By RoboForex Analytical Department

As of Friday, the GBP/USD pair hovered around 1.2642, following a substantial decline. The Bank of England (BoE) has yet to find reasons to lower the interest rate, indicating intentions to maintain high rates for an extended period to support the necessary inflation level in the country. The BoE’s monetary policy remains restrictive.

In its latest meeting, the Bank of England kept the interest rate steady at 5.25% annually, unchanged from previous sessions.

The BoE’s primary inflation target is 2%. Official forecasts suggest that the Consumer Price Index in the UK will likely reach this target by Q2 2024, with no immediate changes in monetary attitudes anticipated.

The market was “disappointed” that the BoE did not introduce any new policies, given that key central banks worldwide have started (at least verbally) to move towards tightening monetary conditions. The BoE remains an outlier, sticking to a conservative “wait-and-see” approach.

The BoE will likely continue with its current strategy. It will wait to see the outcomes of interest rate hikes by the US Federal Reserve and the European Central Bank (ECB) and observe currency reactions before considering any steps towards tightening based on the inflation trend.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

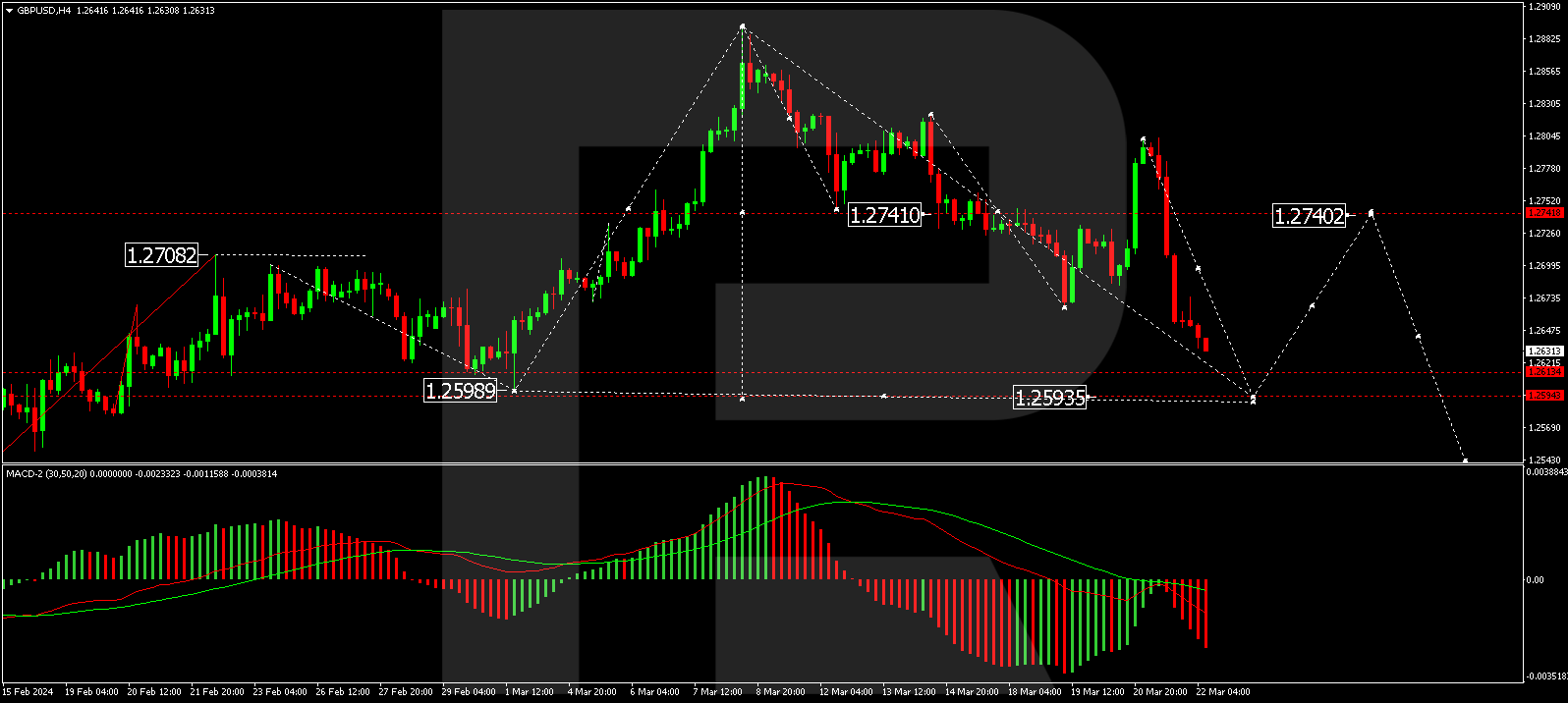

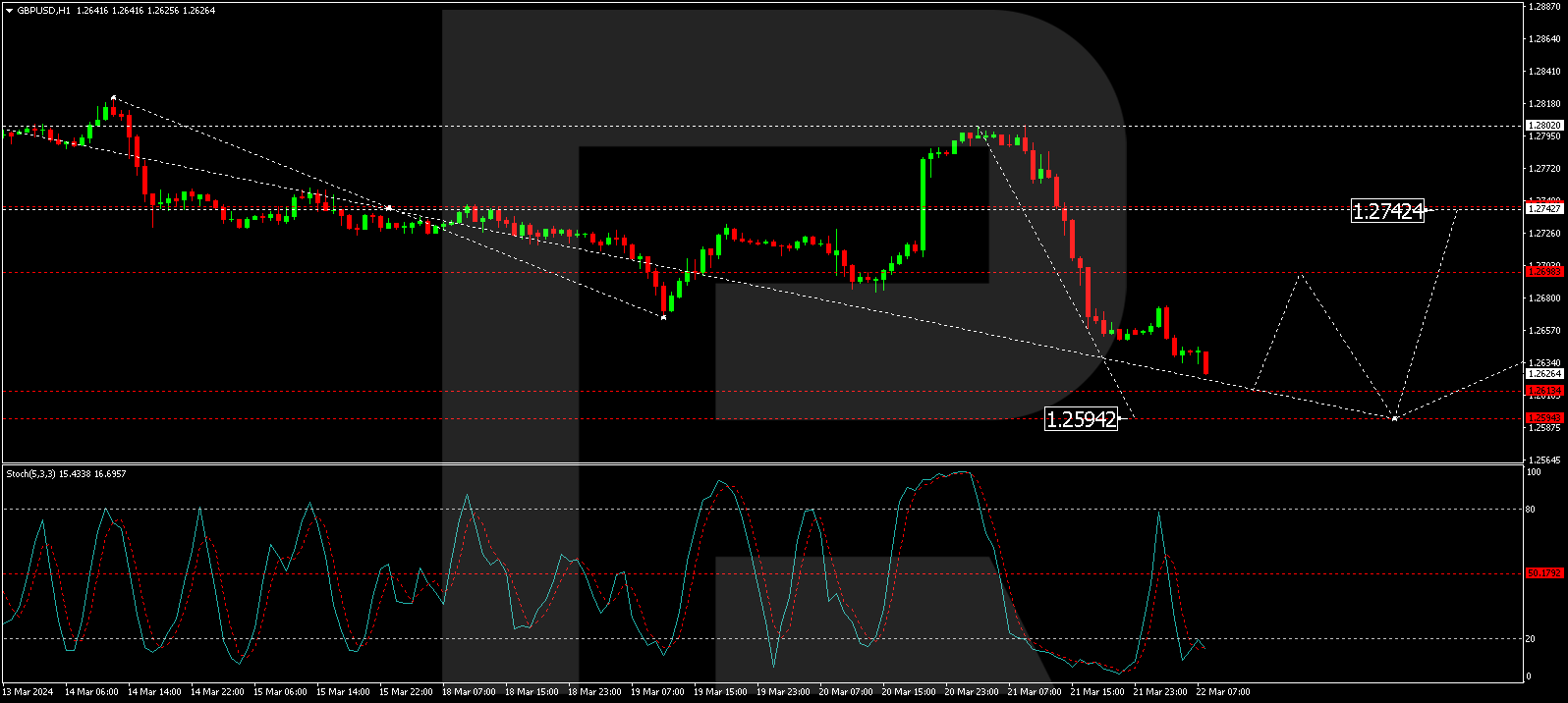

Technical analysis of GBP/USD

The H4 chart of GBP/USD is developing the fifth wave of decline towards the level of 1.2594. After that, a potential correction to 1.2742 is considered, with a continued downward trend expected. The MACD oscillator supports this scenario, with its signal line below zero and continuing downward towards new lows.

On the H1 chart, a declining wave structure towards 1.2615 is forming. After reaching this level, a potential rise to 1.2698 could occur, followed by a decline to 1.2594. The Stochastic oscillator confirms this scenario, with its signal line below 20 and sharply directed downwards.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026