By RoboForex Analytical Department

The Pound Sterling keeps trying to reach stability against the USD. On Monday, 3 October, GBP/USD is balancing around 1.1211.

After the Bank of England revised its stance on supporting the country’s economy and decided to buy government bonds instead of selling them, the Pound got too much stress and dropped to multi-year lows.

The monetary and financial policy delivered by the Bank of England together with Her Majesty’s Treasury makes investors worry. It looks like London put up with an inflation boost and might try to improve the economy from the other side.

It does not necessarily mean that this strategy will work – market players should wait for real data that will help them to analyse the effect.

So far, the Pound remains fundamentally weak.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

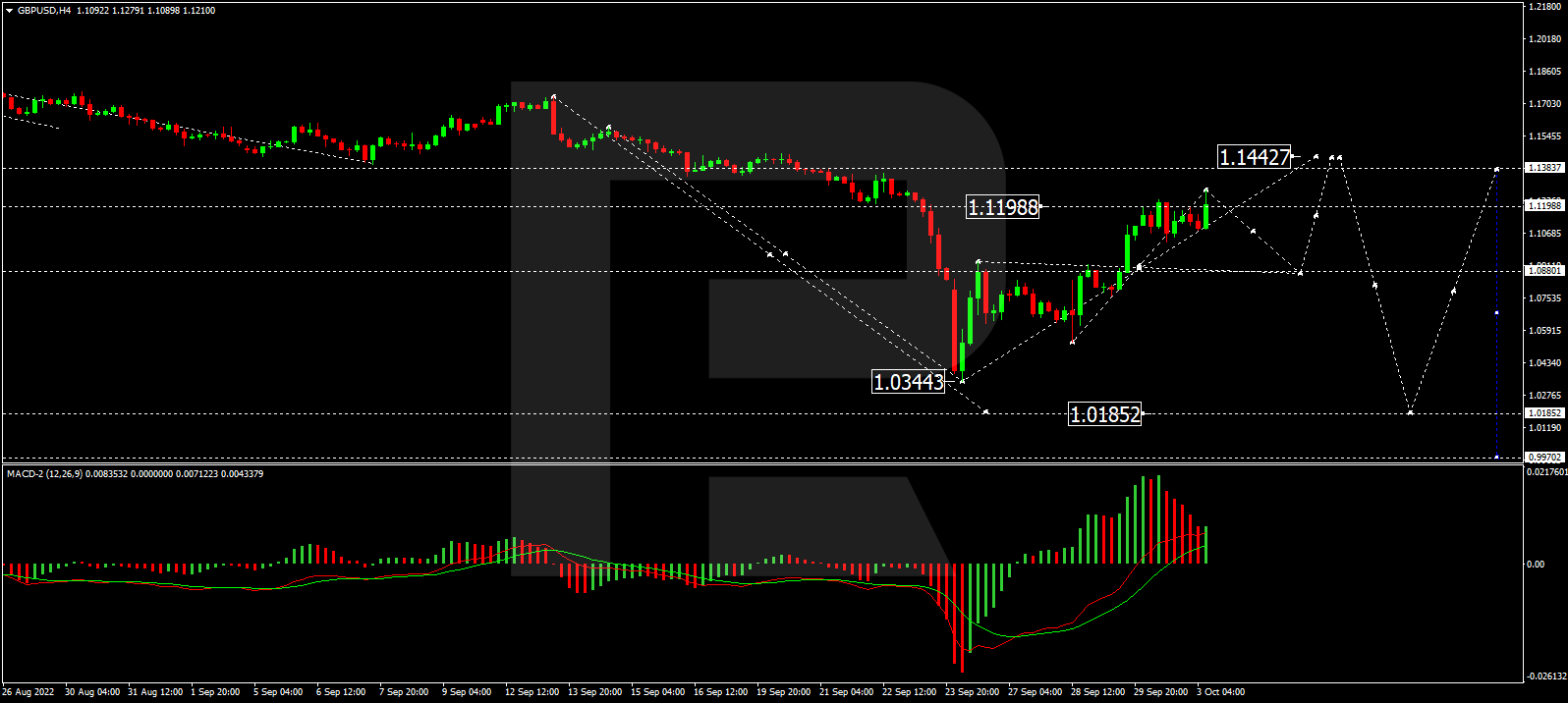

As we can see in the H4 chart, after finishing the descending wave at 1.1275, GBP/USD has formed a new consolidation range there. If later the price breaks the range to the downside, the market may resume trading downwards with the target at 1.0880; if to the upside – form one more ascending structure towards 1.1447 and then start another decline to reach 1.0185. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving above 0 and may continue growing to reach new highs soon.

