Shifting expectations for the next policy moves by major central banks remain a key theme across global financial markets, as investors and traders digest these major data releases and events in the week ahead:

Monday, April 25

- EUR: Euro to react to Sunday’s French presidential election results

- EUR: Germany April IFO business climate

Tuesday, April 26

Wednesday, April 27

- AUD: Australia weekly consumer confidence, 1Q CPI

- CNH: China March industrial profits

- US crude: EIA weekly US crude inventories

- Meta Platforms Q1 earnings

Thursday, April 28

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

- JPY: Bank of Japan policy decision, March retail sales and industrial production

- EUR: Germany April CPI, Eurozone April economic confidence, ECB economic bulletin

- USD: US weekly initial jobless claims, 1Q GDP

- Nasdaq 100: Amazon, Apple, Twitter Q1 earnings

Friday, April 29

- EUR: Eurozone April CPI, 1Q GDP

- USD: US March personal income and spending, PCE deflator, April consumer sentiment

- Exxon Q1 earnings

- Chevron Q1 earnings

The Bank of Japan is set to go into action, or rather the lack thereof, as the central bank is widely expected to stick to its ultra-loose monetary policy stance.

The BOJ has kept its policy rate floored at negative 0.1% and buying up even more bonds, which is in stark contrast to what other major central banks are doing (bar China). Most central banks around the world are already raising interest rates and starting to curb their bond purchases in an apparent race to quell skyrocketing inflation.

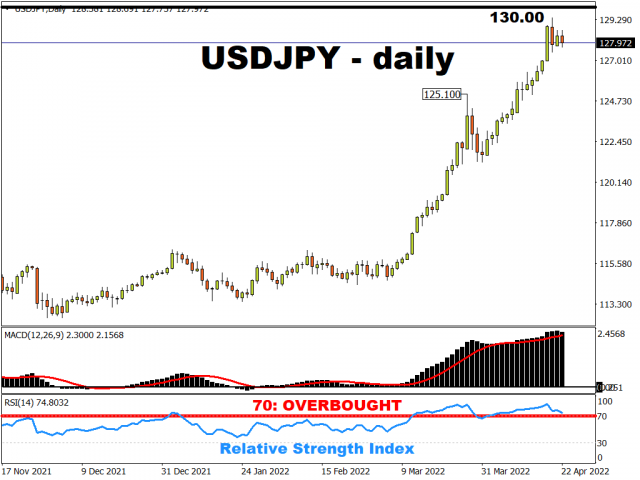

This policy divergence between the Fed and the BOJ in particular has sent USDJPY racing towards a 20-year high, closing in on the psychologically-important 130 mark.

Still, it’s ascent is on a breather at this point in time, with the 14-day relative strength index suggesting that the currency pair is trying to clear some of the froth and attempting to recover from overbought conditions.

READ MORE: Why is the Yen so weak?

Markets will be closely monitoring if BOJ Governor Haruhiko Kuroda will make any adjustments to policymakers’ stance on keeping bond yields capped at 0.25% and tolerating a weaker yen.

If the BOJ chief stays staunchly dovish, that could well pave the way for USDPJY to run towards its 2002 peak around 135. This climb could be further accentuated if the incoming GDP and PCE deflator data out of the US shows that the world’s largest economy could do with more Fed rate hikes – widening the policy divergence between the Fed and the BOJ.

However, any hints that a change in tack is forthcoming could translate into the unwinding of gains for USDJPY, potentially moving it closer to the previous cycle’s peak of 125.10.

French presidential election: Macron win could aid EURUSD recovery

The euro recently resurfaced back above the 1.08 mark against the US dollar as markets return to their bets that the European Central will be forced to lean harder into its hawkish pivot.

Still, the recovery in the bloc currency proved fleeting, with EURUSD‘s downside bias still evident at the time of writing.

While the ECB policy outlook remains a major influence over the euro’s performance, traders and investors will also be digesting the results out of the presidential elections between incumbent Emmanuel Macron and nationalist challenger Marine Le Pen when markets reopen for the new trading week.

A win for Macron, which should ensure policy continuity amid a trying time for the Eurozone, could result in further relief for the euro.

However, a surprise Le Pen victory, which injects policy ambiguity into an already uncertain economic outlook in light of the still-raging war in the Ukraine, may drag EURUSD further below 1.08 as a knee-jerk risk-off reaction.

Big Tech earnings boost needed to stem losses for Nasdaq 100

Surging US Treasury yields in recent months have earned the scorn of tech stocks, with the Nasdaq 100 dragged further below 14,000 this week.

The prospects of higher US interest rates and the accompanying rise in borrowing costs have soured the outlook for growth companies.

Having a year-to-date drop of almost 16% (before US markets open on Friday, 22 April), it’s up to illustrious names such as Amazon, Apple, Alphabet, Meta and Twitter to provide an earnings beat to shore up the declines in the Nasdaq 100 (though Twitter’s earnings call will likely be dominated by the latest developments surrounding the much-hyped takeover bid by Elon Musk).

Note that the 5 companies mentioned above have a combined market cap of more than US$6.4 trillion, which is almost 40% of the entire market cap of the Nasdaq 100.

In other words, those 5 companies carry a lot of heft that could move the entire index.

These Big Tech companies are expected to see decelerating growth last quarter, given the heightened competition and the tough comparisons with a stellar Q1 2021.

Still, any positive surprises out of these earnings calls (barring another shock move by Mr. Musk) could offer some relief for the Nasdaq 100, though the index is expected to remain capped by its 50-day simple moving average as the prospects of more incoming Fed rate hikes loom closer.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026