By RoboForex Analytical Department

The Euro has halted its three-week decline, finding local support at 1.0900.

Despite the European Central Bank’s (ECB) latest interest rate hike to 4.25% on 27 July, the Euro is weakening against the US Dollar. Over the past three weeks, the EURUSD pair has retreated from its highs near 1.1300 to around 1.0900.

On Friday, US employment market data was released, slightly falling short of expert predictions: the Nonfarm Payrolls (NFP) indicator registered a figure of 187 thousand compared to the market’s projected 200 thousand. Consequently, the Dollar weakened against the Euro, causing the EURUSD pair to recover from its lows around 1.0900 to surpass 1.1000.

The key driver for heightened market volatility this week will be the forthcoming US Consumer Price Index (CPI) data, due for release on Thursday. Should the data surpass forecasts, the Euro’s decline may continue; conversely, weaker data could give the Euro reason to rise.

Technical analysis for the EUR/USD currency pair

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

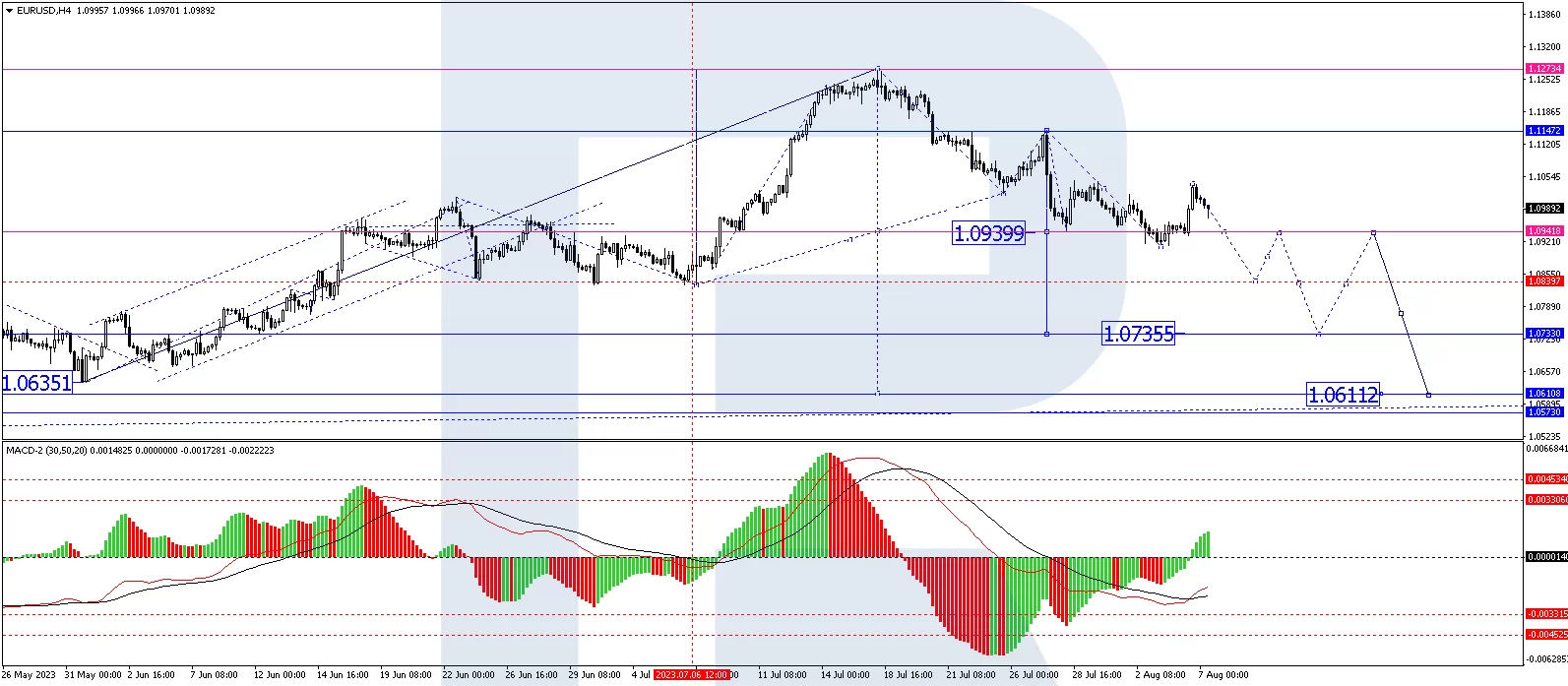

On the H4 chart, EUR/USD completed a corrective wave to the 1.1040 level and started to develop another wave of decline. The 1.0941 level could be reached. A downward breakout of this level will open the potential for a wave of decline to 1.0840. Once the price hits this level, a link of growth to 1.0940 (a test from below) is expected, followed by a decline to 1.0735. This is a local target. Technically, the MACD indicator confirms this scenario with its signal line below the zero mark. The price is expected to return to it and continue falling to new lows.

