By RoboForex Analytical Department

The main currency pair starts the week and the month by consolidating around the 1.0569 mark.

The US Federal Reserve’s intention to potentially raise interest rates once again in 2023 is strengthening the position of the USD. The 10-year treasury bonds yield in the US remains at long-term highs regardless of a minor correction.

This week, statistics will be abundant in both the US and the eurozone. Employment sector reports for September in the US are expected to show stabilisation without any notable catalysts.

The eurozone will report on retail sales in August, the PPI, and business activity in the services sector. All these reports will provide insight into the state of the economic system. It is not certain whether there will be any catalyst among the European statistics to support the EUR, although this possibility exists.

Technical analysis of EUR/USD currency pair:

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

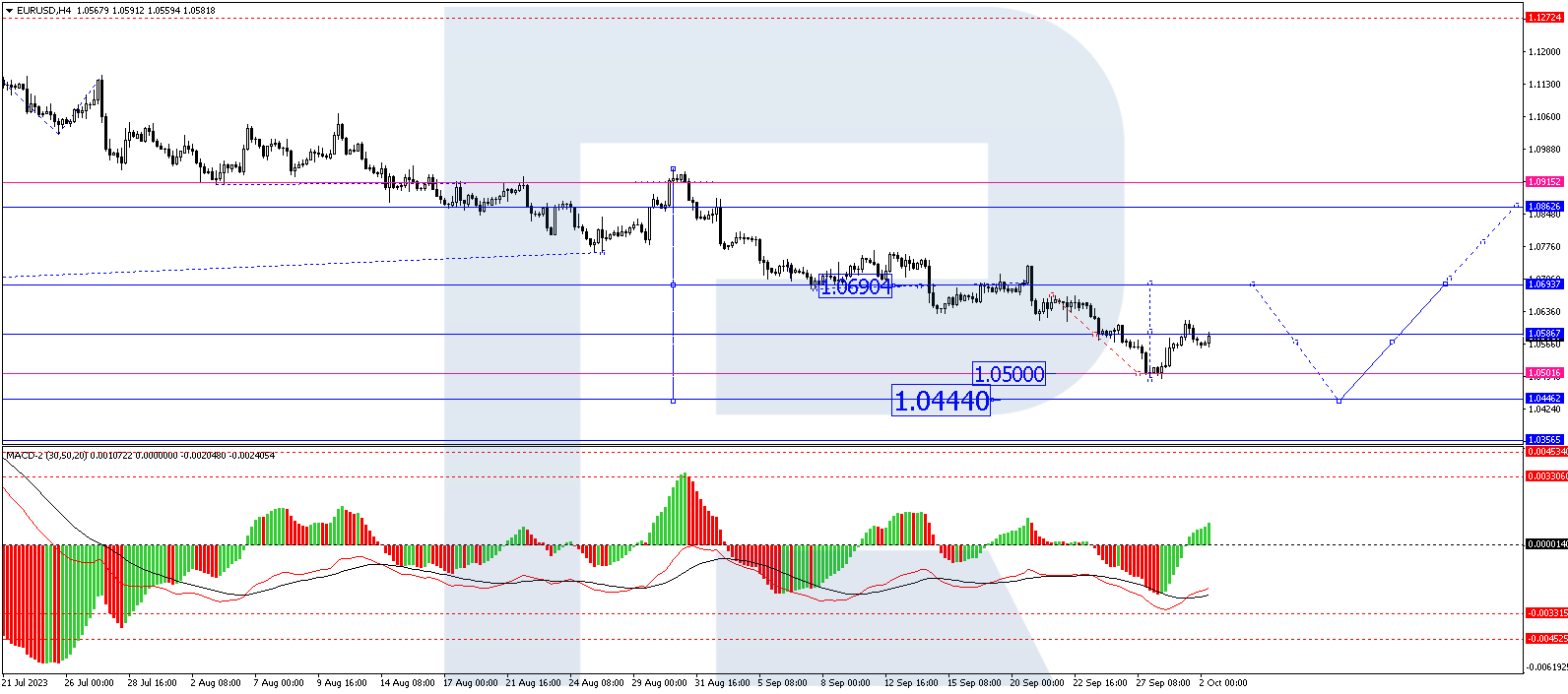

On the EURUSD H4 chart, a consolidation range has formed around 1.0700, reaching the local target of a declining wave at 1.0500 upon escaping the range downwards. Today the market has corrected to 1.0615. A new link of correction to 1.0620 is not excluded, followed by a decline to 1.0440. After reaching this level, a correction to 1.0700 could follow (with a test from below). Next, a decline to 1.0140 is expected. Technically, this scenario is confirmed by the MACD, whose signal line is below zero. The indicator is expected to set new lows.

