By Orbex

EURUSD falls as the prospect of rate hike fades

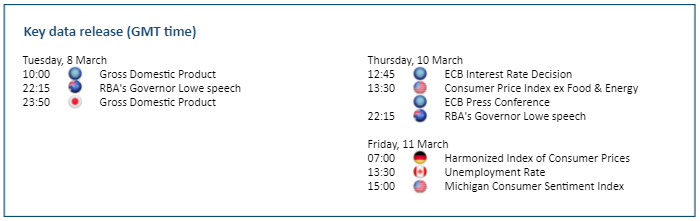

The euro tumbles as traders cut their ECB rate hike wager. A dovish statement from the central bank is expected this week as the war at the gate of the eurozone intensifies.

Surging energy prices and trade disruptions could slow the recovery. This could also hurt household and business confidence. The risk of stagflation puts a serious dent in policymakers’ optimism. The ECB may refrain from taking a drastic turn in monetary policy despite the inflation headache, or even start to backpedal with more stimulus.

The euro is now heading towards April 2020’s lows near 1.0750. 1.1160 is the resistance in case of a rebound.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

AUDUSD gains from surging commodities

The Australian dollar bounces higher thanks to soaring commodity prices.

The war in Ukraine triggered fears of supply disruptions in Eastern Europe and drove coal prices to a record high. Massive price spikes in coal, iron ore and copper (Australia’s main exports) boost demand for the Aussie.

Additionally, as traders scale back their hike expectations on major central banks, the RBA may feel less peer pressure to catch up on monetary tightening. The Aussie’s recovery may gain traction despite a risk-off mood across the board.

The pair is heading towards last October’s high at 0.7550. 0.7250 is the closest support.

USOIL surges on disruption fears

Oil prices continue to soar as mounting sanctions on Russia could disrupt global supply.

Russia is the second-largest exporter of crude oil behind Saudi Arabia, and the West has so far refrained from cutting the country off the supply chain for fear of collateral damage to its own economy. The latest proposal of a bipartisan bill to ban US imports of Russian oil stirs the pot.

Nonetheless, the Biden administration would be reluctant to take actions that could pump prices higher. Major consumers shunning Russian oil may make the market tighter than ever. WTI crude is hitting April 2011’s high at 115.00. And 90.00 is a strong support in case of a pullback.

US 100 consolidates on less hawkish Fed

The Nasdaq recouped some losses as the Federal Reserve may temper its tightening.

Geopolitical risks could push back the normalization agenda. In addition, the latest testimony from Fed Chairman Jerome Powell indicates a less hawkish stance. Economic impacts from the Russia-Ukraine conflict remain uncertain and the Fed may proceed with caution.

Markets are betting that a mere 25-basis-point rate hike would be on the table this month, and only five instead of six rate rises would happen this year. The Fed’s light-handed approach could soften the sell-off which just stopped short at 13000. 15200 is the first resistance.

Trading the news requires access to extensive market research – and that’s what we do best. Open your Orbex account now.

Article by Orbex

Article by Orbex

Orbex is a fully licensed broker that was established in 2011. Founded with a mission to serve its traders responsibly and provides traders with access to the world’s largest and most liquid financial markets. www.orbex.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026