Source: Streetwise Reports (2/16/23)

First Tellurium Corp. sees increased tellurium production in a bid to meet rising global demand in 2023.

First Tellurium Corp. (FTEL:CSE) is expecting global demand and prices of tellurium (Te) to increase this year, therefore also seeing bright prospects for its Te production from its Deer Horn property in British Columbia, Canada.

FTEL is a company engaging in the exploration and development of predominantly Te mines. The company has two high-grade mining jurisdictions, which are its Deer Horn property in British Columbia, Canada, and Klondike property in Colorado, U.S.

Why Tellurium? Looming Shortage Driving Demand and Price Increases

Te is essential for the generation of clean and sustainable energy. It is a raw material for manufacturing solar photovoltaic (PV) panels, new batteries, and other advancing technologies.

Te is incorporated in lithium-ion battery cathodes, and this improves the batteries’ energy density for longer-lasting charging; enhanced electrical conductivity for quicker charging time; and safety. For solar panels, Te provides better conductivity, making a thin film efficiently absorb sunlight and convert it into electricity.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

FTEL President and CEO Tyrone Docherty said 90% of Te comes from refining copper, and only 10% comes from mines. The company said there is a looming shortage of Te as the demand is rapidly growing, but much of the supply is not mined on its own.

He said FTEL is well positioned to increase the share of mining in Te production and to meet the increasingly growing demand for Te, which mostly comes from the clean energy sector.

According to a report by Investing Whisperer, other than sourcing through copper processing, Te is a rare and brittle metalloid element found in small quantities in the Earth’s crust — about eight times rarer than gold itself. As the demand from solar panel manufacturers grows, Te production is seen to shoot up in the near future.

“It’s possible that the market for Te could be much larger in the near-to-mid term–due to the increased use of solar panels. Right now, it’s a very small market with just under 600,000 kg produced in 2021,” the report said.

China has 20% of the world’s Te resource and has produced most (61%) of the global Te output last year. Responding to the looming shortage fears and bright prospects in terms of demand, the U.S. wants to get a larger share of the pie — to see more domestic supply chains of Te which denotes an increase in delivery from U.S. suppliers like FTEL.

Chen Lin of What is Chen Buying? What is Chen Selling? recommended FTEL in a December posting. He mentioned that North America is too dependent on outside sources for the element and went on to say, “This metal can be in demand, this is a pure-play, and management just a lot of (its) own money in the stock.” Lin later reiterated his recommendation in a February newsletter. He said, “FTEL was very well received at both the Metals Investment Forum and Vancouver Resource Investment Conference. The management was surrounded by investors and talked for hours afterward. I think investors’ interests definitely picked up and there could be other newsletters recommending it.”

FTEL Answers Demand

FTEL answers the demand for critical metals such as Te, Au, Ag, Cu, and W, with a focus on Te. Major U.S.-based solar PV manufacturer First Solar has recognized their Deer Horn property as one of the four world-class Te projects, with the other three located in Sichuan, China; Sonora, Mexico; and Boliden Area, Sweden.

