By RoboForex Analytical Department

The NZD/USD pair has climbed to the highest level since 15 January 2024, continuing its trajectory within an ascending channel towards a target of 0.6233. The New Zealand dollar’s growth is primarily fuelled by the weakening US dollar, mirroring trends observed with other currencies such as the AUD and CAD.

Investor sentiment is buoyed by the anticipation that the US Federal Reserve will begin easing monetary policy at its September meeting. Debates about whether the rate cut will be 25 or 50 basis points are ongoing. The decision is seen as imminent given the current inflationary environment in the US and the need to support the employment market.

Conversely, the Reserve Bank of New Zealand (RBNZ) has already taken proactive steps by lowering its interest rate earlier this month. The RBNZ has also signalled a potential reduction in lending costs by up to 75 basis points by year-end, marking a fairly aggressive stance on rates. This transparent approach to monetary policy is helping to shape market expectations and bolster the NZD.

Technical analysis of NZD/USD

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

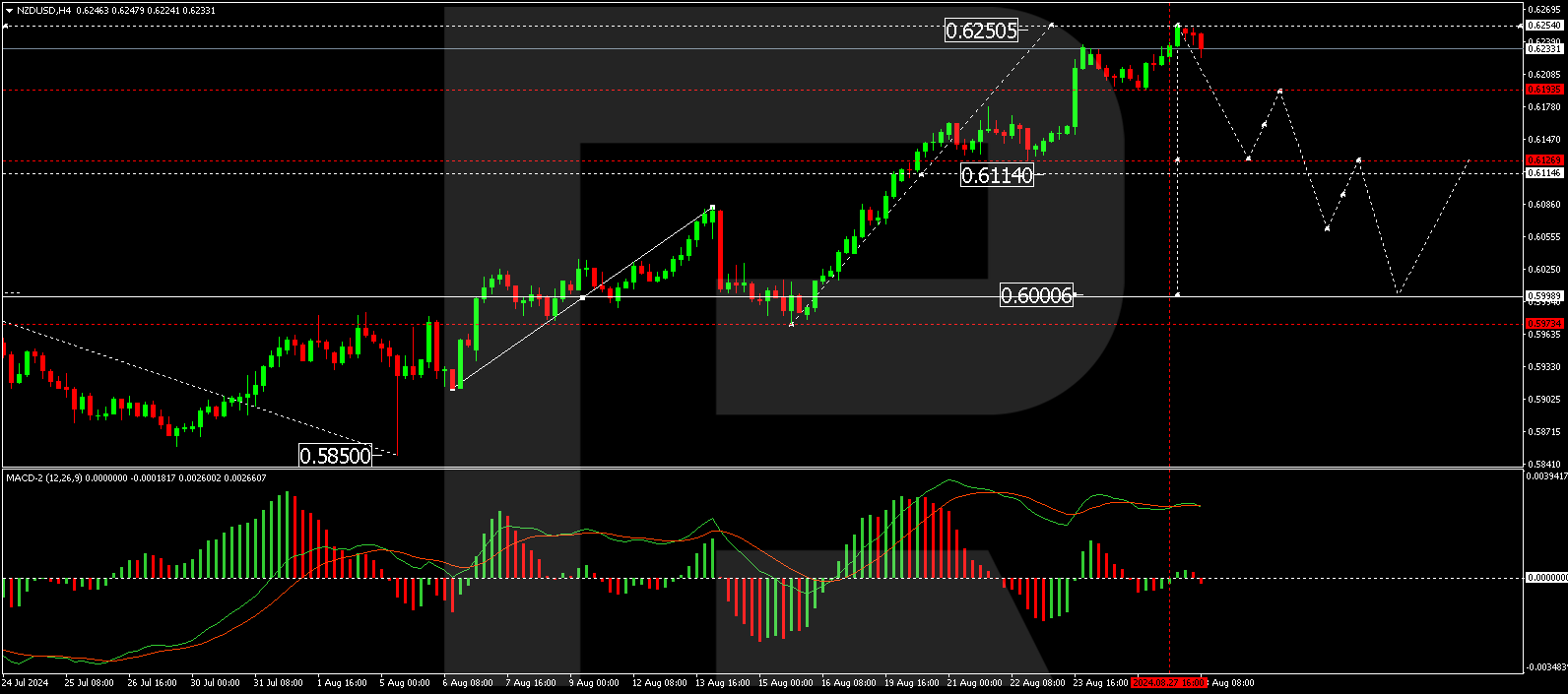

On the H4 chart, NZD/USD has completed a growth wave to 0.6250 and is now forming the initial decline phase towards 0.6128. After reaching this target, a corrective movement to 0.6191 might occur, testing it from below before initiating a further decline to 0.6065 and possibly extending to 0.6000. The MACD indicator, positioned above zero but trending downwards, supports this bearish outlook.

