By RoboForex Analytical Department

The EUR/USD currency pair kicked off the week on a vibrant note, trading around 1.0720. The days ahead promise a series of impactful events that could influence the pair’s trajectory.

In the U.S., critical inflation data for August is set to be released this week. Year-over-year Consumer Price Index (CPI) figures are expected to have increased to 3.6%, up from 3.2% the prior month. On the eve of the Federal Reserve’s upcoming meeting, this uptick could bring mixed sentiments. In contrast, core inflation is projected to decline to 4.3% year-over-year from the previous 4.7%.

Across the Atlantic, the European Central Bank (ECB) is scheduled to convene on Thursday to determine interest rate policy. Given the precarious state of the Eurozone’s economy, the consensus expectation is that the ECB will opt to maintain its current interest rate of 3.75% per annum. Any statements or actions from the ECB are expected to significantly influence the euro’s value.

Technical Analysis of the EUR/USD Currency Pair

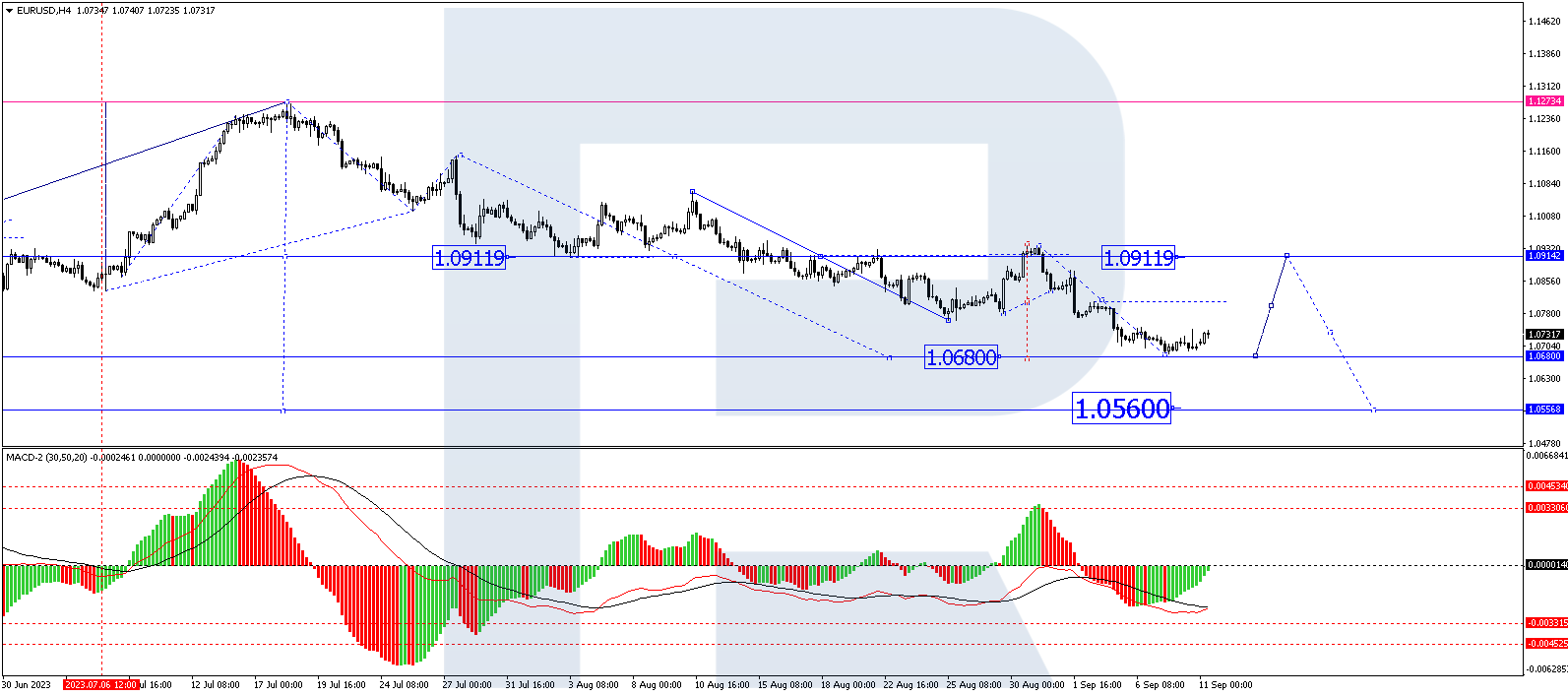

On the 4-hour chart, EUR/USD recently completed a downward wave at 1.0686. In the short term, the market could experience a corrective rally towards 1.0755. Upon reaching this level, a fresh downward structure targeting 1.0680 may ensue. Subsequently, a bullish wave could set its sights on 1.0911. The Moving Average Convergence Divergence (MACD) indicator lends technical support to this scenario; its signal line is currently below zero but appears to be gearing up for an upward move.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

