By Ino.com

Investors may want to keep an eye on discount retailers, like Dollar General (DG).

For one, the latest pullback may be a great buy opportunity.

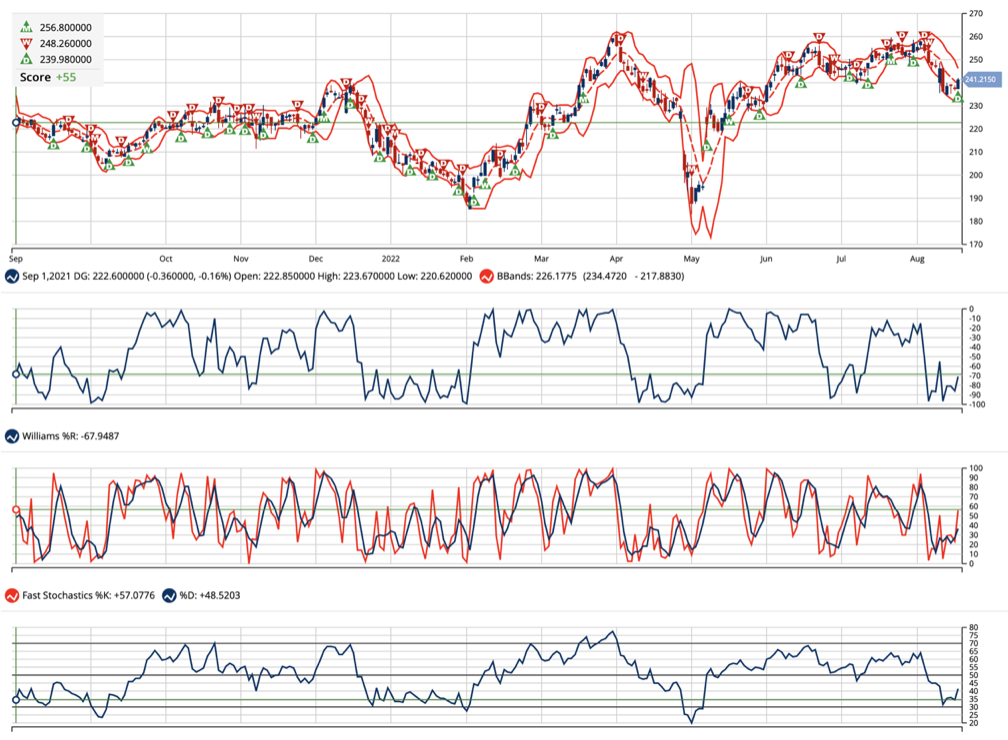

If you take a look at this chart, you’ll notice that Williams’ %R, Fast Stochastics, and RSI are all starting to pivot well off oversold conditions. With patience, I’d like to see the Dollar General stock retest $260 resistance, near-term from $241.65 support.

Unlock $2,600 in Investing Resources – Learn More >>

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Two, while other major retailers take a hit with inflation, Dollar General is rising because of inflation. In fact, we can see that with the company’s recent earnings report.

Not only did Dollar General report second quarter EPS of $2.98, which was better than the expected $2.94 a share, sales were up to $9.4 billion, same-store sales were up 4.6% as compared to expectations for 3.9%. The company even increased its same-store sales forecast to a range of 4% to 4.5% for the fiscal year, from a prior call for 3% to 3.5%.

Three, wealthier people are now shopping at dollar stores because of inflation.

According to Business Insider, Todd Vasos, CEO of Dollar General, said on a call with analysts that the store saw a rise in higher-income households shopping there, “which we believe reflects more consumers choosing Dollar General as they seek value.”

Plus, we have to realize consumers are “trying to make ends meet, and when you have limited funds in your wallet, the dollar stores provide the ability to do that,” added Joseph Feldman, a senior analyst at Telsey Advisory Group, as quoted by The New York Times.

In addition, analysts seem to like the DG stock, as well.

Guggenheim analyst John Heinbockel reiterated a buy on the stock. Piper Sandler raised its price target on DG to $273 from $265. Raymond James raised its target price to $285 from $160. Morgan Stanley raised its target to $270 from $250. Deutsche Bank says Dollar General is one of the few stable retailers.

Plus, Dollar General will also pay a dividend shortly.

On August 23, 2022, the Company’s Board of Directors declared a quarterly cash dividend of $0.55 per share on the Company’s common stock, payable on or before October 18, 2022 to shareholders of record on October 4, 2022.

All things considered, investors may want to use recent DG weakness as an opportunity.

Ian Cooper

INO.com Contributor

The above analysis of Dollar General (DG) was provided by financial writer Ian Cooper. Ian Cooper is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Ian Cooper expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

By Ino.com – See our Trader Blog, INO TV Free & Market Analysis Alerts

Source: Chart Spotlight: Dollar General (DG)

- China launches a plan to boost domestic consumption. Global trade tensions remain. Mar 17, 2025

- Escalating trade tensions triggered a risk reduction among investors Mar 14, 2025

- Gold poised for record highs strong demand and stable outlook Mar 14, 2025

- The Bank of Canada cut the interest rate as expected. The EU and Canada imposed retaliatory tariffs on the US. Mar 13, 2025

- EUR/USD holds onto hopes of further growth as investors assess the risks Mar 13, 2025

- The uncertainty of the new US administration’s tariff policy negatively affects investor sentiment Mar 12, 2025

- Japanese yen declines: temporary pause amid strong long-term outlook Mar 12, 2025

- Hedge funds have significantly reduced their holdings in equities. Oil fell to $66 per barrel Mar 11, 2025

- Gold remains in consolidation amid ongoing market uncertainty Mar 11, 2025

- China’s consumer prices fell the most in 13 months. Canada has chosen a new prime minister Mar 10, 2025