By RoboForex Analytical Department

The EUR/USD pair moved upward to 1.0844 on Thursday, marking an unexpected shift following a period of strong US dollar performance. This change in dynamics can be attributed to investors’ positive response to comments made by US Federal Reserve Chair Jerome Powell regarding the future of interest rates. Powell’s remarks led to a surge in risk appetite, resulting in the dollar’s decline.

Powell indicated that economic indicators would heavily influence the Federal Reserve’s decisions on interest rate adjustments. Traders interpreted his comments as suggesting that, given the recent modest nature of US economic data, the anticipated forecast of three rate cuts in 2024, starting in June, remains on the table. The expectation is for the Federal Reserve to reduce interest rates by 75 basis points by the year’s end, which aligns with earlier statements from the Fed. These hinted at a majority consensus among monetary policy committee members to commence rate cuts within the year, contingent on economic data.

Powell’s reaffirming the Fed’s trajectory towards lower interest rates, with specific timing depending on upcoming data, sets the stage for March’s closely watched US employment market reports. The focus will be on whether the unemployment rate has remained steady and whether there has been any deceleration in the growth of average wages.

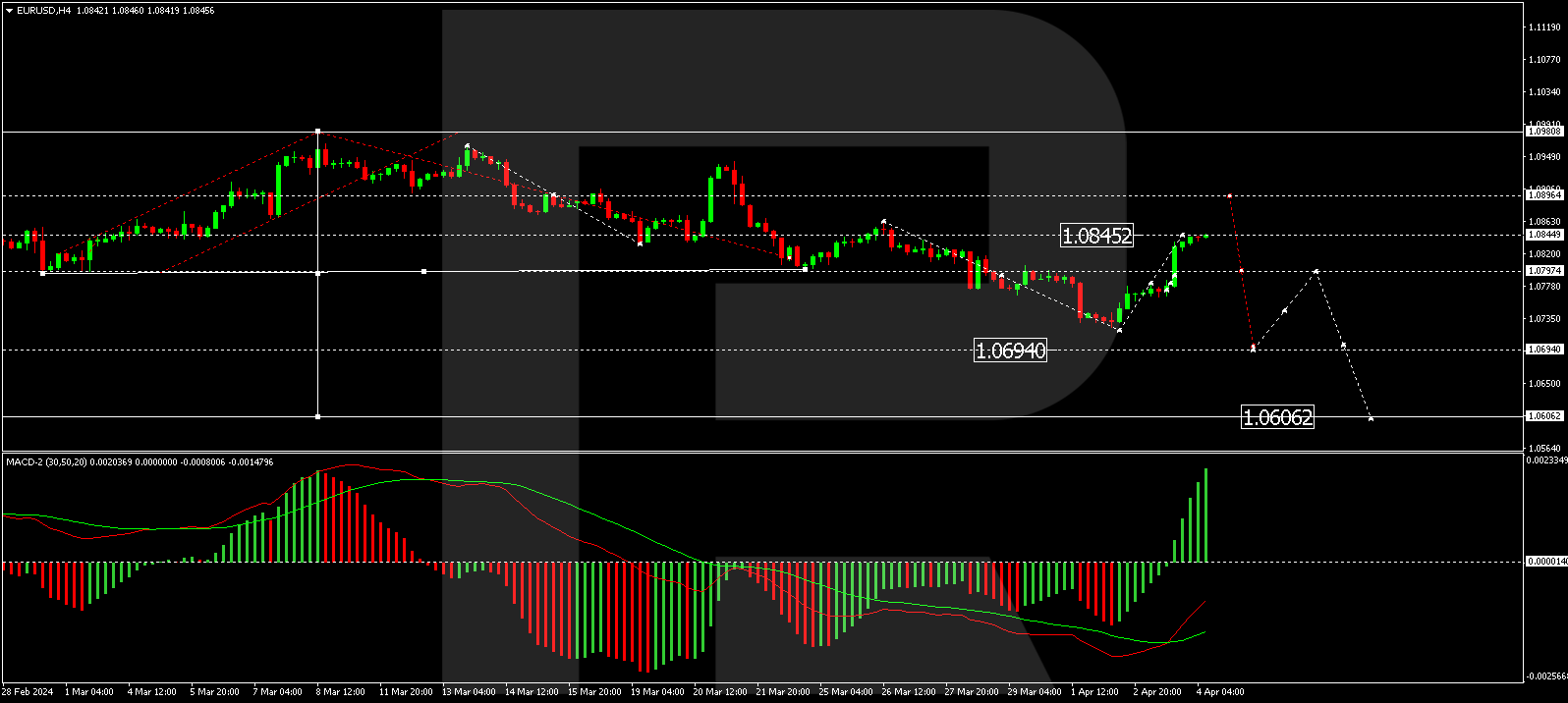

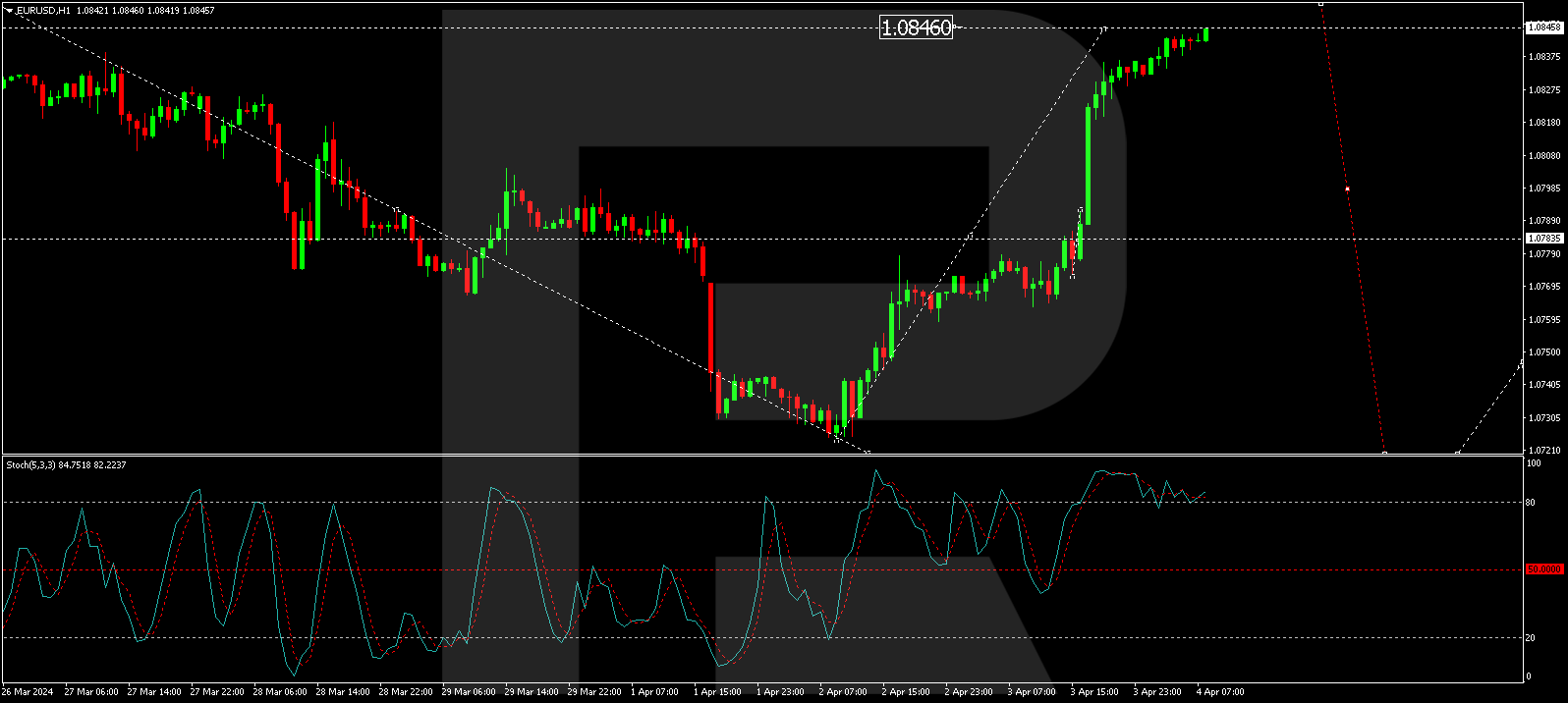

Technical analysis of EUR/USD

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

On the H4 chart, the EUR/USD pair has completed a correction to 1.0783, with a narrow consolidation range now established around this level. An upward breakout from this range could lead to a continuation of the correction to 1.0847, potentially followed by a new downward wave to 1.0694. This scenario is supported by the MACD indicator, where the signal line is below zero and the histogram peaks, suggesting a potential sharp decline.

The H1 chart reveals a corrective pattern towards 1.0847, with an expected shift towards 1.0783 to commence a decline phase. A new consolidation range at these levels could lead to further correction to 1.0888 or a downward wave to 1.0694 upon a breakout. The Stochastic oscillator, positioned above 80, anticipates a significant drop to the 50 mark, potentially leading to further declines.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026