By RoboForex Analytical Department

The Japanese yen continues its recovery rally. The USDJPY pair falls to 143.38 on Monday.

This development is likely only the midpoint of the process as the market regains past losses and brings the JPY to equilibrium. USDJPY is currently at its lowest level since 3 January.

Several reasons are driving this movement. The first is the winding down of carry trade operations on the yen. The process started earlier when it became clear that the Bank of Japan was moving towards tightening monetary conditions.

The second concern is that a US recession is playing an important role. Friday’s employment data was weaker than expected, triggering fears that the Federal Reserve might delay its decision on interest rate cuts. The market is worried the Fed could be late in making a crucial decision.

The third key factor for the JPY is the increased attractiveness of the yen as a safe-haven asset amid escalating geopolitical tensions in the Middle East. The ongoing conflict in the region poses a hypothetical threat to global stability, and investors are factoring in this risk and favouring safe-haven assets.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

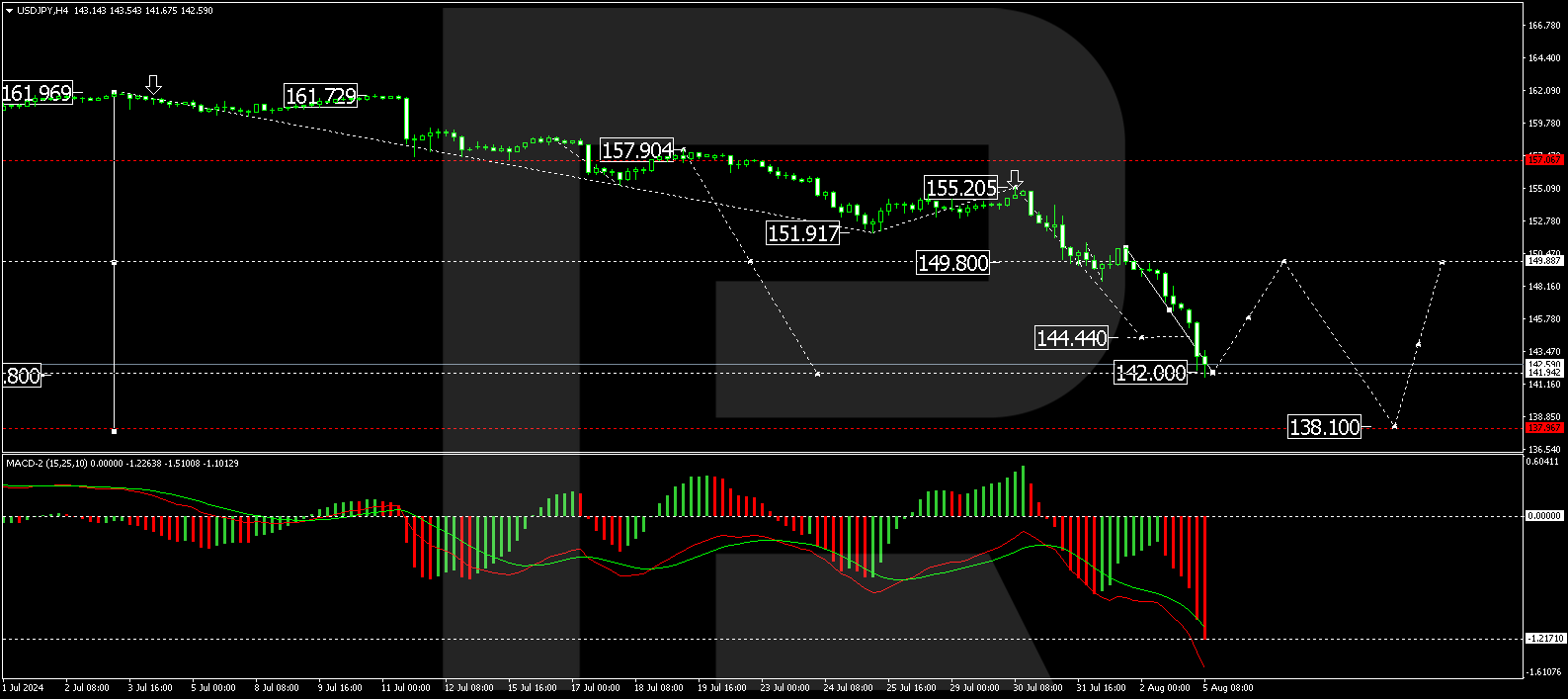

Technical analysis: USD/JPY

The USD/JPY pair formed a consolidation range of around 149.80 before breaking downwards on impactful news. The decline reached 142.00, setting a local low. We anticipate a new consolidation phase above this level. An upward break could see a corrective move towards 149.80. Conversely, a downward exit might extend losses towards 138.10. The MACD indicator supports this bearish outlook, showing continued downward momentum.

