By RoboForex Analytical Department

AUD/USD is balancing at 0.6083 on Monday. The bulls managed to break the descending channel and they stand a good chance of starting a new ascending tendency in the near future.

The RBA Governor is ready to tighten the regulator’s monetary policy by doubling the benchmark interest rate. The reason for this announcement is simple – it’s necessary to push inflation back to its target of 2-3%. Market players tend to respond to such comments, that’s why the AUD got significant support.

The quarterly CPI report is scheduled to be released as early as Wednesday and it is expected to show further growth in inflation, which has already reached its 20-year highs. Another important report, Retail Sales, will be published on Thursday and no positive dynamics are expected here as well. If this indicator is also far below expectations, the risks of a rate-hike by the RBA will increase, helping the AUD to continue its uptrend.

It should be noted that early in the year Philip Lowe wasn’t ready for monetary policy tightening and said that he couldn’t see the rate going up in 2022. However, high inflation forced the regulator to take emergency measures and start raising the rate.

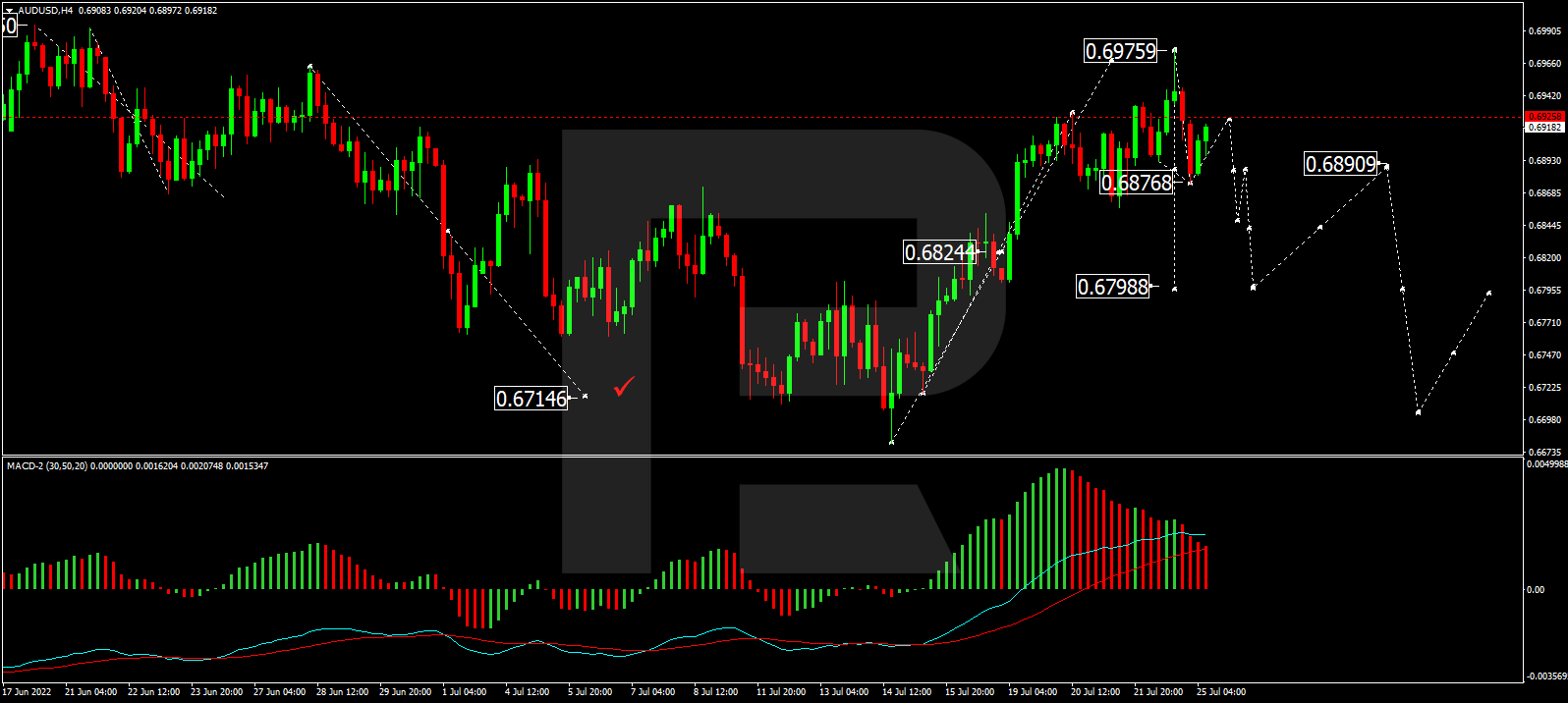

As we can see in the H4 chart, after finishing the first descending impulse at 0.6876, AUD/USD is correcting upwards to reach 0.6925 and may later form another descending impulse towards 0.6886. Later, the market may break the latter level and continue trading within the downtrend with the target at 0.6850, or even extend this structure down to 0.6798. From the technical point of view, this scenario is confirmed by the MACD Oscillator: after leaving the histogram area, its signal line is about to fall and reach 0.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