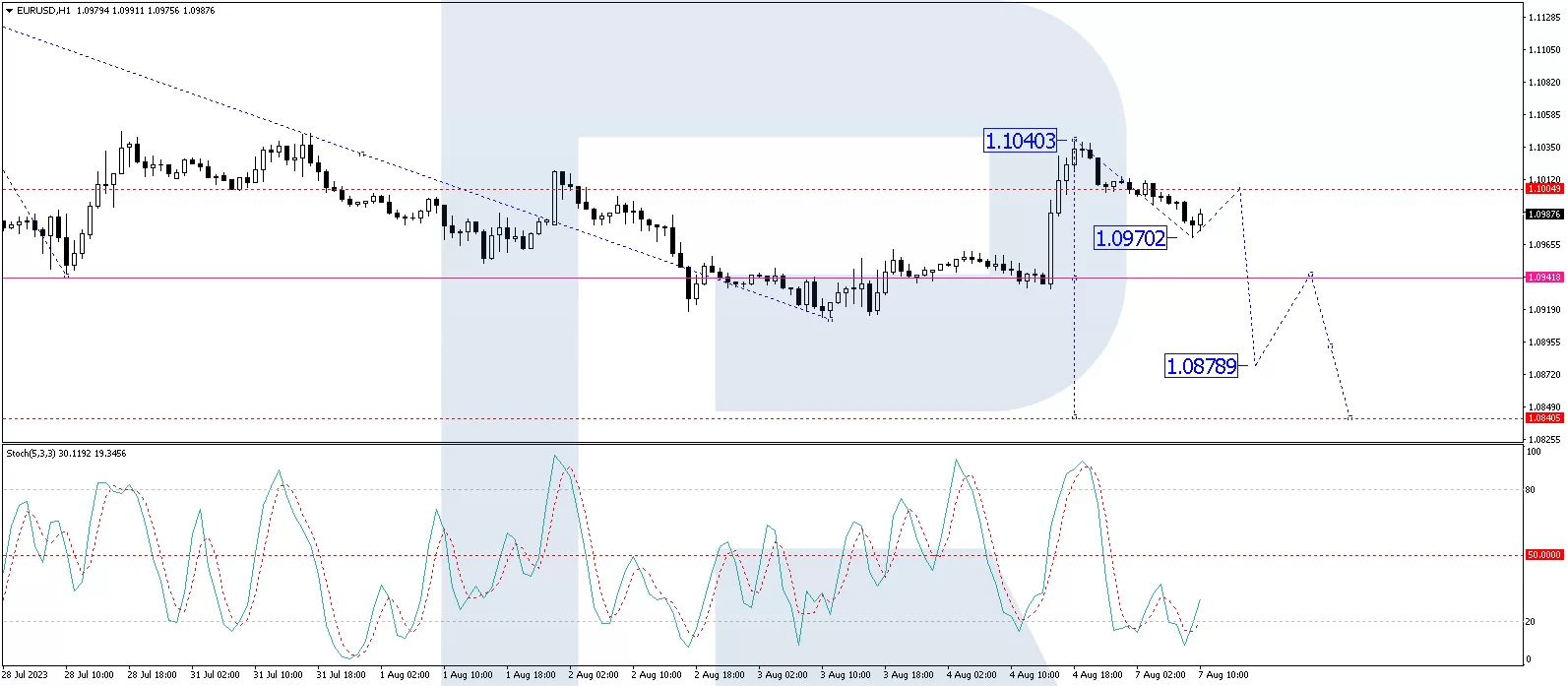

On the H1 chart, EUR/USD has completed an impulse of decline to the 1.1005 level. A consolidation range has formed around it today, and with a downward breakout, the price has declined to 1.0970. A link of correction to 1.1005 (a test from below) could form, followed by another wave of decline to 1.0940. A downward breakout of this level will open the potential for a wave of decline to 1.0878. Technically, the Stochastic oscillator also supports this outlook, with its signal line having broken the 20 mark upwards and continuing to rise to 50.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026