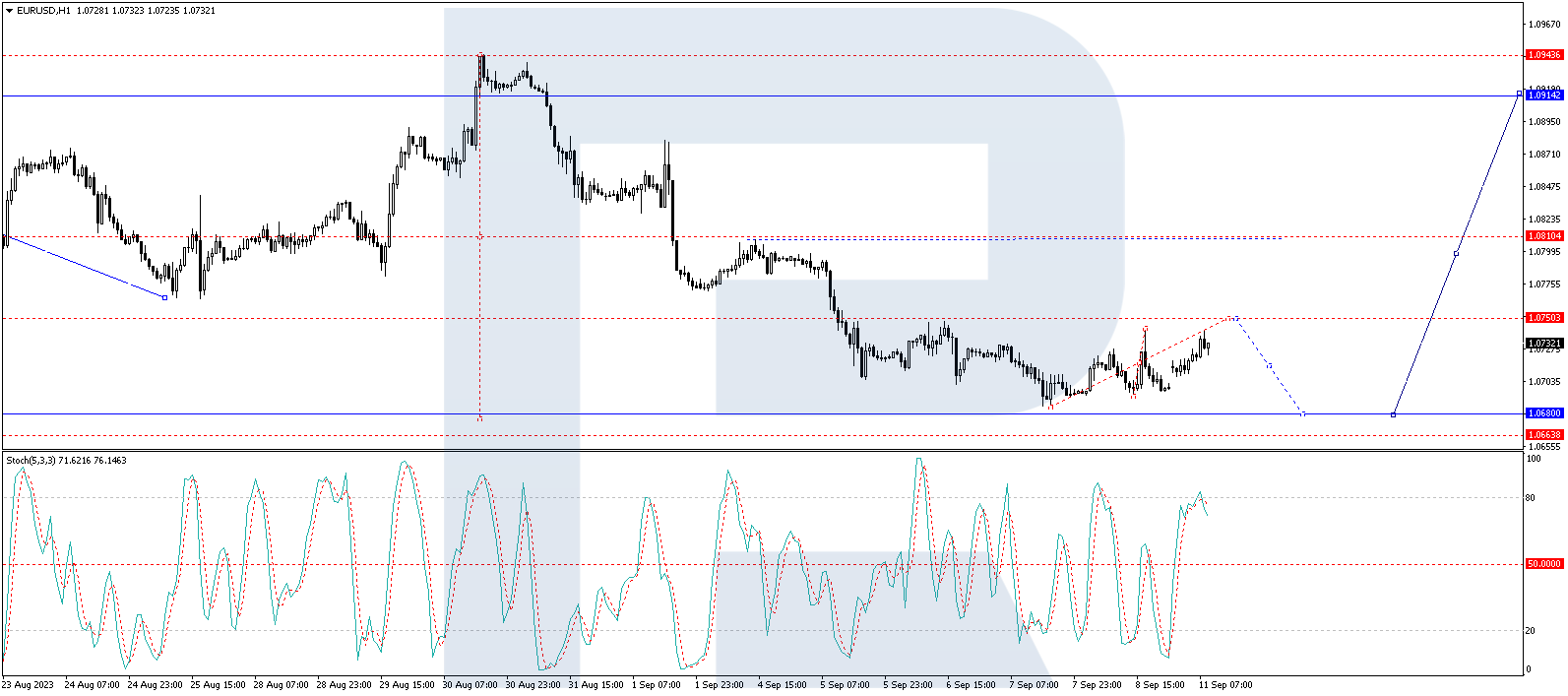

On the 1-hour chart, a consolidation zone has taken shape around 1.0720. The market at one point extended this range upward and could potentially trend towards 1.0755. Once this price level is attained, a downward movement towards 1.0680 may commence. This viewpoint gains technical validation from the Stochastic oscillator, whose signal line has recently recoiled from the 80 mark and is now oriented downward, possibly heading towards the 20 level.

In summary, the EUR/USD pair faces a week rich in potential catalysts, with key data releases and policy meetings in both the U.S. and Eurozone. Both short-term and medium-term technical analyses suggest a mixed outlook, with opportunities for both upward corrections and renewed declines. Keep a close eye on economic indicators and central bank actions as they could drastically alter the landscape.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026