If during the first quarter of this year we commented that the U.S. dollar was experiencing a rebound against the main currencies, and as we commented in past analyses, during last April, the dollar yielded 2.11% compared to the main currencies with a decrease reflected in the dollar index from the $93.36 with which it opened last April to the $91.27 rate at the end of the month.

This decline can be explained by the relaxation in the yields of North American bonds and the uncertainty in relation to whether or not the Federal Reserve will finally make a decision on its current monetary policy, in terms of tightening it due to the economic recovery. However, these doubts seem to have dissipated for the moment, following the bad unemployment data on Friday.

Specifically, in the employment data for last April, we can see that not only were they not lower than those of last month, but they fell far short of market expectations after creating 266,000 jobs compared to the 770,000 expected, negatively impacting the dollar.

EURUSD analysis

Market attention last week focused mainly on employment data from the United States after the important NFP was released on Friday. This data was especially bad, since 266,000 jobs were created compared to the 770,000 expected, affecting the dollar significantly, so the EURUSD managed to overcome the medium-term downtrend line.

Technically speaking, the break of this trend line can cause a new upward momentum that takes the price to levels not seen since the beginning of the year, although for this we must be attentive as to whether the price is able to maintain this break. On the contrary, the loss of the 18 session average would in turn endanger the 1.20 level and open the doors to a further decline.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Source: Daily chart of the EURUSD of the Admiral Markets MetaTrader 5 platform from January 23, 2020 to May 10, 2021. Taken on May 10 at 12:45 CEST. Note: Past performance is not a reliable indicator of future results, or future performance.

Source: Daily chart of the EURUSD of the Admiral Markets MetaTrader 5 platform from January 23, 2020 to May 10, 2021. Taken on May 10 at 12:45 CEST. Note: Past performance is not a reliable indicator of future results, or future performance.

Evolution of the last 5 years:

- 2020 = + 8.93%

- 2019 = -2.21%

- 2018 = -4.47%

- 2017 = + 14.09%

- 2016 = -3.21%

GBPUSD analysis

In the case of GBPUSD, we can see that this pair is following a very clear upward trend since it marked minimums on March 20, 2020 around the level of 1.14100 until it almost reached the level of 1.42366, which led it to exceed its long-term downtrend line (in dotted red).

As we can see in the weekly chart, after marking maximums last February, the EURUSD price began a correction that led it to lose the important level of 1.40. This was in search of its average of 18 sessions, where it has found an important support point to start a new momentum that has led it to break above not only the 1.40 level but also to trade at levels close to 1.41.

As long as the price does not lose its average of 18, the feeling will continue to be bullish. The final loss of the 1.40 and the 18 average would unlock a further correction to the previous resistance level in red.

Source: GBPUSD weekly chart from Admiral Markets MetaTrader 5 platform from September 28, 2014 to May 10, 2021. Taken on May 10 at 1:10 p.m. CEST Note: Past performance is not a reliable indicator of future results, or future performance.

Source: GBPUSD weekly chart from Admiral Markets MetaTrader 5 platform from September 28, 2014 to May 10, 2021. Taken on May 10 at 1:10 p.m. CEST Note: Past performance is not a reliable indicator of future results, or future performance.

Evolution of the last 5 years:

- 2020 = + 3.10%

- 2019 = + 3.95%

- 2018 = -5.54%

- 2017 = + 9.43%

- 2016 = -16.26%

USDJPY Analysis

Finally, if we take a look at the USDJPY pair, we can observe how the Japanese Yen was one of the currencies that was greatly affected by the increases in the dollar. This is because, during the rises in February and March, it went from trading at levels close to 102,700 to trading at levels close to 111,000. As we can see in the weekly chart, after facing its important support level for a long time, represented by the red band, the price definitely bounced past the 200 red average and the long-term downtrend line.

As we have commented previously, during the month of April this currency pair fell by 1.29%, leading the price to find the coincident zone of its 200 session average and the downtrend line, thus leaving the accumulated overbought.

Technically speaking, we must pay attention to the evolution of the price in the coming weeks, since if the price confirms the upward break of the previous resistance levels that currently act as the main support, the price could look for the upper band of the lateral channel in green. On the contrary, if the price re-enters lower levels, we could obtain a greater correction.

Source: Weekly USDJPY chart from Admiral Markets MetaTrader 5 platform from December 14, 2014 to May 10, 2021. Taken on May 10 at 1:15 PM CEST. Note: Past performance is not a reliable indicator of future results, or future performance.

Source: Weekly USDJPY chart from Admiral Markets MetaTrader 5 platform from December 14, 2014 to May 10, 2021. Taken on May 10 at 1:15 PM CEST. Note: Past performance is not a reliable indicator of future results, or future performance.

