Oil prices have skyrocketed due to heightened fears surrounding the Ukraine crisis.

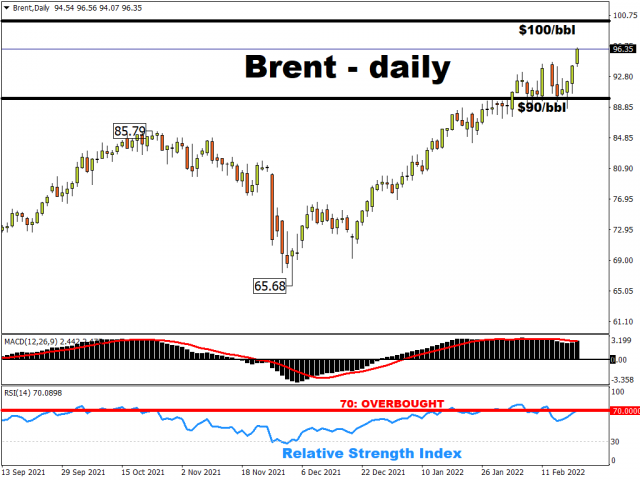

Brent crude has soared well over 20% so far this year to hit a fresh seven-year high above $96/bbl, a level not seen since 2014.

How does the Ukraine crisis impact oil markets?

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

An escalation in the conflict between Russia and the West (via Ukraine) could mean sanctions being imposed on Russia, with the US, UK, and EU potentially announcing such measures by today.

Russia is the third-largest oil producing country in the world (behind the US and Saudi Arabia). According to the US Energy Information Agency (EIA), in 2020, Russia produced an average of 10.5 million barrels per day in total liquid fuels. Also note that half of Russia’s exports of oil go to Europe.

With many countries relying on Russia for oil supplies, any disruption to such supplies, be it via sanctions or otherwise, could make the much-needed commodity harder to find.

What’s moving oil prices?

Of course, developments surrounding Ukraine remain front and center in driving oil prices for the immediate future.

This Thursday, February 24th, US Secretary of State, Antony Blinken, is reportedly set to meet Russian Foreign Minister, Sergei Lavrov, with hopes of moving closer towards a peaceful resolution. Progress this week could potentially set up a summit in France between US President Joe Biden and Russian President Vladimir Putin. However, note that a phone call between Biden and Putin earlier this month had failed to make any headway in this standoff.

The potential US-Russia summit has also come under threat given Russia’s decision to recognize two separatist regions in eastern Ukraine, which would see peacekeeping forces move into those territories.

Besides the ongoing Ukraine crisis, there are enough events to keep oil traders on their toes:

- Weekly US crude inventories data: These figures are typically released every Wednesday, but will be announced on Thursday (Feb 24th) instead this week due to Monday’s holiday in the US. Markets are expecting a slight build in stockpiles, which could put some resistance in Brent’s march towards $100, at least for a while.

- Iran nuclear deal: The US and Iran are in talks to bring back a 2015 nuclear deal, which could see the lifting of sanctions of Iran’s oil. The ongoing talks in Vienna may even conclude by the end of February.

Given the forward-looking nature of global financial markets, further signs of progress in these talks could see oil prices pulling back in anticipation of the one million or so additional barrels of oil that Iran could flood back into the markets within months of a deal. Note that Iran, having the fourth largest oil reserves in the world, has a lot of oil to offer its customers around the world. - US may release more strategic oil reserves: The Biden administration’s top priority is to combat soaring inflation in the US. A large driver of oil’s surge has been down to the fact that producers can’t keep up with soaring demand.

The US government has already unleashed some of its oil reserves that it holds, and could do so again, especially if the Ukraine crisis escalates and sends oil prices even higher.

For broader context, even without this conflict between Russia and the West, oil prices have had enough reasons to stay elevated:

- Member nations of OPEC+ (an alliance of 23 oil-producing countries) have struggled to deliver on its widely touted 400,000 barrels per day (bpd) output monthly hikes. Meanwhile, shale output in the US has not yet returned to pre-pandemic levels.

- Stockpiles of crude oil in Cushing, Oklahoma (a key storage hub in the world’s largest economy) has fallen for six straight weeks to hit its lowest levels since 2018.

- Global demand for the oil is moving closer towards pre-pandemic levels of 100 million bpd, with the International Energy Agency (IEA) forecasting that crucial level will be breached later this year.

These are signs that the world is using up, and needing, more oil than producers can churn out. This in turn creates a tremendous amount of support for oil prices.

In other words, oil is likely to climb higher than suffer a massive decline.

What could slow oil’s climb?

- If there is a meaningful de-escalation this week, perhaps by way of positive signs out of the Blinken-Lavrov meeting, that could see a pullback in oil prices.

- Technical factors may also warrant a slight drop back towards $90/bbl if Brent’s 14-day relative strength index breaks above the 70 threshold which typically means that the asset has reached overbought conditions and is ripe for a pullback. Such a pullback however is merely expected to clear some of the froth in oil prices, potentially setting a stronger base for Brent to eventually claim that $100 mark based on oil’s strong fundamentals (strong demand for oil amid lacking supply).

- Some of the other risks mentioned earlier: a larger-than-expected buildup in US crude oil stockpiles, progress on the Iran deal, the unleashing of US strategic reserves.

So the big question is, can Brent hit $100 this week?

From current levels, $100 Brent oil is well within reach. The spark that sends Brent to $100 could be another escalation in this standoff over Ukraine, perhaps via an actual invasion of Russian forces.

It’s important to also note that the world’s most important oil price, Dated Brent (which measures the prices of actual barrels of oil – as opposed to just tradable on-paper contracts – bought and sold in the North Sea), had already broken above the $100 level last week. This is the price that traders are willing to pay to get their hands on physical barrels of oil right now, before they potentially become harder to get due to an escalation in the Ukraine crisis.

With that in mind, perhaps it’s only a matter of time before the Brent prices that you see on your screens hit that $100 landmark as well.

PODCAST THROWBACK: Listen to Han Tan and Lukman Otunuga discuss the prospects of $100 Brent back in February 2021.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026