Brent

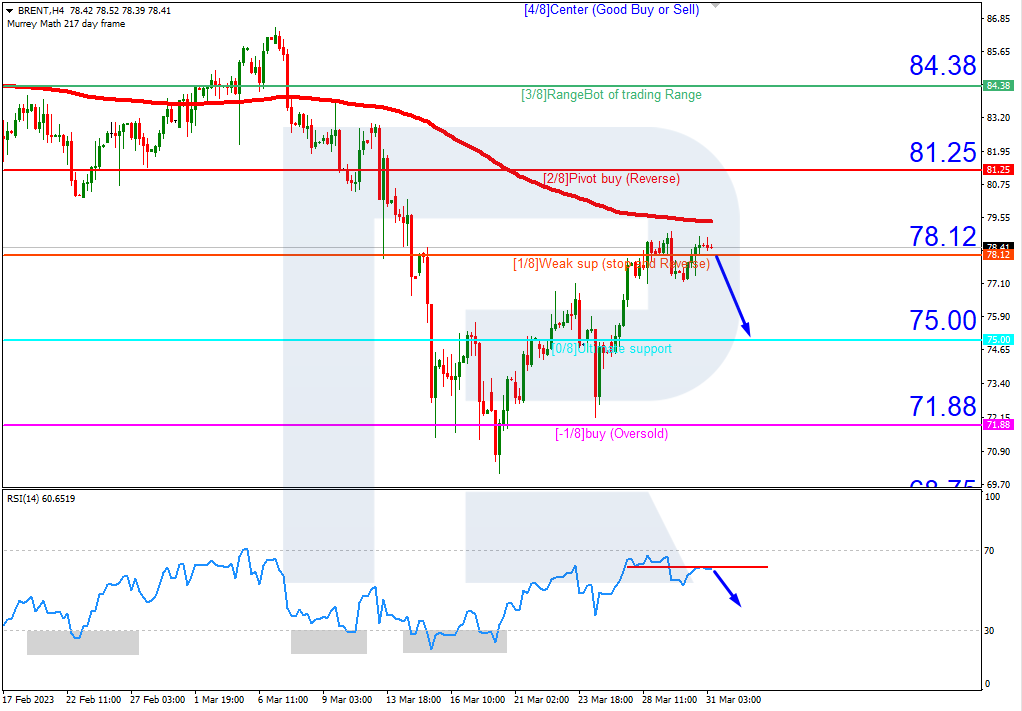

On H4, Brent quotes are under the 200-day Moving Average, which indicates the prevalence of a downtrend. The RSI is testing the resistance line. In this circumstances, we expect a downward breakout of 1/8 (78.12) and falling to the support at 0/8 (75.00). The scenario can be canceled by rising above 2/8 (81.25), which might lead to a trend reversal and growth to the resistance level of 3/8 (84.38).

On M15, a breakout of the lower line of the VoltyChannel indicator will increase the probability of further price falling.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

S&P 500

On H4, the quotes of the S&P 500 index have broken the 200-day Moving Average and are now above it, which indicates a probable development of the uptrend. However, the RSI has reached the overbought area. As a result, in such a situation, a rebound from the level of 4/8 (4062.5) is expected, after which the price could fall to the support at 3/8 (3984.4). The scenario can be canceled by rising above the resistance at 4/8 (4062.5). In this case, the growth of the S&P 500 index will continue, and the index could reach 5/8 (4140.6).

On M15, further price falling can be supported by a breakout of the lower border of VoltyChannel.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024