Article By RoboForex.com

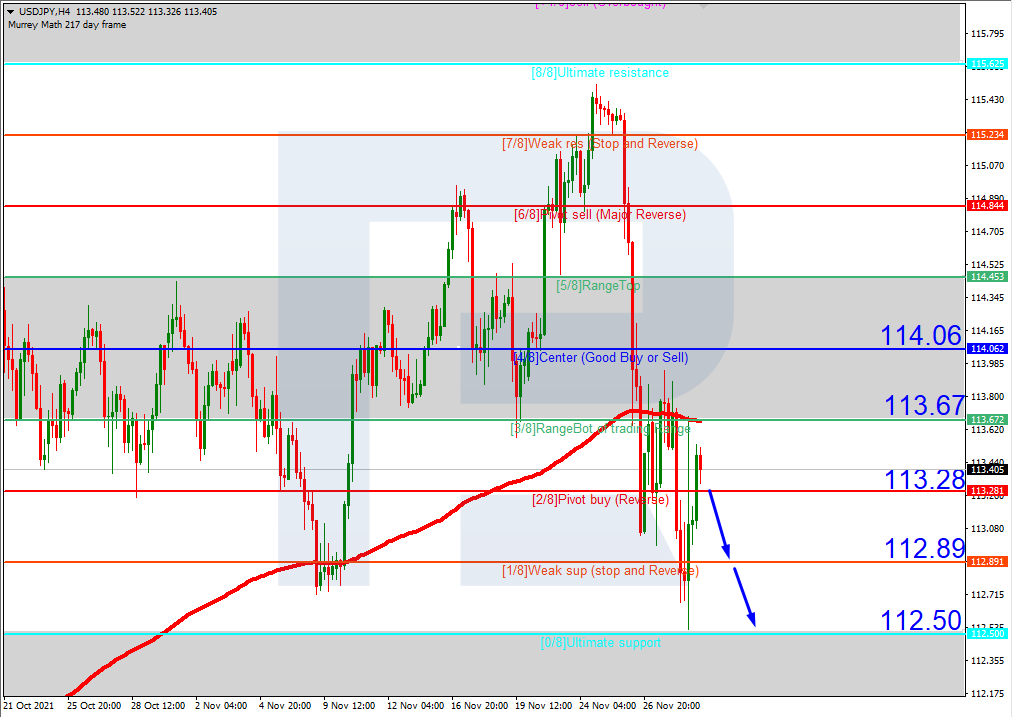

USDJPY, “US Dollar vs. Japanese Yen”

In the H4 chart, after breaking the 200-day Moving Average, USDJPY is trading below it, thus indicating a descending tendency. In this case, the price is expected to test 2/8, break it, and continue falling to reach the support at 0/8. However, this scenario may no longer be valid if the price breaks 3/8 to the upside. After that, the instrument may reverse and grow towards the resistance at 5/8.

As we can see in the M15 chart, the downside line of the VoltyChannel indicator is pretty far away from the price, that’s why the pair may resume trading downwards only after breaking 2/8 in the H4 chart.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

