By RoboForex Analytical Department

The British pound against the US dollar is devaluating too fast. The GBP/USD pair has already dropped to 1.1477.

On the one hand, the pound is really vulnerable to the USD. On the other hand, today the name of the new had of the Conservative Party will be known, a.k.a. the new Prime Minister of Great Britain. There is too much ambiguity in this issue: it might be either a young politician, head of the Treasury, or the head of Foreign Office, notorious for her political views.

The political imbalance that might increase if Liz Truss is elected, noticeably scares pound fans.

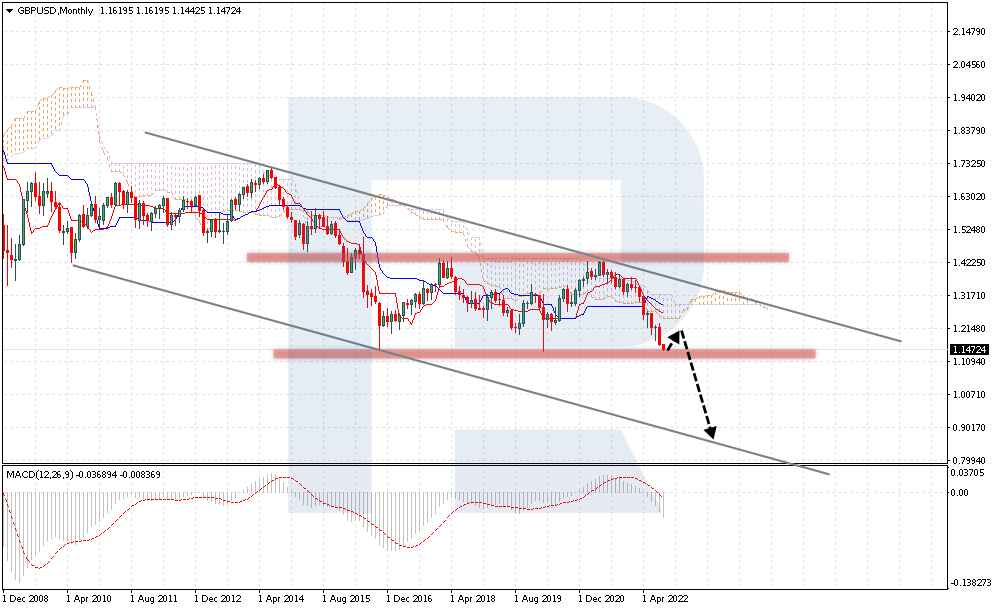

GBP/USD quotes are already testing their long-time lows of 2016 and 2020. The buyers managed to fight back two attacks of the bears on 1.1460. However, if this level is indeed broken away, there are chances to see the pair fall for the width of the sideways movement, in which it has been squeezed since mid-2016. In this case, the goal of the developing downtrend will be 0.8600. The idea will be confirmed if the support level is broken and the price secures under 1.1400. Growth of the quotes above 1.1900 might provoke another attempt to develop a lengthy bullish correction.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

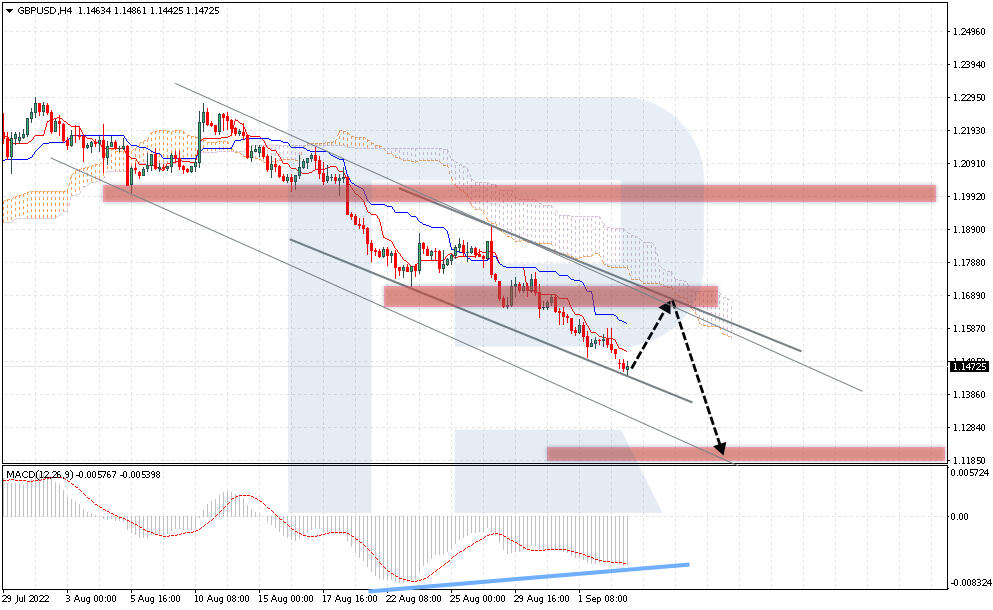

On H4, GBP/USD is going under the Ichimoku Cloud, which presumes a medium-term bearish impulse. A strong resistance level is 1.1640, where goes the upper border of the descending channel. The upward correction is also supported by a bullish divergence forming on the MACD. After a bounce off 1.1640 we may speak about further development of the current downtrend to 1.1180. The scenario can be cancelled by a breakaway of the upper border of the Cloud and securing above 1.1765, after which the correction should develop to 1.2000.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026