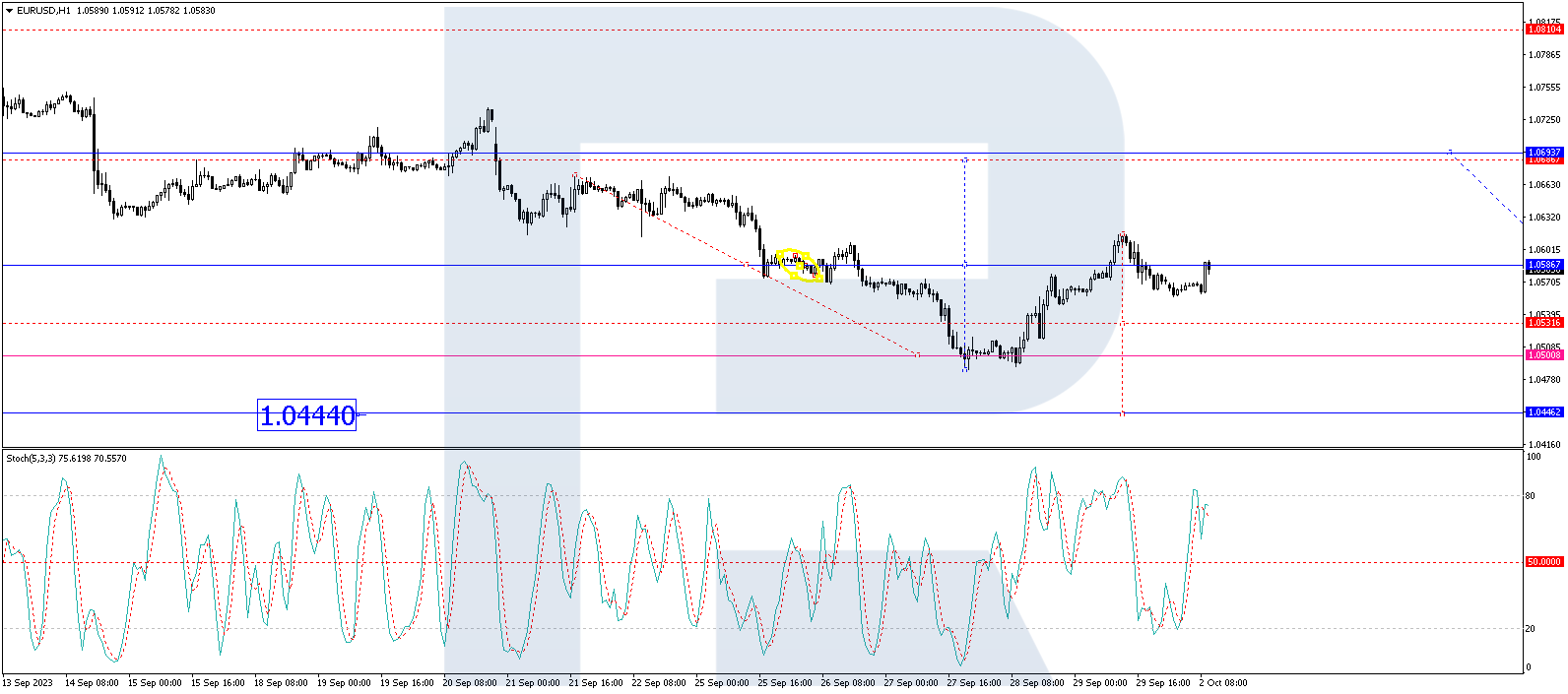

On the EURUSD H1 chart, a movement in a declining wave to 1.0440 is forming. By now, the market has completed a consolidation range of around 1.0586, reaching the local target of a declining wave at 1.0500 with an escape from the range downwards. A link of correction to 1.0615 has formed today. A new price hike to 1.0620 is not excluded. Next, a new declining movement to 1.0440 is expected, followed by a rise to 1.0700. Technically, this scenario is confirmed by the Stochastic oscillator, whose signal line has rebounded from the 80 mark and is currently pointing sharply downwards. The line might eventually fall to the 20 mark.

Disclaimer

Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026