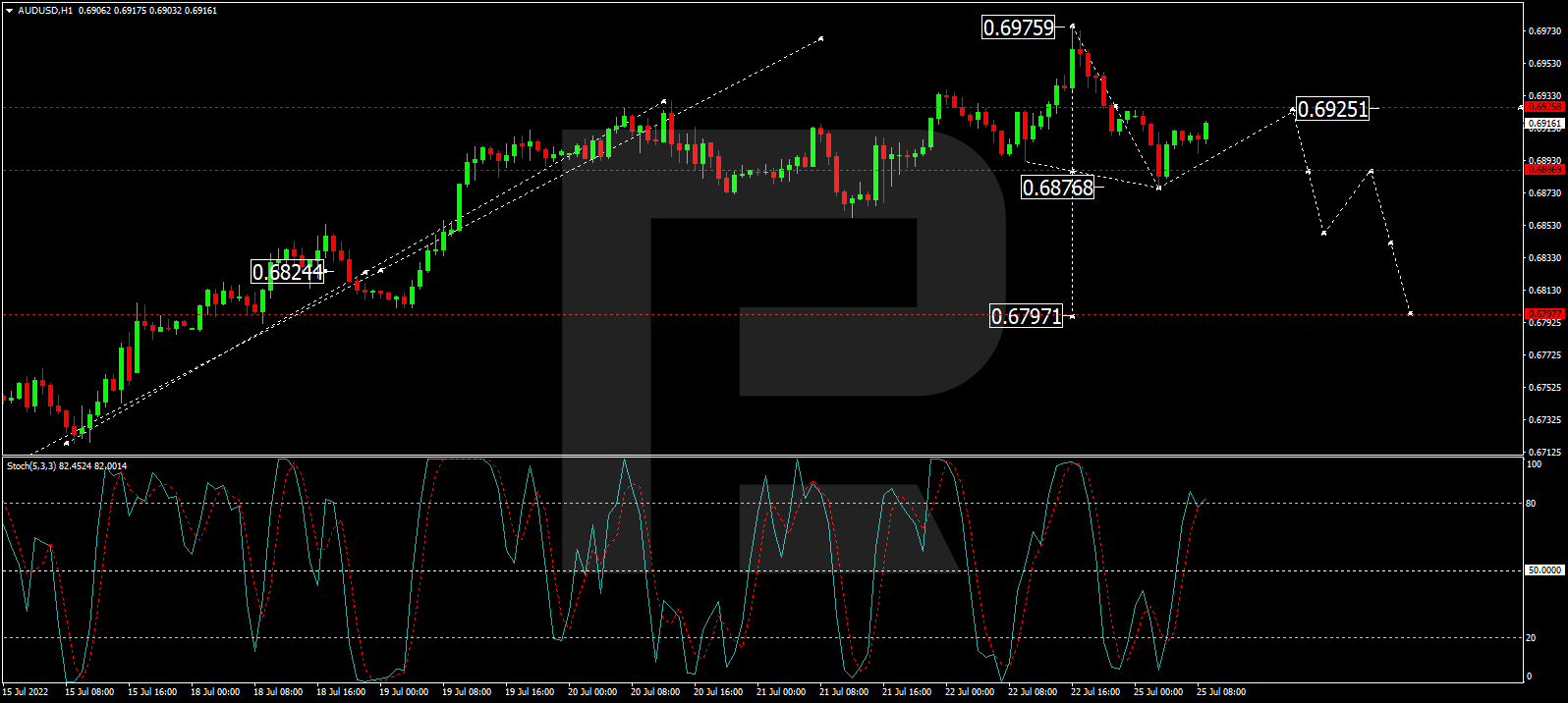

In the H1 chart, having completed the five-wave structure of the first descending impulse at 0.6875, AUD/USD is correcting upwards to reach 0.6925 and may later fall towards 0.6888, thus forming a new consolidation range between the two latter levels. After that, the instrument may break the range to the downside and form a new descending structure with the target at 0.6850. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: its signal line is moving above 80 and may soon start falling to break 50. Later, it may continue moving down to 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026