By ForexTime

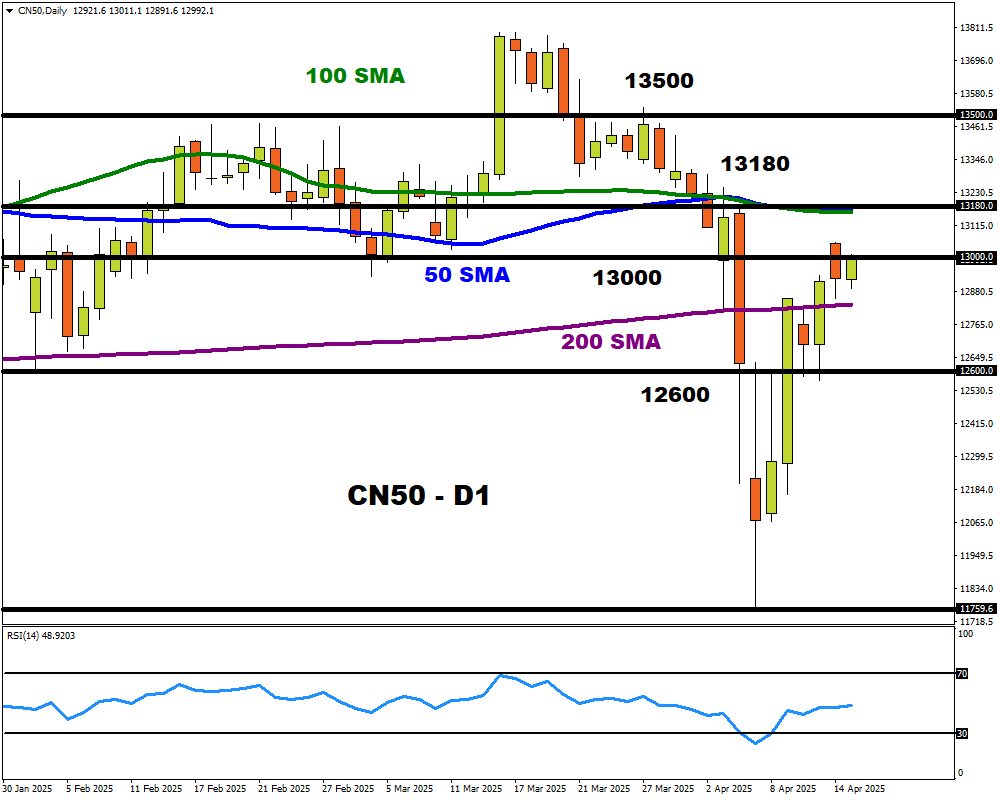

- CN50 rebounds over 10% from 2025 low

- China GDP expected to slow to 5.2% in Q1

- Index remains influenced by US-China trade war

- Technical levels: 13,180, 13,000 and 12,600

European shares flashed green on Tuesday as investors welcomed Donald Trump’s hints of a potential pause in auto tariffs.

Some stability is returning to markets after the chaos witnessed last week, with Trump’s tariff exemptions on consumer electronics from China helping sentiment. However, caution lingers due to conflicting messages after Commerce Secretary Lutnick stated the exemptions as short-term.

Nevertheless, the two largest economies in the world remain in an aggressive tit-for-tat battle of rising tariffs. Any fresh escalation may spark another wave of risk aversion with equities in the firing line.

In Asia, FXTM’s CN50 index may see heightened volatility on Wednesday morning due to key China data.

Note: The CN50 tracks the benchmark FTSE China A50 Index

The CN50 index’s performance is very much tied to the overall health of the Chinese economy.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

This is because stocks within the financial, consumer, and industrial sectors account for roughly two-thirds of the CN50’s weight.

Note: Back in February 2025, Trump imposed a 10% tariff on all Chinese goods before raising it by another 10% in March – bringing the total to 20% in Q1.

China Q1 GDP – Wednesday 16th April – 02:00 AM GMT)

China’s economy may have lost speed in Q1 as the country headed into a sharp escalation in trade tensions with the United States.

Q1 GDP is expected to have cooled to 5.2% versus the 5.4% in the previous quarter.

Note: Over the past 12 months, the China GDP report has triggered upside moves on the CN50 of as much as 3.1% or declines of 0.9% in a 6-hour window post-release.

The incoming retail sales report and industrial production may provide fresh insight into the world’s second-largest economy.

POTENTIAL SCENARIOS:

The CN50 has rebounded over 10% from its 2025 low with prices testing resistance at 13,000.

- If the data comes in better than expected, this could boost the CN50 index higher. A solid breakout and daily above 13,000 may open a path toward the 100-day SMA at 13,180 and 13,500.

- However, a set of disappointing data could drag the CN50 index lower. A move below the 200-day SMA at 12,810 may trigger a decline toward 12,600.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026