Brent

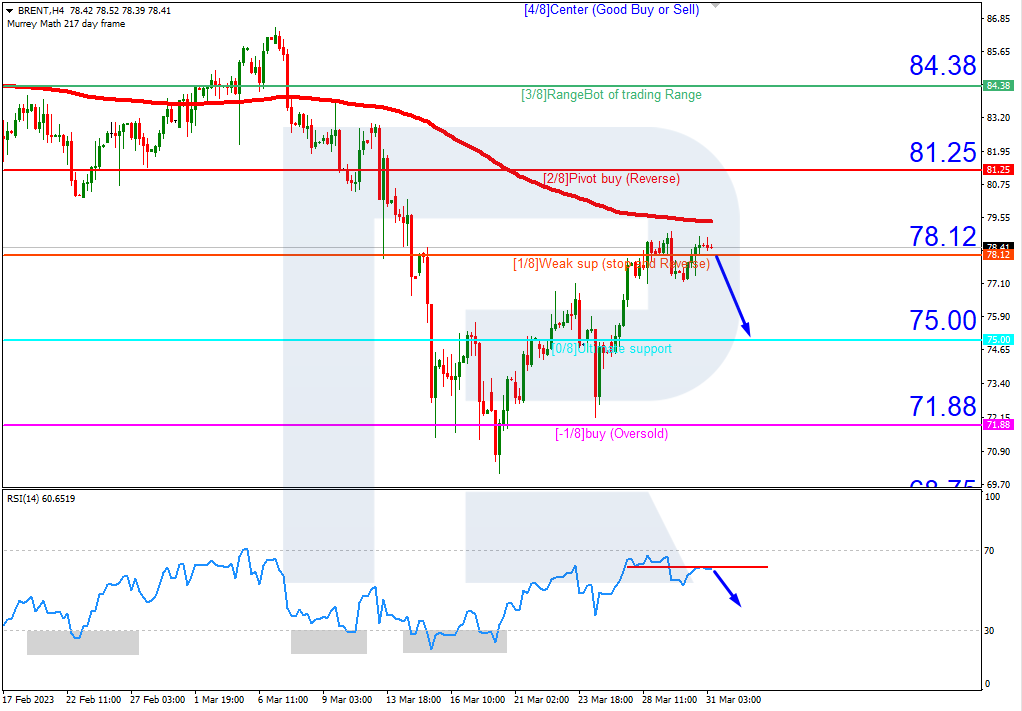

On H4, Brent quotes are under the 200-day Moving Average, which indicates the prevalence of a downtrend. The RSI is testing the resistance line. In this circumstances, we expect a downward breakout of 1/8 (78.12) and falling to the support at 0/8 (75.00). The scenario can be canceled by rising above 2/8 (81.25), which might lead to a trend reversal and growth to the resistance level of 3/8 (84.38).

On M15, a breakout of the lower line of the VoltyChannel indicator will increase the probability of further price falling.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

S&P 500

On H4, the quotes of the S&P 500 index have broken the 200-day Moving Average and are now above it, which indicates a probable development of the uptrend. However, the RSI has reached the overbought area. As a result, in such a situation, a rebound from the level of 4/8 (4062.5) is expected, after which the price could fall to the support at 3/8 (3984.4). The scenario can be canceled by rising above the resistance at 4/8 (4062.5). In this case, the growth of the S&P 500 index will continue, and the index could reach 5/8 (4140.6).

On M15, further price falling can be supported by a breakout of the lower border of VoltyChannel.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026