Article By RoboForex.com

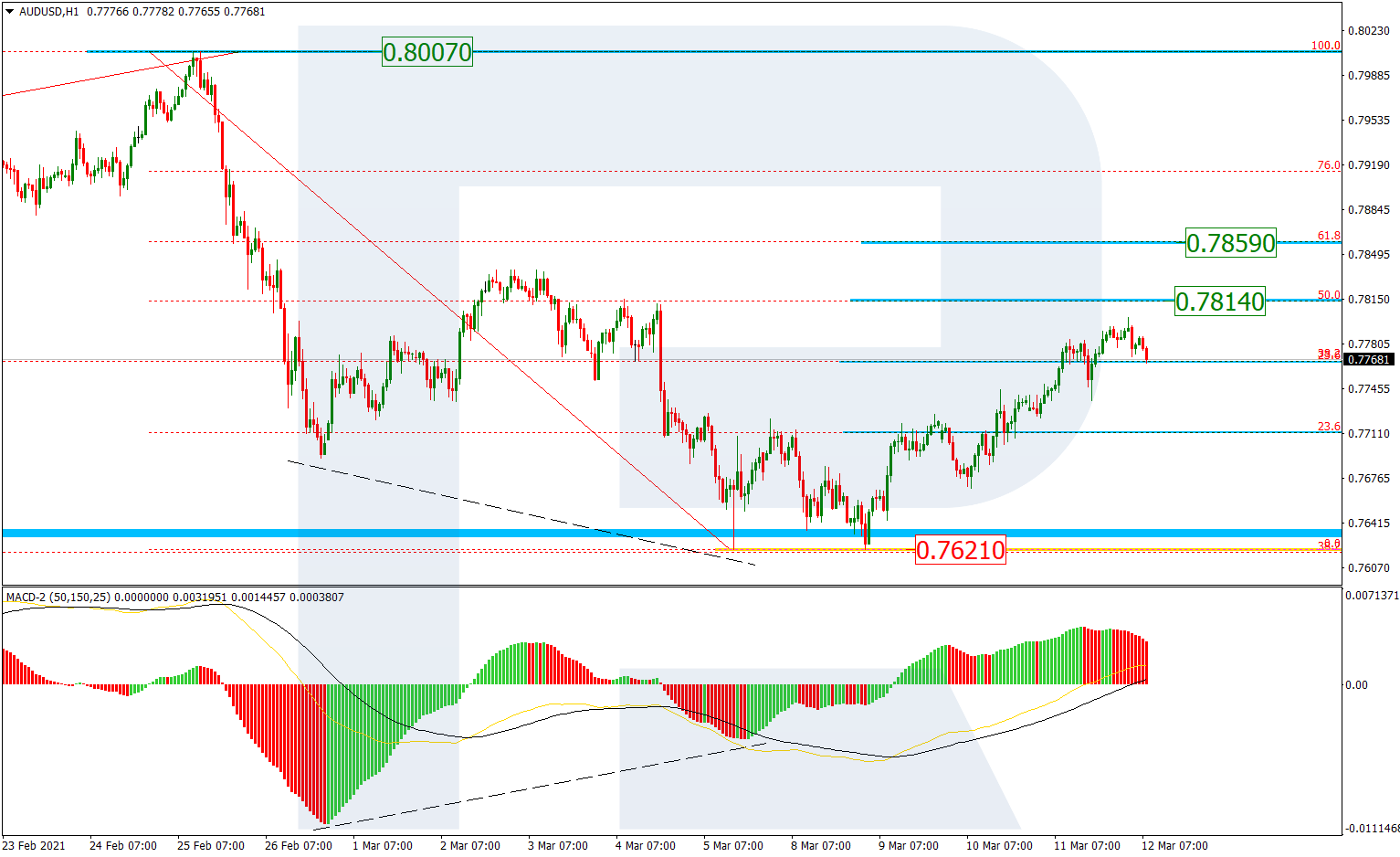

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, the mid-term “bearish” phase in AUDUSD is experiencing a correction to the upside. After testing 38.2% fibo at 0.7619, the asset has started a slight pullback, which may be later followed by a further decline towards 50.0% and 61.8% fibo at 0.7500 and 0.7379 respectively. Despite a global divergence, one shouldn’t exclude a further uptrend to reach the high at 0.8007. if the asset breaks this level, it may continue growing towards the long-term 50.0% fibo at 0.8292.

