By RoboForex Analytical Department

Brent crude oil prices fell to a four-week low of 86.50 USD on Monday, influenced by several contributing factors. The primary cause of the decline was a reduction in geopolitical tensions as Iran’s rhetoric toward Israel showed signs of de-escalation. This change is significant given that Iran is the third-largest OPEC oil producer, with substantial exports to China and other countries, making stability in the region crucial for global oil markets.

On the demand side, US crude oil inventories rose 2.7 million barrels for the week, nearly double what was anticipated. This unexpected increase has put additional pressure on oil prices.

Furthermore, global economic uncertainties and concerns that the Federal Reserve may maintain elevated interest rates for an extended period also impact the outlook for oil demand. Heightened interest rates tend to strengthen the US dollar, making oil, priced in dollars, more expensive for holders of other currencies. However, the current stability of the US dollar is providing some support, preventing even steeper declines in oil prices.

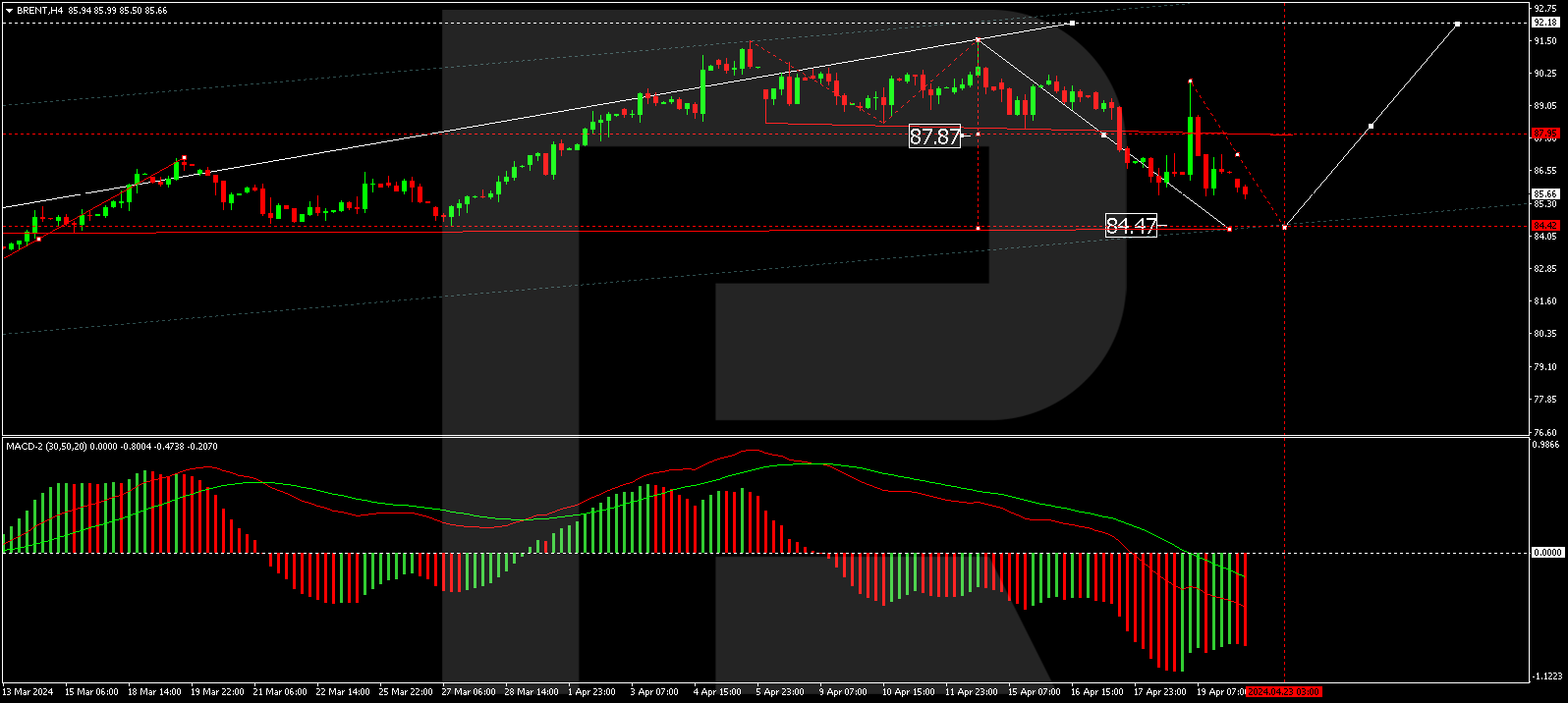

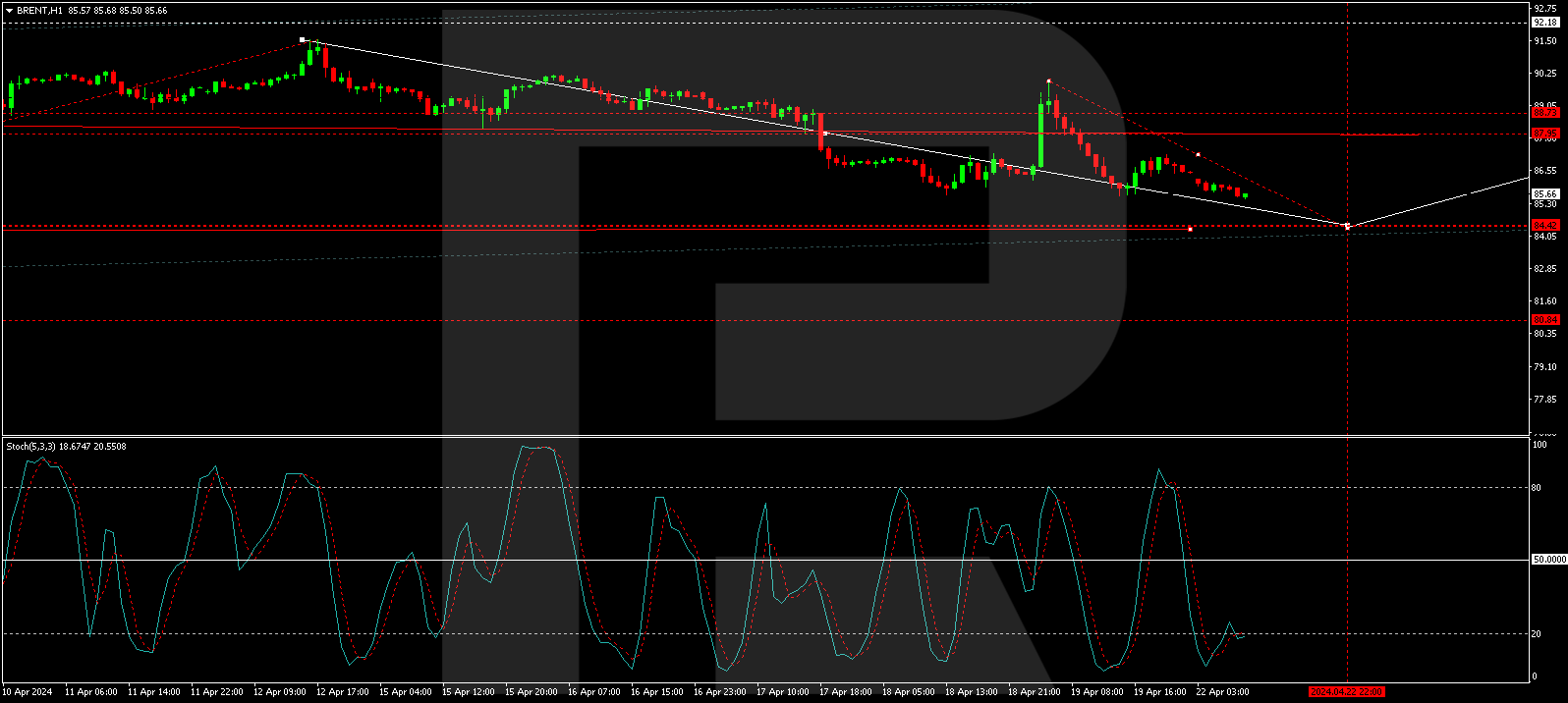

Technical analysis of Brent

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

On the H4 chart, Brent established a consolidation range at around 87.87. The downward breakout from this range initiated a correction wave to 84.48. After reaching this target, the market may see a rebound towards 92.00, potentially continuing towards 95.00. This bullish scenario is supported by the MACD indicator, currently below zero, suggesting that the lows may soon be updated.

The H1 chart shows that Brent is forming the fifth correction structure towards 84.48. Once this level is reached, there may be potential for a rebound to 87.87 (testing from below). A successful breakout from this range upward could lead to further growth towards 90.50, with a possible continuation to 92.00. The Stochastic oscillator, currently below 20, indicates readiness to initiate a new growth structure towards higher levels, supporting the possibility of an upward trend resuming after the correction.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026