By Orbex

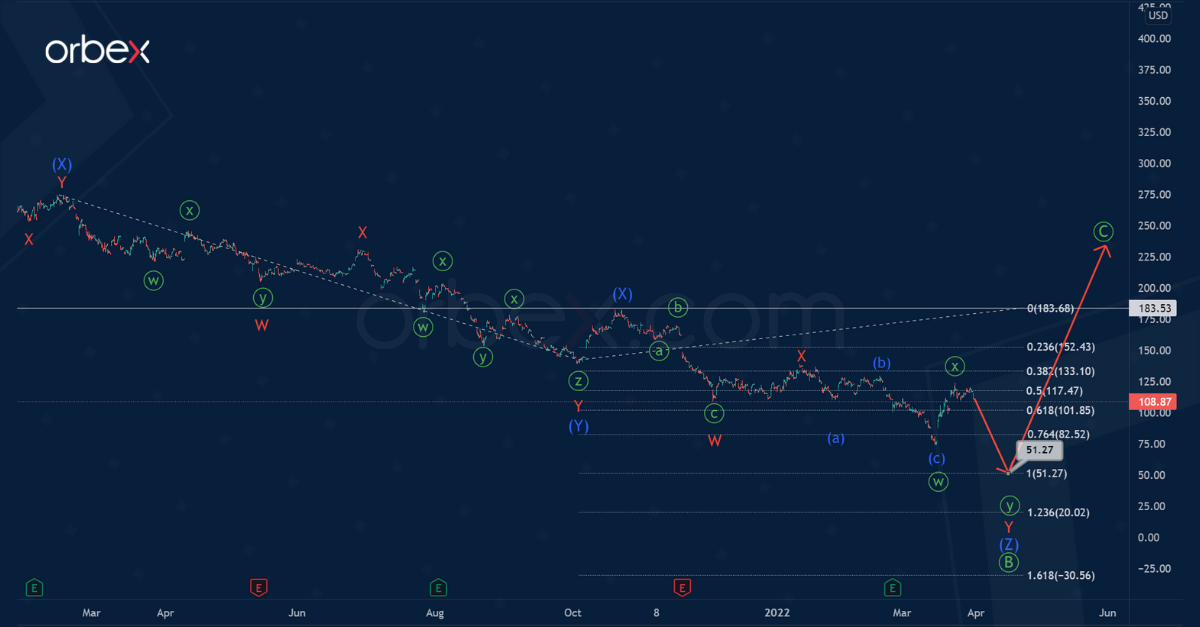

The internal structure of BABA shares suggests the construction of a large bullish zigzag Ⓐ-Ⓑ-Ⓒ of the primary degree.

At the time of writing, the price is at the end of the primary correction Ⓑ. This correction has the form of an intermediate triple zigzag (W)-(X)-(Y)-(X)-(Z). Now the formation of the final actionary wave (Z) is taking place. Its structure hints at a complex formation of a double zigzag W-X-Y.

The decrease in wave (Z), more precisely in its last actionary wave Y in the form of a minute double zigzag ⓦ-ⓧ-ⓨ, could reach the level of 51.27. At that price level, sub-waves (Z) and (Y) will be equal.

After the completion of the primary correction Ⓑ, an impulse growth is possible significantly above the end of the intermediate intervening wave (X), above 183.53.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Let’s consider the second scenario, where the formation of the primary correction wave Ⓑ has already come to an end. Thus, we can expect the beginning of a bullish primary wave Ⓒ in the near future.

The wave Ⓒ could be a simple impulse consisting of intermediate waves (1)-(2)-(3)-(4)-(5)

It is possible that prices, with a growing wave Ⓒ, will rise above the maximum of 273.78, which was marked by the intervening wave (X).

Article by Orbex

Article by Orbex

Orbex is a fully licensed broker that was established in 2011. Founded with a mission to serve its traders responsibly and provides traders with access to the world’s largest and most liquid financial markets. www.orbex.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026