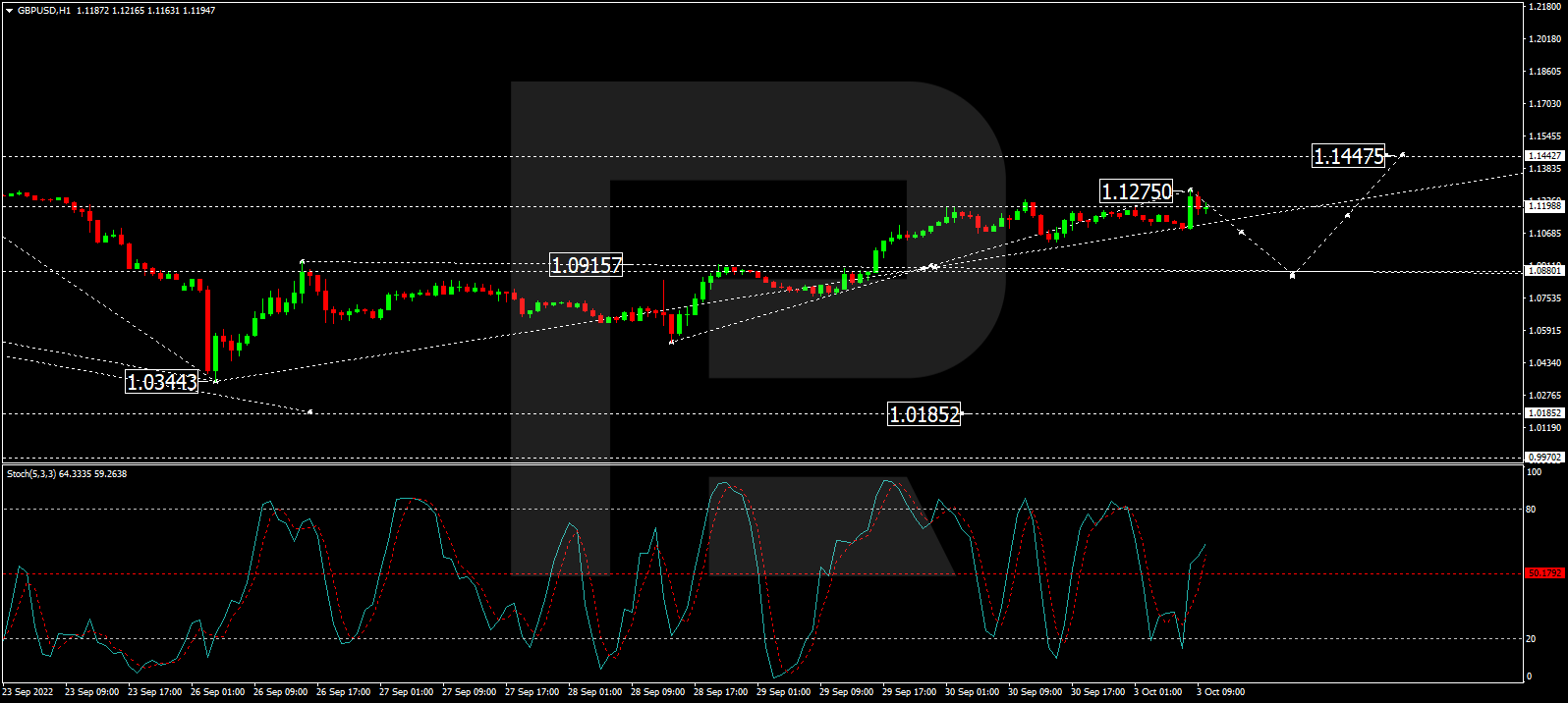

In the H1 chart, GBP/USD has completed the ascending structure with the short-term target at 1.1275. Possibly, the pair may fall towards 1.0880 and then start another growth to reach 1.1447. Later, the market may resume trading within the downtrend with the target at 1.0880. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: its signal line is moving below 80 and may fall to break 50. After that, the line may reach 20 and then resume growing to return to 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026