Evolution of the last 5 years:

- 2020 = -4.95%

- 2019 = -0.88%

- 2018 = -2.76%

- 2017 = -3.59%

- 2016 = -2.85%

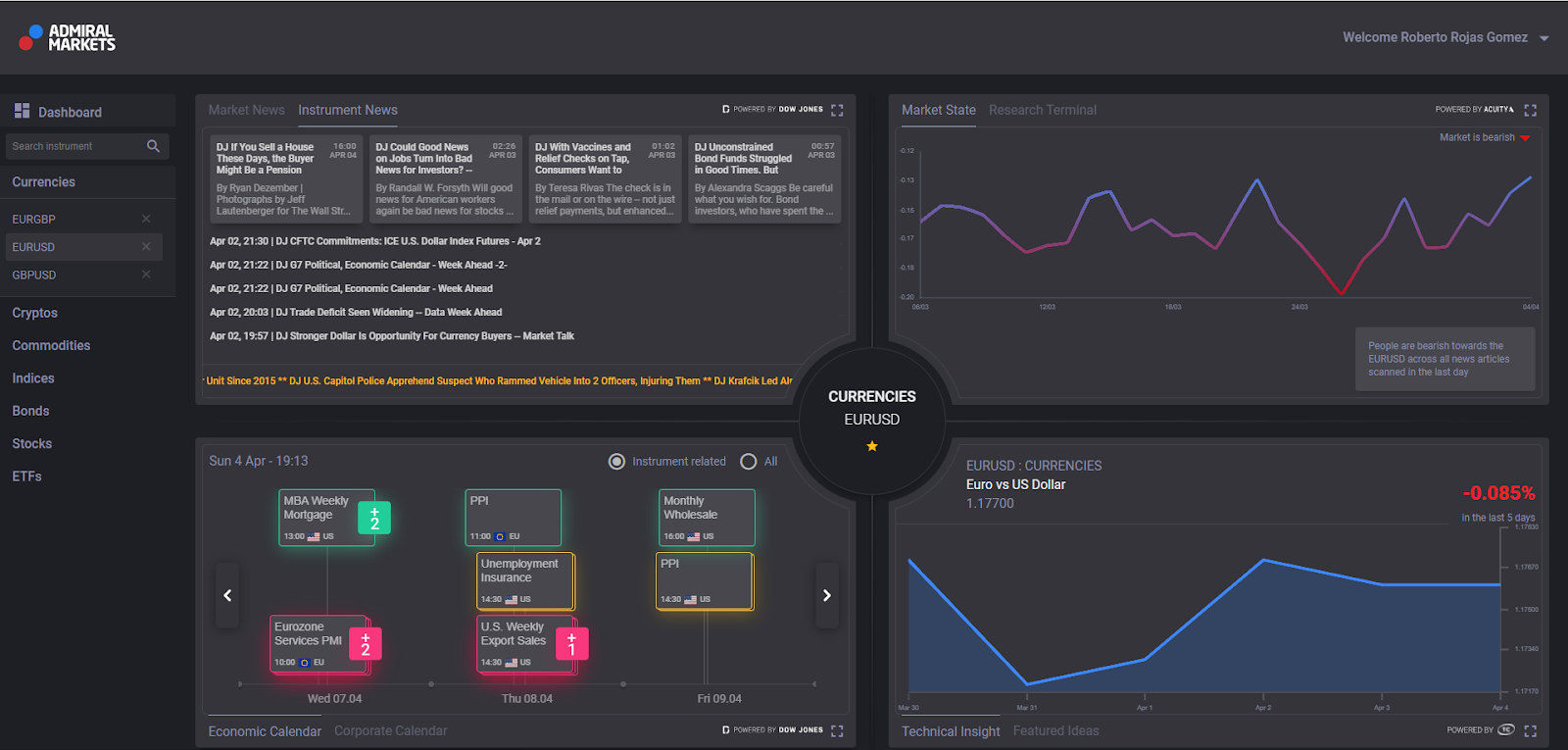

Discover Premium Analytics

With Premium Analytics, you can follow all the important news and get the latest macroeconomic data through the news and the economic calendar offered by Dow Jones:

With the Admirals Trade.MT5 account, you can trade Contracts for Differences (CFDs) on EURUSD, GBPUSD and USDJPY and many more instruments. CFDs allow traders to try to profit from bull and bear markets, as well as the use of leverage. Click on the following banner to open an account today:

INFORMATION ABOUT ANALYTICAL MATERIALS:

The given data provides additional information regarding all analysis, estimates, prognosis, forecasts, market reviews, weekly outlooks or other similar assessments or information (hereinafter “Analysis”) published on the websites of Admiral Markets investment firms operating under the Admiral Markets trademark (hereinafter “Admiral Markets”) Before making any investment decisions please pay close attention to the following:

- This is a marketing communication. The content is published for informative purposes only and is in no way to be construed as investment advice or recommendation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

- Any investment decision is made by each client alone whereas Admiral Markets shall not be responsible for any loss or damage arising from any such decision, whether or not based on the content.

- With view to protecting the interests of our clients and the objectivity of the Analysis, Admiral Markets has established relevant internal procedures for prevention and management of conflicts of interest.

- The Analysis is prepared by an independent analyst, Roberto Rojas (analyst), (hereinafter “Author”) based on their personal estimations.

- Whilst every reasonable effort is taken to ensure that all sources of the content are reliable and that all information is presented, as much as possible, in an understandable, timely, precise and complete manner, Admiral Markets does not guarantee the accuracy or completeness of any information contained within the Analysis.

- Any kind of past or modeled performance of financial instruments indicated within the content should not be construed as an express or implied promise, guarantee or implication by Admiral Markets for any future performance. The value of the financial instrument may both increase and decrease and the preservation of the asset value is not guaranteed.

- Leveraged products (including contracts for difference) are speculative in nature and may result in losses or profit. Before you start trading, please ensure that you fully understand the risks involved.

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024

- Bitcoin hits an all-time high above $88,000. Oil remains under pressure Nov 12, 2024

- Brent Crude Stumbles as Market Sentiments Turn Cautious Nov 12, 2024