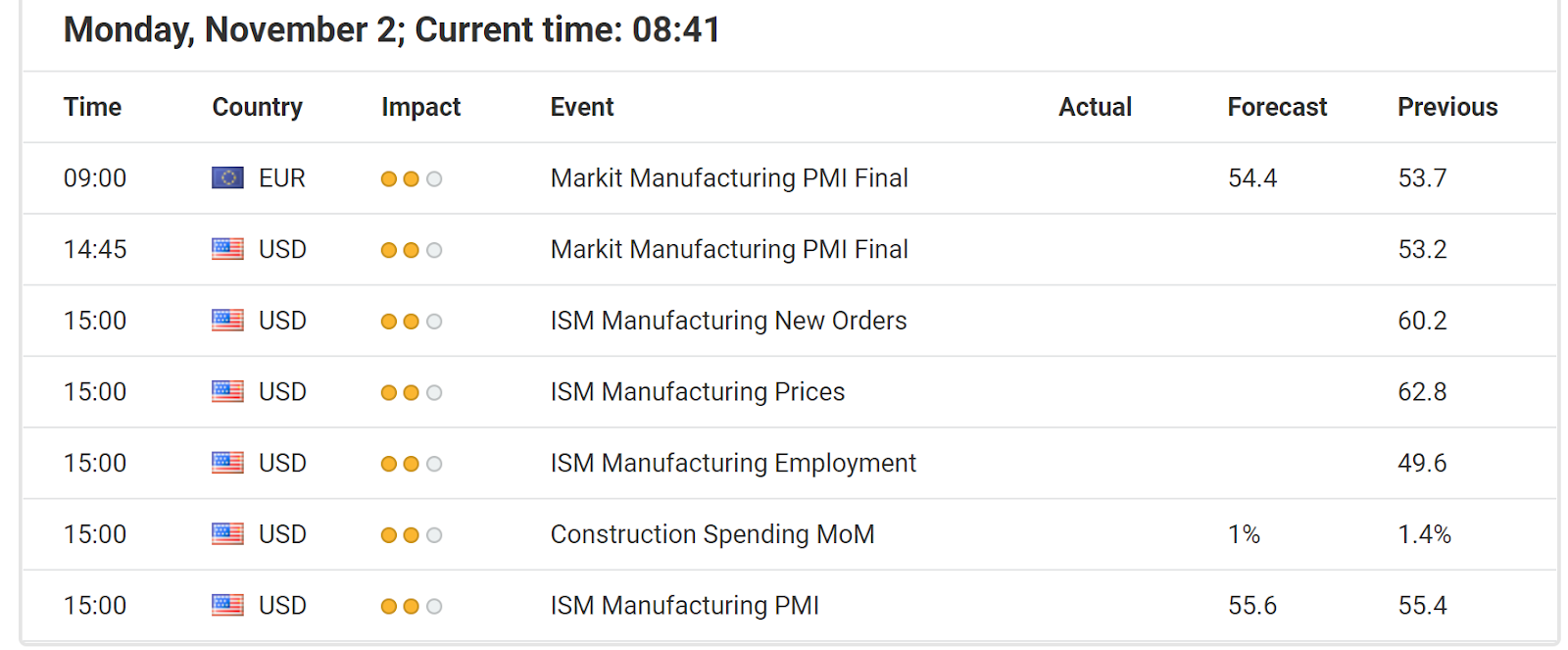

Source: Economic Events November 02, 2020 – Admiral Markets’ Forex Calendar

Source: Economic Events November 02, 2020 – Admiral Markets’ Forex Calendar

The DAX saw a big drop last week losing more than 8%, falling below 12,000 points.

As pointed out in our last technical analysis for the German index, failing to sustainably recapture 12,700/730 points, leaves the DAX30 at risk of another bearish stint and a testing of the region around 12,200 points which was already seen last week on Monday.

The acceleration on the downside was then triggered by the imposed lockdowns in Germany and France on Tuesday and Wednesday.

Here are some factors one could have helped:

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

- A very dovish ECB on Thursday with president Lagarde saying that there’s “little doubt” that the ECB will have to recalibrate monetary policy in December

- The ECB will likely increase PEPP from 1.35 trillion Euro to 2 trillion Euro and probably push the facility rate into even deeper negative territory

- Crushing earnings from Amazon, Google, Apple and Facebook

However, the picture still is not bright.

