By Orbex

USDCHF Sinks to 6-Year Lows

The US dollar’s rebound has mirrored the pause in the equity market. This probably has more to do with profit-taking than anything else.

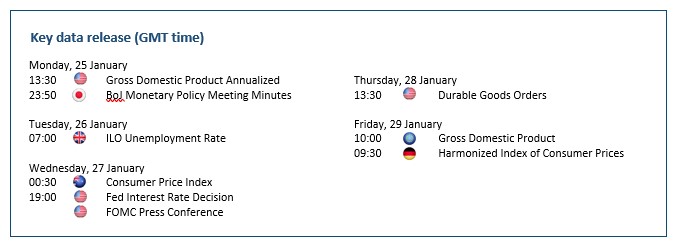

Indeed, optimism is hard to fade when Janet Yellen, President-elect Joe Biden’s nominee for Treasury Secretary, called for “act big” on stimulus. This week’s Fed meeting might not be eventful but policymakers are expected to maintain the liquidity flow for at long as possible.

As the greenback is heading towards lows from 2015, trend-followers would be eager to sell into strength. 0.8500 is the next target while 0.9000, the support-turned-resistance may cap any upward pressure.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

GBPNZD Bounces as UK Vaccine Campaign Speeds Up

With the Brexit theme out of the picture, the pound sterling has benefited from the bullish sentiment across the board, even outperforming riskier currencies like the kiwi in its latest rebound.

As the UK accelerates the rollout of the vaccine markets have started to price in the inflection point in restrictions in late spring. This would put the pound in an enviable position compared to its European and American counterparts.

Buyers have gained a foothold near last July’s low of 1.8600. The recent breakout above 1.9100 is a sign of sellers getting out of their positions, which may lead to a gradual recovery.

AUDCAD Rises on Brighter Domestic Data

As the dust settles down in Washington DC, the prospect of a larger stimulus is exactly what global markets need to sustain the exuberance.

Combined with an improvement in domestic employment data, the commodity-linked Australian dollar still has room to the upside. Should this week’s CPI read above the consensus of 1.5%, the Reserve Bank of Australia might consider cutting back on its easing program, another strong tailwind for the Aussie.

The pair is grinding up along the bullish trendline established last October. In case of a deeper pullback, 0.9700 is a key support level to keep the optimism intact.

EURJPY Awaits Breakout Catalyst

Last week both ECB and BoJ adopted a wait-and-see attitude and pledged to support their respective economy through the pandemic. This was another way to say business as usual when it comes to the price action.

Technical drivers have prevailed after the euro retreated from its ten-month high of 127.30 and went sideways. With the uptrend at stake, buyers will need a strong catalyst to push through this key hurdle.

Positive growth and inflation data from the eurozone and Germany might do the trick.

A bullish breakout past 127.30 may resume the rally. To the downside, 123.00 is the psychological support to watch for.

By Orbex

- As expected, the RBNZ cut the rate by 0.5%. Australia’s inflation rate remained at its lowest level since the summer of 2021 Nov 27, 2024

- EUR/USD Steady Ahead of Major US Data Releases Nov 27, 2024

- NZD/USD Hits Yearly Low Amid US Dollar Strength Nov 26, 2024

- Trump plans to raise tariffs by 10% on goods from China and 25% on goods from Mexico and Canada Nov 26, 2024

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024