After much hype, we are now just days away from the Federal Reserve’s flagship event, the Jackson Hole Economic Symposium. This keenly-awaited event however will be held virtually for a second consecutive year, this time due to concerns over the resurgence of Covid-19.

Besides the comments by Fed officials at the symposium, here’s a list of notable market-related events for the week:

Monday, August 23

- EUR: Eurozone August manufacturing, services and composite PMIs

- GBP: UK August manufacturing, services and composite PMIs

- USD: US August manufacturing, services and composite PMIs

Tuesday, August 24

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Wednesday, August 25

Thursday, August 26

- USD: US weekly jobless claims and 2Q GDP (second estimate)

Friday, August 27

- CNH: China July industrial profits

- USD: US July personal income and spending

- USD: US July PCE price index

- USD: US August consumer sentiment (final)

- USD: Fed Chair Jerome Powell delivers speech virtually at Jackson Hole Symposium

Market participants will be clinging on to every word uttered by Fed Chair Jerome Powell, and those of the other Fed officials who might be commenting as part of the yet-to-be-unveiled full agenda (to be released on 26 August).

US policymakers are seemingly on the cusp of easing up on their asset purchases that have shored up global financial markets since the pandemic. The FOMC July meeting minutes that was just released last week suggested that the tapering could even begin before 2021 is over.

Experienced market observers know that the symposium, where policymakers traditionally engage in open discussion, could produce the slightest hint about the Fed’s next policy move and such hints, if they happen, could jolt multiple asset classes.

Dollar poised to climb another leg up on more tapering talk

Some market participants think this will be a non-event, given how much various Fed officials have already telegraphed their tapering intentions over recent months. Others however are bracing for heightened volatility on potential cues out of Fed officials, judging by positioning in the options markets for various asset classes.

Should Fed officials on Friday point to an even more bullish case for tapering, that might push the US dollar even higher while prompting the likes of gold and US stocks to unwind more of their recent gains.

However, should Fed Chair Jerome Powell, in his virtual speech on Friday, pour cold water on the thought of announcing the Fed’s tapering plans anytime soon, that could prompt the greenback to unwind recent gains while potentially evoking a cheer out of gold and stock market bulls.

Friday data could overshadow Powell’s speech

Investors and traders worldwide will also be assessing whether the views espoused by Powell, a notable dove, would be in line with the latest US economic data. Before the Fed chair even utters a single word on Friday, investors will be poring over the trove of figures on US personal income and spending, as well as the Fed’s preferred inflation gauge, the PCE price index.

If the data suggests that the US economic recovery is roaring ahead and that the Fed has to taper sooner rather than later, market participants might pay less heed to Powell’s potentially dovish coos and instead race ahead of the world’s most influential central bank that markets think might be at risk of falling behind the inflation curve.

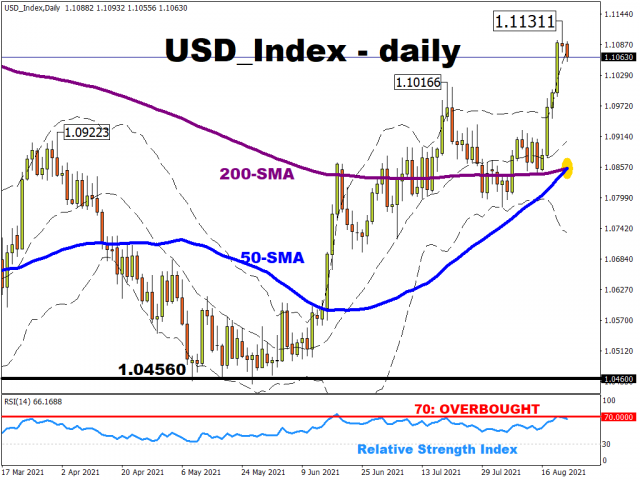

USD Index forms golden cross

Note that the equally-weighted US dollar index is now pulling away from technically overbought territory, as it moderates back to within its Bollinger band and its 14-day relative strength index returns below the 70 line which typically denotes overbought conditions. Yet, it has the potential to set a new 9-month high if dollar bulls are emboldened by heightened prospects of a Fed’s tapering announcement that’s looming closer.

And having formed a golden cross (where its 50-day simple moving average crosses above its 200-day counterpart), such a technical event also typically paves the way for more upside.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024

- Bitcoin hits an all-time high above $88,000. Oil remains under pressure Nov 12, 2024

- Brent Crude Stumbles as Market Sentiments Turn Cautious Nov 12, 2024

- Bitcoin hits new record high just shy of $82,000! Nov 11, 2024

- The Dow Jones broke the 44 000 mark, and the S&P 500 topped 6 000 for the first time. The deflationary scenario continues in China Nov 11, 2024