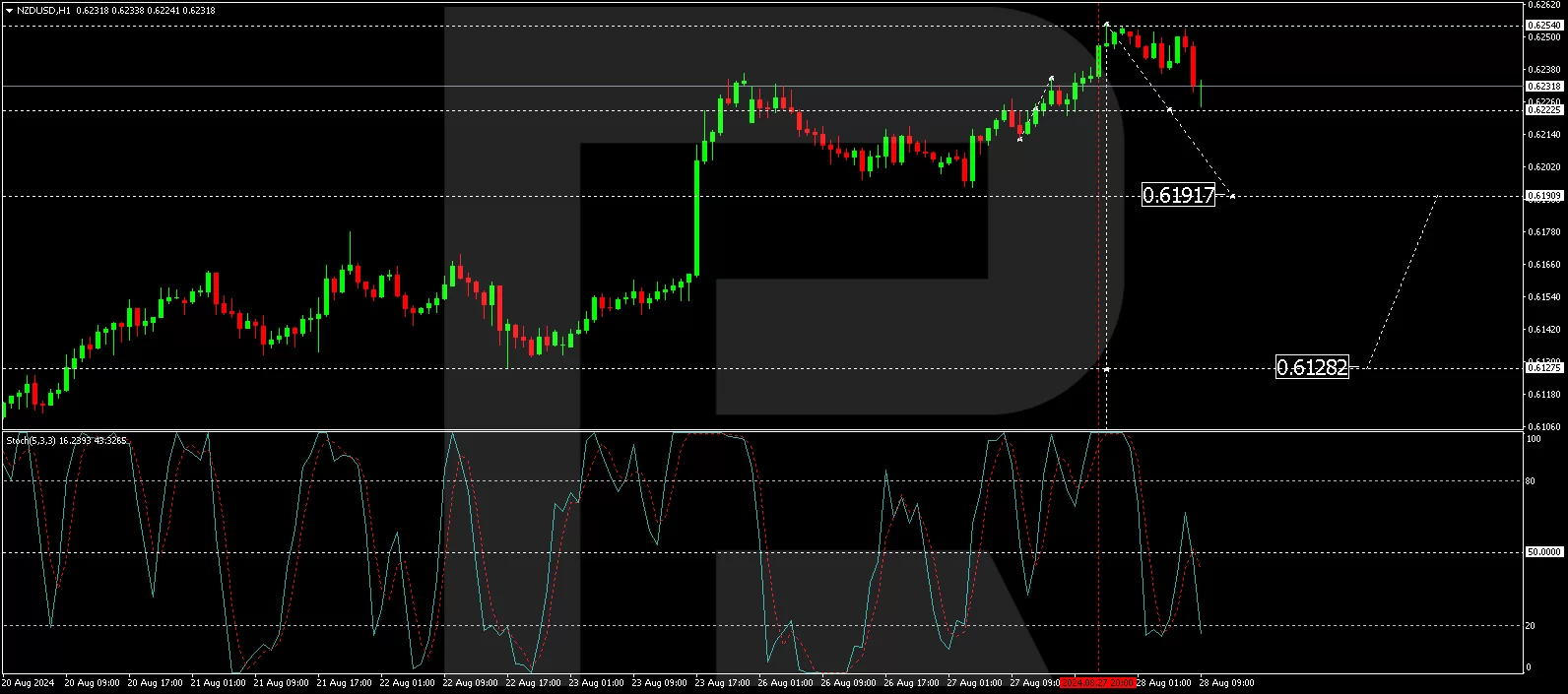

On the H1 chart, the pair is currently developing a decline structure towards 0.6222. Following this, a brief uptick to 0.6238 is expected, potentially leading to a consolidation around this level. A downward exit from this consolidation could signal the continuation of the downward trend towards 0.6128. This scenario is corroborated by the Stochastic oscillator, with its signal line below 50 and aiming towards 20, indicating a likely continuation of the downward movement.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026