The H1 chart shows a more detailed structure of the current ascending correction, which has already reached 38.2% fibo. After a short-term decline, the price may continue growing towards 50.0% and 61.8% fibo at 0.7814 and 0.7859 respectively. A breakout of the low at 0.7621, which is the current support, may lead to a further downtrend.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

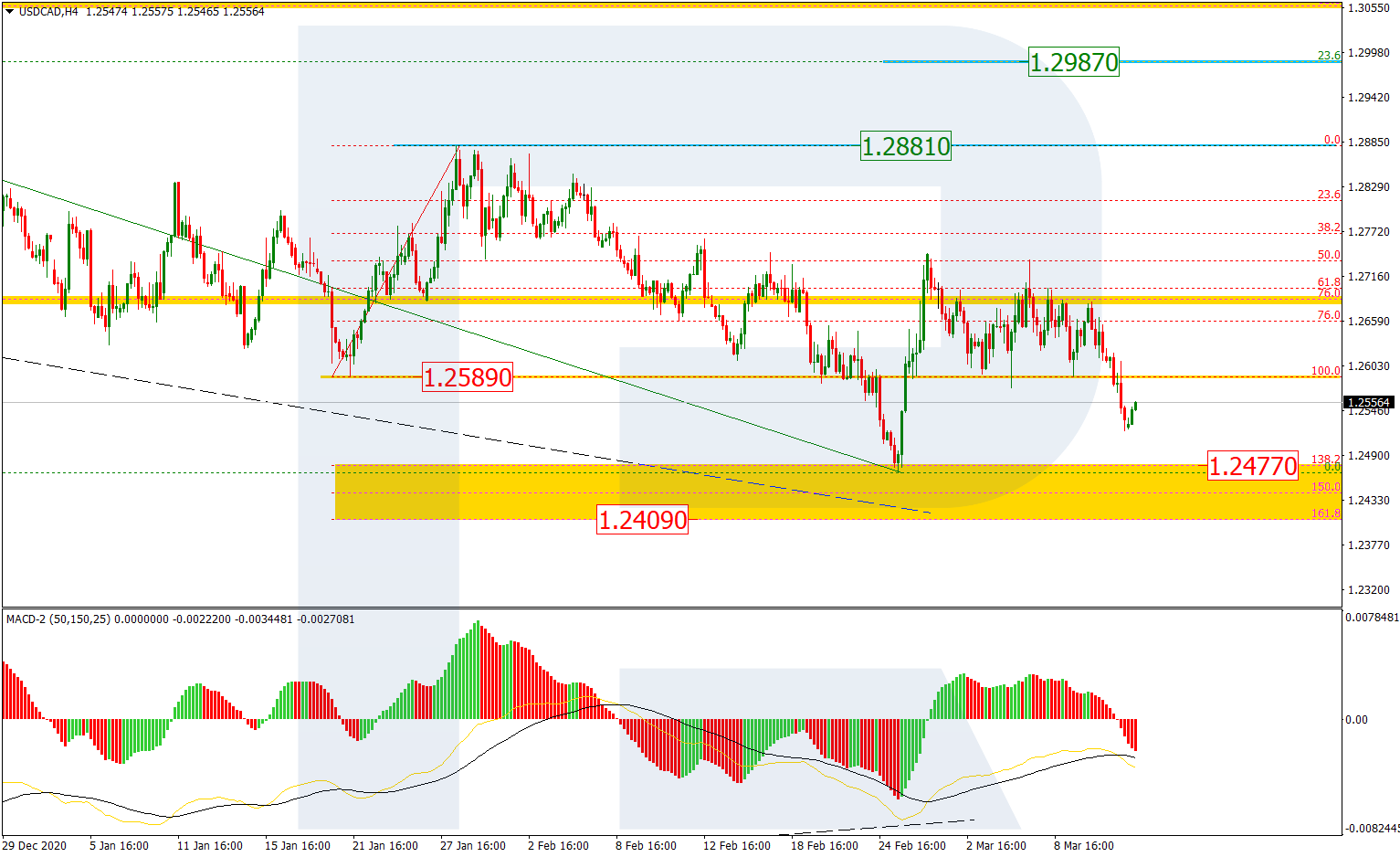

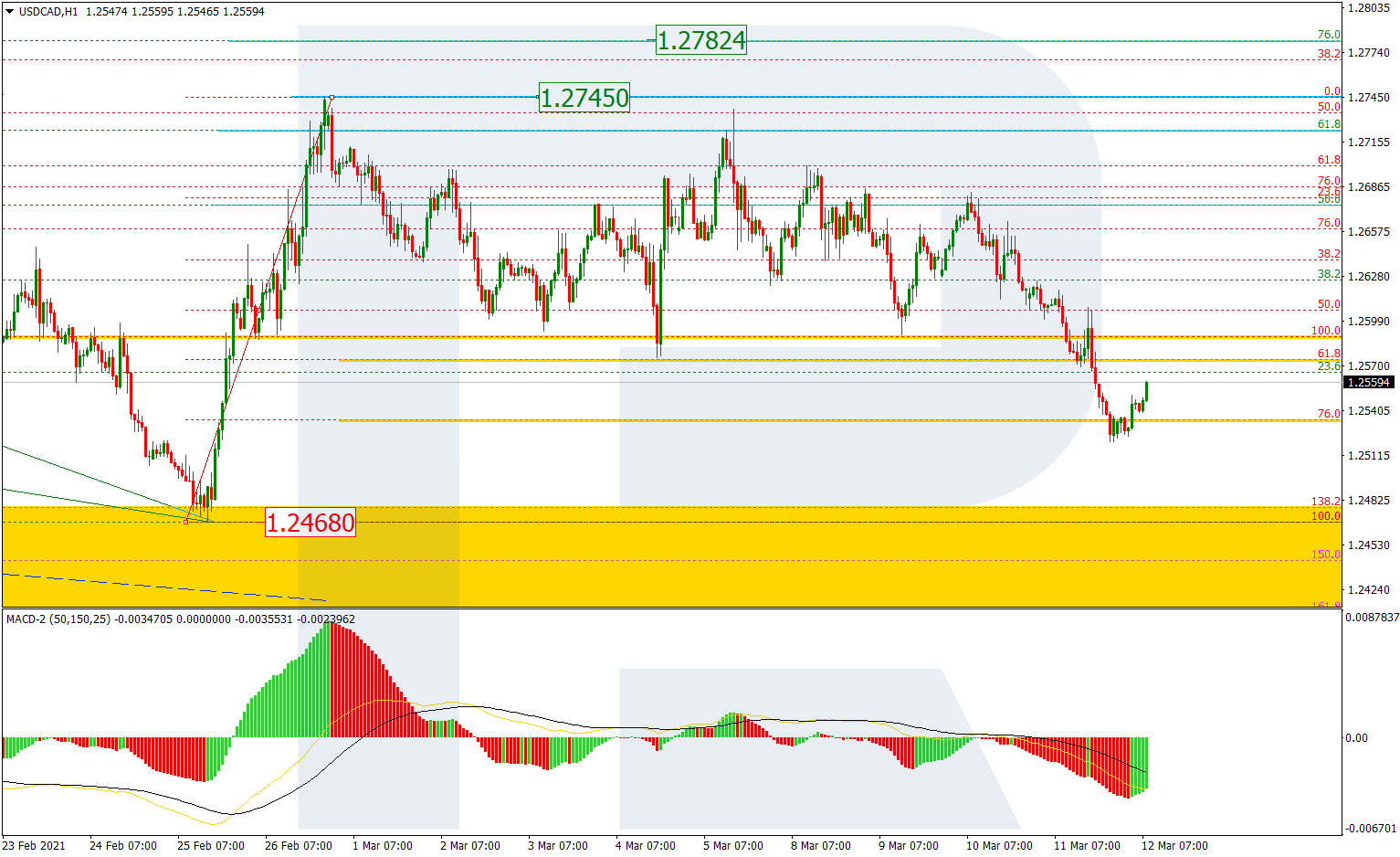

USDCAD, “US Dollar vs Canadian Dollar”

In the case of USDCAD, the situation hasn’t changed much. As we can see in the H4 chart, after completing the first impulse to the upside, the pair has started a new descending pullback, which may be later followed by another ascending impulse but much stronger than the first one. The closest upside target of the latter impulse may be the high at 1.2881 and then 23.6% fibo at 1.2987. This scenario may imply the start of a new long-term uptrend.

In the H1 chart, the pair has reached 76.0% fibo and may later start a new growth towards the local high at 1.2745 and then 76.0% fibo at 1.2782. The support is the low at 1.2468.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- NZD/USD Hits Yearly Low Amid US Dollar Strength Nov 26, 2024

- Trump plans to raise tariffs by 10% on goods from China and 25% on goods from Mexico and Canada Nov 26, 2024

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024