More Fed speak …

more US earnings …

and the freshest updates to the global economic outlook (via the latest IMF projection and GDP figure for China, the world’s second largest economy) …

Investors and traders can feast on these major data releases and events scheduled for the week ahead:

Monday, April 18

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

- CNH: China Q1 GDP, March industrial production and retail sales

- Bank of America 1Q earnings

- USD: St. Louis Fed President James Bullard speech

- UK, European, Hong Kong markets closed

Tuesday, April 19

- JPY: Japan February industrial production (final)

- Gold: IMF releases updated world economic outlook

- Netflix 1Q earnings

- USD: Chicago Fed President Charles Evans speech

Wednesday, April 20

- JPY: Japan March external trade

- CNH: China loan prime rates

- EUR: Eurozone February industrial production

- CAD: Canada March CPI

- US crude: EIA weekly US crude inventories

- Tesla 1Q earnings

- USD: Fed releases Beige Book, speeches by San Francisco Fed President Mary Daly and Chicago Fed President Charles Evans

Thursday, April 21

- NZD: New Zealand Q1 CPI

- EUR: Eurozone March CPI (final), April consumer confidence (advance)

- USD: US weekly initial jobless claims

- EURUSD: Fed Chair Jerome Powell and ECB President Christine Lagarde take part in IMF discussion

Friday, April 22

- American Express 1Q earnings

- EUR: Eurozone April PMIs

- GBP: UK March retail sales, April consumer confidence and PMIs, BOE Governor Andrew Bailey speech

- CAD: Canada retail sales

Monday’s data dump out of the China should give investors a better idea of what 2022 has in store for the world.

Here’s what economists are forecasting:

- Q1 GDP = 4.2% growth compared to Q1 2021 (year-on-year); faster than the 4.0% y/y posted in Q4 2021

- March industrial production = 4.0% y/y, lower than December’s 4.3% and the 7.5% posted for the January-February 2022 period.

- March retail sales = -3%, compared to 1.7% y/y growth in February

The contraction in March retail sales is particularly telling, considering that the tail-end of the month saw lockdowns imposed in Shenzhen and Shanghai, China’s financial hub.

Given that China is the world’s second largest economy and also the largest trading partner for many countries, any slowdown in growth there will reverberate around the world.

The International Monetary Fund (IMF) is also set to lower its forecast for 2022’s global growth, with the Russia-Ukraine war raising the risk of a recession.

If investors are given more cause for alarm out of these economic data or the IMF’s outlook, that could spur more demand for safe havens such as gold.

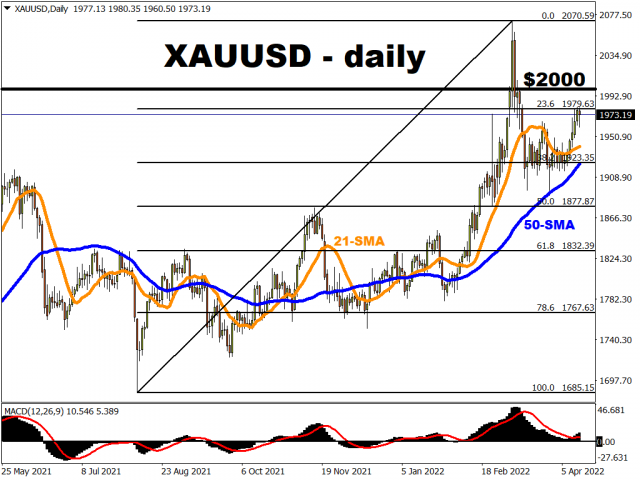

Such a fear-ridden narrative may push spot gold closer to the psychologically-important $2000 mark. However, gold bulls must first overcome and secure a daily close above the immediate resistance line at a key Fibonacci retracement level from gold’s August through March ascent.

However, this precious metal could be met with a moment of reckoning should real Treasury yields cross over into positive territory in the coming week. Note that real-yields are now just 9 basis points away from crossing that crucial threshold, and have come a long way from the negative 1.25% mark seen back in November.

Further gains in Treasury yields, both nominal and real, could ultimately weaken the resolve of gold bulls, given that bullion offers zero yield.

Powell vs. Lagarde divergence could heap more pain on euro

We saw this week how the euro was dragged lower by a dovish European Central Bank, which appeared to be needing more time before it wants to join other central banks in raising interest rates.

EURUSD fell to its lowest since April 2020 (remember the early days of the Covid-19 pandemic?) before paring some of its losses at the time of writing.

With Fed Chair Jerome Powell and ECB President Christine Lagarde set to both feature on the same panel discussion on Thursday, hosted by the IMF, the gap between the Fed and the ECB could be made more evident in this debate on the global economy.

To be clear, both central banks are battling red-hot inflation; but the Fed is perceived to be doing more about it than their European counterparts at present.

The Fed already raised interest rates by 25 basis points in March, with a 50-basis point hike widely expected in May.

Meanwhile, the ECB may only hike sometime in the third quarter.

Should markets perceive an even-wider gap between those two influential central banks, in terms of how quickly they’re reacting to subdue skyrocketing consumer prices, that could ensure a weekly close below 1.08 for EURUSD in the coming week.

Such price action could all but pave the way towards 1.06 for EURUSD by the middle of the year, with perhaps a pit stop at the April 2020 low of 1.07269.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024

- COT Soft Commodities Charts: Speculator bets led by Soybean Meal & Lean Hogs Apr 20, 2024

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024