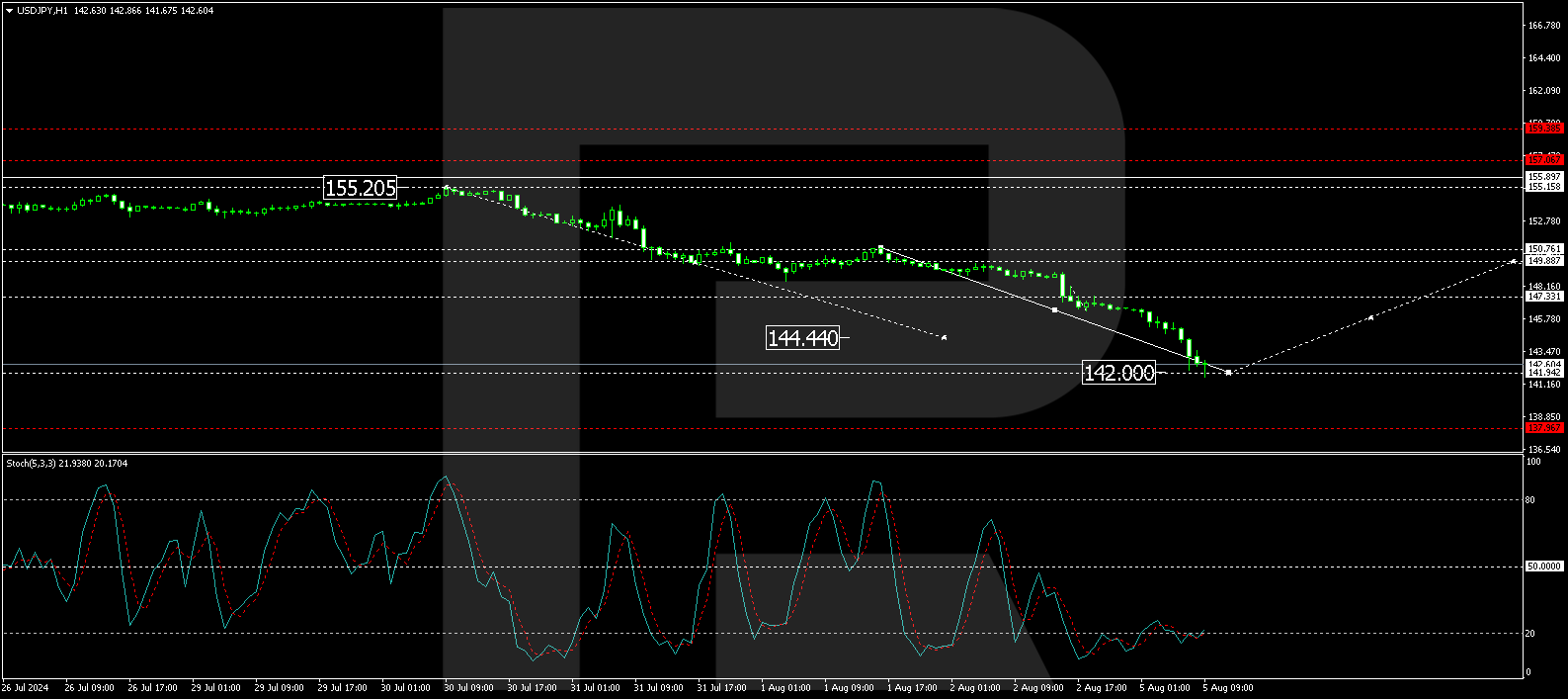

After reaching 142.00, a corrective phase to 147.33 may unfold, representing an intermediate target. Following this correction, a further decline to 144.66 could occur. This analysis aligns with the Stochastic oscillator, indicating a potential for an upward correction from oversold levels.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026