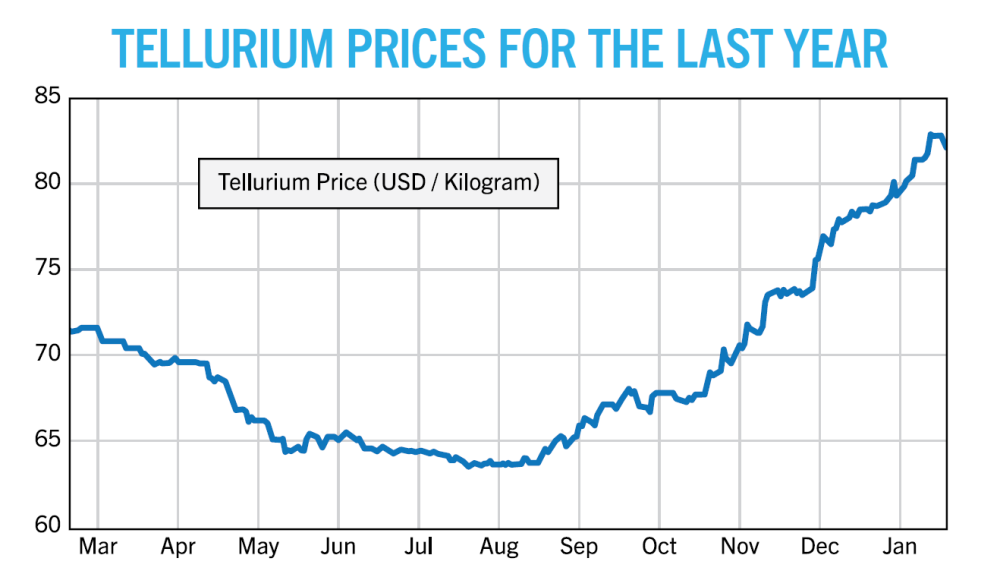

New Te supplies from the company will benefit as prices need to increase to meet Te demand. From a US$70 per kg price level a year ago, prices have already gone up to US$80 per kg as of January 2023. Its market price is expected to get a boost from First Solar as its annual Te demand could exceed last year’s Te global production by up to 70%.

The Deer Horn jurisdiction hosts the only Te, Au, and Ag resources in North America, and has also passed a positive PEA or Preliminary Economic Assessment, which is crucial for moving forward with any mining project.

Based on Investing Whisperer’s analysis, FTEL and its two mines with Te deposits close to the surface is the only Te play for investors.

The company adopts a phased expansion approach, where they start exploration and production with small mines, and then expand mining areas in the same territory over time.

The company benefits from this approach with lower exploration and development costs, lower capital spending, faster production and delivery of supplies, a faster-permitting process with small mine applications than larger mines, and many others.

FTEL’s exploration in 2022 extended their mineral zone potential in the Deer Horn property to an additional 1.1 km, expanding their total potential strike length to 3.5 km.

Based on Investing Whisperer’s analysis, FTEL and its two mines with Te deposits close to the surface is the only Te play for investors.

The report also factored in the prospect to expand these sites in the future, and that there are Au, Ag, Cu, and W deposits in the mines which can account for 50% of the company’s value.

The Catalyst: Drilling Set for the Summer

FTEL is set to start its drilling within its polymetallic Deer Horn site in the summer of 2023. This will yield new Te, Au, and Ag production for the company which will allow them to deliver supply this year.

The company will also greatly benefit from favorable market conditions such as the ongoing advances in battery technologies, and solar power demand, as well as the push for funding and focus on critical metals by the U.S. and Canadian governments.

EcoWatch mentioned that as the green energy technology sector grows, then so is the demand for Te and other critical metals which can have Te as a byproduct, given that 90% of global Te supply comes from refining copper mining. FTEL has two predominantly Te mines that can contribute to supporting the growth of green energy technologies.

On February 2, 2023, technical analyst Clive Maund touched on the outlook of the company, saying, “First Tellurium presents a positive picture and overall looks like a low-risk setup. We, therefore, stay long.”

Ownership and Share Structure

Streetwise Ownership Overview*

First Tellurium Corp. (FTEL:CSE)

| Retail: 89% | |

| Management/Insiders: 11% | |

| Institutions & Strategic Investors: 0% |

According to the company, 11% of First Tellurium is owned by management and insiders. According to Reuters CEO, President, and Director Tyrone Docherty owns 10.50%m with 7.63 million shares. Director Josef Anthony Steve Fogarassy has 1.38%, with 1 million shares, and Director Lyle Allen Schwabe has 0.77%, with 0.56 million shares.

There are no institutional investors and the rest is retail.

FTEL has CA$1.5 million in the bank with a CA$35,000 to CA$40,000 monthly burn rate.

The company has a market cap of CA$23.37 million and 84.026 million outstanding shares. Their stock is trading between CA$0.085 and CA$0.710 based on its 52-week range.

Disclosures:

1) Nika Cataldo wrote this article for Streetwise Reports LLC as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: First Tellurium Corp. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously publish First Tellurium Corp., a company mentioned in this article.

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026