By RoboForex Analytical Department

The USD/JPY pair has stabilised around 147.60 following two consecutive days of gains, with the yen now attempting to recoup some of its recent losses.

Key factors influencing USD/JPY movements

Uncertainty in global trade relations remains a key focus for currency markets, heightening demand for safe-haven assets. Recent reports indicate that US President Donald Trump has agreed to meet Japanese officials to initiate trade discussions following a phone call with Prime Minister Shigeru Ishiba.

US Treasury Secretary Scott Bessent will lead the negotiations, underscoring the strength of the US-Japan alliance. Key topics will include tariffs, non-tariff barriers, foreign exchange policies, and government subsidies.

Despite Trump’s openness to dialogue, he has dismissed the possibility of delaying new reciprocal tariffs and warned that these measures could remain in place indefinitely. Domestically, Japan’s current account surplus for February reached a record high, buoyed by rising exports and declining imports, which has provided firm support for the yen.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Technical outlook: USD/JPY

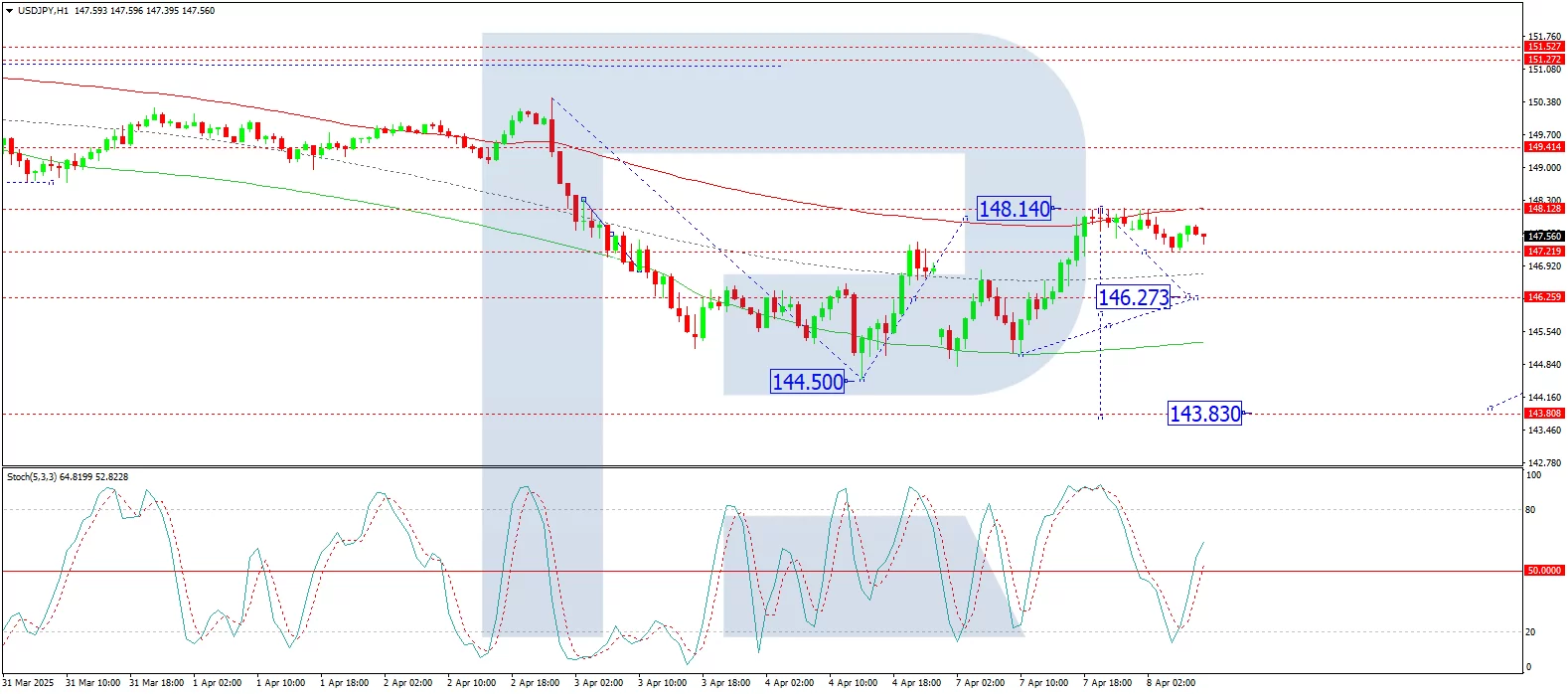

H4 Chart: The pair achieved its local downside target at 144.50 before correcting to 148.12. Following this correction, we anticipate another potential decline towards 143.83. This scenario is supported by the MACD indicator, where the signal line remains below zero and points sharply downward.

H1 Chart: The pair completed an upward structure, reaching 148.12, and is now consolidating below this level. We expect a new downward wave towards 146.27, with further downside potential to 143.83. The Stochastic oscillator confirms this outlook, with its signal line below 50 and trending firmly downward towards 20.

Conclusion

The yen’s recovery reflects ongoing market caution, with technical indicators suggesting further downside for USD/JPY. Investors will closely monitor trade developments and macroeconomic data for directional cues.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026