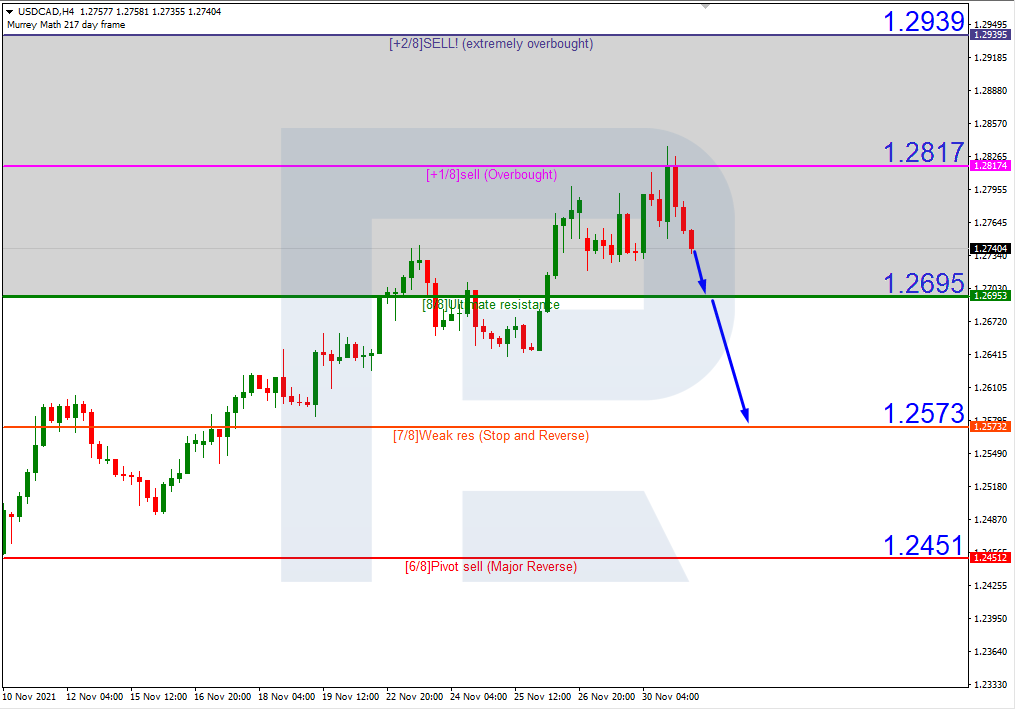

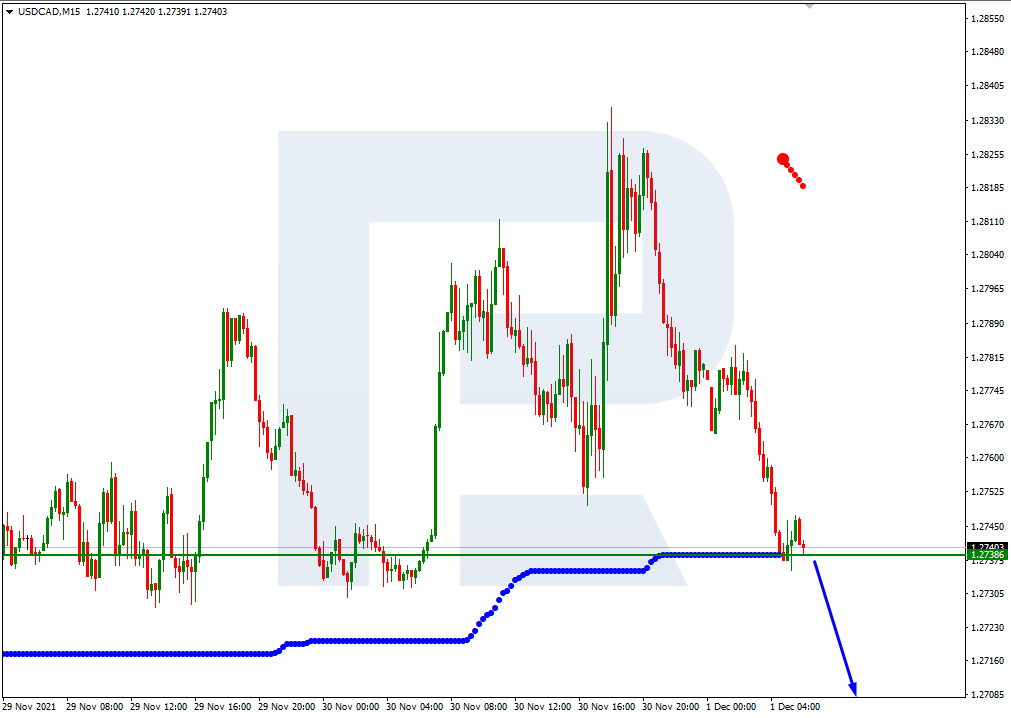

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, USDCAD is trading within the “overbought area”. In this case, the price is expected to test the support at 8/8, break it, and then continue falling towards 7/8. Still, this scenario may no longer be valid if the price breaks the resistance at +1/8 to the upside. After that, the instrument may grow to reach +2/8.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue falling.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Goldman Sachs has updated its economic projections for 2025. EU countries are looking for alternative sources of natural gas Dec 23, 2024

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & 10-Year Bonds Dec 21, 2024

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Palladium Dec 21, 2024

- COT Soft Commodities Charts: Speculator Bets led by Live Cattle, Lean Hogs & Coffee Dec 21, 2024

- COT Stock Market Charts: Speculator Bets led by S&P500 & Russell-2000 Dec 21, 2024

- Riksbank and Banxico cut interest rates by 0.25%. BoE, Norges Bank, and PBoC left rates unchanged Dec 20, 2024

- Brent Oil Under Pressure Again: USD and China in Focus Dec 20, 2024

- Market round-up: BoE & BoJ hold, Fed delivers ‘hawkish’ cut Dec 19, 2024

- NZD/USD at a New Low: The Problem is the US Dollar and Local GDP Dec 19, 2024

- The Dow Jones has fallen for 9 consecutive trading sessions. Inflationary pressures are easing in Canada. Dec 18, 2024