This well-worn phrase is meant to go back to the early 1800s and is attributed to London financier Lord Rothschild which suggests that the start of a war is a good time to invest in the stock market. Conversely, the end of a war is a good time to sell. We saw a lot of optimism in risk sentiment yesterday about the potential progress in peace talks, but markets are more circumspect this morning, especially Western governments around any possible Russian de-escalation.

Interestingly, if we look at US equities, then the bottom in the S&P 500 was exactly on the first day of the Russian invasion in late February. The index has climbed over 12% since then, through both the 200-day simple moving average at 4491.3 and more recently the 100-day at 4542.1.

Is it time to sell the news?

The next resistance is the last major Fibonacci level, the 78.6% retracement of this year’s high to low move, at 4666.9. Support should initially come at the long-term moving averages.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

We note that Wall Street’s “fear gauge”, the VIX, has dropped significantly lower that it was a week before the invasion when markets were priced on the assumption that there would be no war. The relatively smooth downward course of this indicator is also grabbing some analysts’ attention.

In short, stock traders are behaving like they were given a clear reason two or three weeks ago that the market was going to be fine.

Dollar slumps as euro surges

Yesterday’s big FX moves saw some unwinding of defensive long dollar positions. The buck has been sold over the past few sessions after closing in on 100 and the year-to-date high at 99.42 on the DXY.

At some point, traders will pay more attention to interest rate differentials which is normally a key driver for FX price action. This means buyers could emerge for the greenback thanks to the Fed accelerating the pace of their tightening of interest rates and policy stimulus.

We get ADP payrolls today as a forerunner to the nonfarm payrolls data and both are expected to support bigger near-term Fed rate hikes.

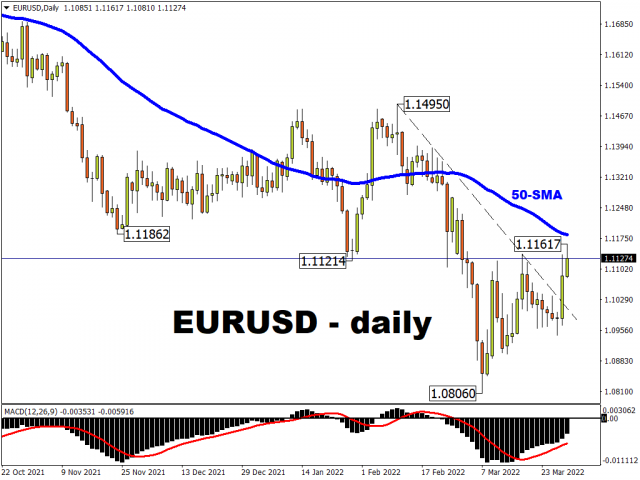

That said, EUR/USD is continuing to move north today amid rising German inflation driven by higher energy prices. This may be keeping alive the market’s expectations for ECB tightening, with around 60bps worth of rate hikes priced by money markets by the end of the year.

The major has broken the near-term downward trendline from the February highs. Prices are currently trading just around the halfway point of that move at 1.1150. Next resistance is the 50-day simple moving average at 1.11834 and the November low at 1.11862.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026