of war. As highlighted yesterday, there is no doubt that the next few days will be eventful with its near-term outlook impacted by the looming Fed meeting.

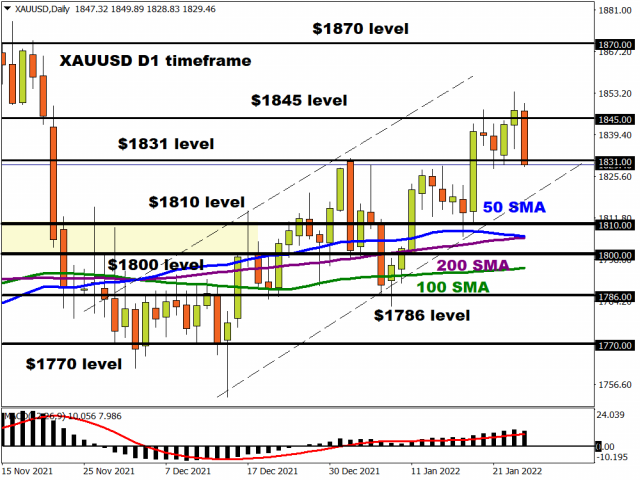

Markets widely expect the Fed to leave interest rates unchanged in January. However, investors will closely scrutinise the meeting for fresh insight into the Fed’s aggressive monetary policy path for 2022. Should Fed hawks dominate the scene, this could hit buying sentiment towards gold with prices sinking back towards $1810 and $1800 in the short term. A strong daily close below the psychological $1800 level could open the doors towards$1786.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

If the Fed shows any hesitancy in future rate hikes, this could rekindle appetite for zero-yielding gold, pushing prices back towards $1845 and $1870.

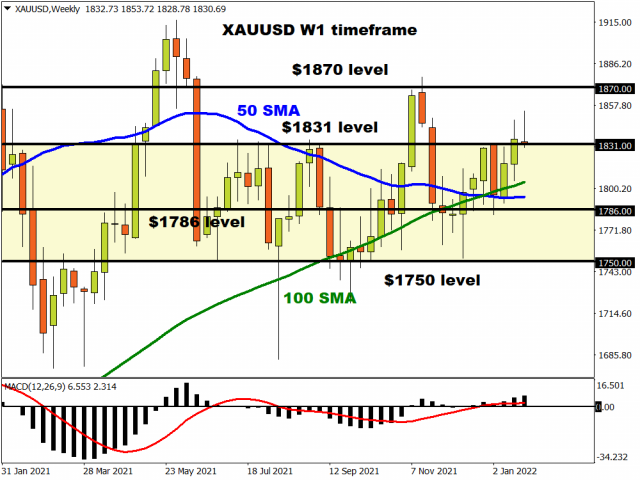

Looking beyond today, the road ahead for gold remains rocky and filled with many obstacles. 2022 is already shaping up to be a rough and uncertain year for the metal thanks to Fed hike expectations and a stronger dollar. If Treasury yields continue to rise, this may compound to gold’s woes, paving the way for steeper declines. It may be wise to keep a close eye on the weekly timeframe. Prices still remain in a very wide range while the MACD is flat. Bulls look slightly exhuasted with a bearish pin bar in the making. Should prices end the week below $1831, this could signal a decline back towards the $1786 level and $1750, respectively.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024