While, technically, the first signs of a bearish divergence on the H1 in the RSI(14) point to diminishing bearish momentum, below 11,650/700 points the sequence of falling highs and lows remains intact and the German index faces the risk of a drop to below 11,000 points.

Still, we should not forget that the US presidential election Tuesday/Wednesday will probably “re-shuffle the deck” and if, for whatever reason, the DAX30 recaptures 11,650/700 points, a deep run back above 12,000 points could be the result, technically resulting in a re-test of the neckline of the Head-shoulder formation on a daily time-frame:

Source: Admiral Markets MT5 with MT5SE Add-on DAX30 CFD Hourly chart (from October 12, 2020, to October 30, 2020). Accessed: October 30, 2020, at 10:00 PM GMT

Source: Admiral Markets MT5 with MT5SE Add-on DAX30 CFD Hourly chart (from October 12, 2020, to October 30, 2020). Accessed: October 30, 2020, at 10:00 PM GMT

Source: Admiral Markets MT5 with MT5SE Add-on DAX30 CFD Daily chart (from June 10, 2019, to October 30, 2020). Accessed: October 30, 2020, at 10:00 PM GMT. Please note: Past performance is not a reliable indicator of future results, or future performance.

Source: Admiral Markets MT5 with MT5SE Add-on DAX30 CFD Daily chart (from June 10, 2019, to October 30, 2020). Accessed: October 30, 2020, at 10:00 PM GMT. Please note: Past performance is not a reliable indicator of future results, or future performance.

In 2015, the value of the DAX30 CFD increased by 9.56%, in 2016, it increased by 6.87%, in 2017, it increased by 12.51%, in 2018, it fell by 18.26%, and in 2019, it increased by 26.44%, meaning that in five years, it was up by 34.2%.

Check out Admiral Markets’ most competitive conditions on the DAX30 CFD and start trading on the DAX30 CFD with a low 0.8 point spread offering during the main Xetra trading hours.

Discover the world’s #1 multi-asset platform

Admiral Markets offers professional traders the ability to trade with MetaTrader 5, allowing you to experience trading at a significantly higher, more rewarding level than with MetaTrader 4. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much more. Click the banner below to start your FREE download of MT5!

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter “Analysis”) published on the website of Admiral Markets. Before making any investment decisions please pay close attention to the following:

- This is a marketing communication. The analysis is published for informative purposes only and is in no way to be construed as investment advice or recommendation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

- Any investment decision is made by each client alone whereas Admiral Markets shall not be responsible for any loss or damage arising from any such decision, whether or not based on the Analysis.

- Each of the Analysis is prepared by an independent analyst (Jens Klatt, Professional Trader and Analyst, hereinafter “Author”) based on the Author’s personal estimations.

- To ensure that the interests of the clients would be protected and objectivity of the Analysis would not be damaged Admiral Markets has established relevant internal procedures for prevention and management of conflicts of interest.

- Whilst every reasonable effort is taken to ensure that all sources of the Analysis are reliable and that all information is presented, as much as possible, in an understandable, timely, precise and complete manner, Admiral Markets does not guarantee the accuracy or completeness of any information contained within the Analysis. The presented figures that refer to any past performance is not a reliable indicator of future results.

- The contents of the Analysis should not be construed as an express or implied promise, guarantee or implication by Admiral Markets that the client shall profit from the strategies therein or that losses in connection therewith may or shall be limited.

- Any kind of previous or modelled performance of financial instruments indicated within the Publication should not be construed as an express or implied promise, guarantee or implication by Admiral Markets for any future performance. The value of the financial instrument may both increase and decrease and the preservation of the asset value is not guaranteed.

- The projections included in the Analysis may be subject to additional fees, taxes or other charges, depending on the subject of the Publication. The price list applicable to the services provided by Admiral Markets is publicly available from the website of Admiral Markets.

- Leveraged products (including contracts for difference) are speculative in nature and may result in losses or profit. Before you start trading, you should make sure that you understand all the risks.

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024

- Bitcoin hits an all-time high above $88,000. Oil remains under pressure Nov 12, 2024

- Brent Crude Stumbles as Market Sentiments Turn Cautious Nov 12, 2024

- Bitcoin hits new record high just shy of $82,000! Nov 11, 2024

- The Dow Jones broke the 44 000 mark, and the S&P 500 topped 6 000 for the first time. The deflationary scenario continues in China Nov 11, 2024