By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On Monday 28 February, the major currency pair is falling and trading at 1.1169. Market players are now interested in the “safe” USD as it often happens during global market fluctuations.

Investors are not so focused on statistics as before due to inflamed geopolitical tensions in the world. However, there will be some interesting reports that shouldn’t be overlooked.

For example, the US labour market data for February, which is usually published early in a month. The Unemployment Rate is expected to drop to 3.8-3.9% after being 4.0% the month before. The Non-Farm Payroll may increase due to the removal of anti-coronavirus restrictions. This is good news for the “greenback”.

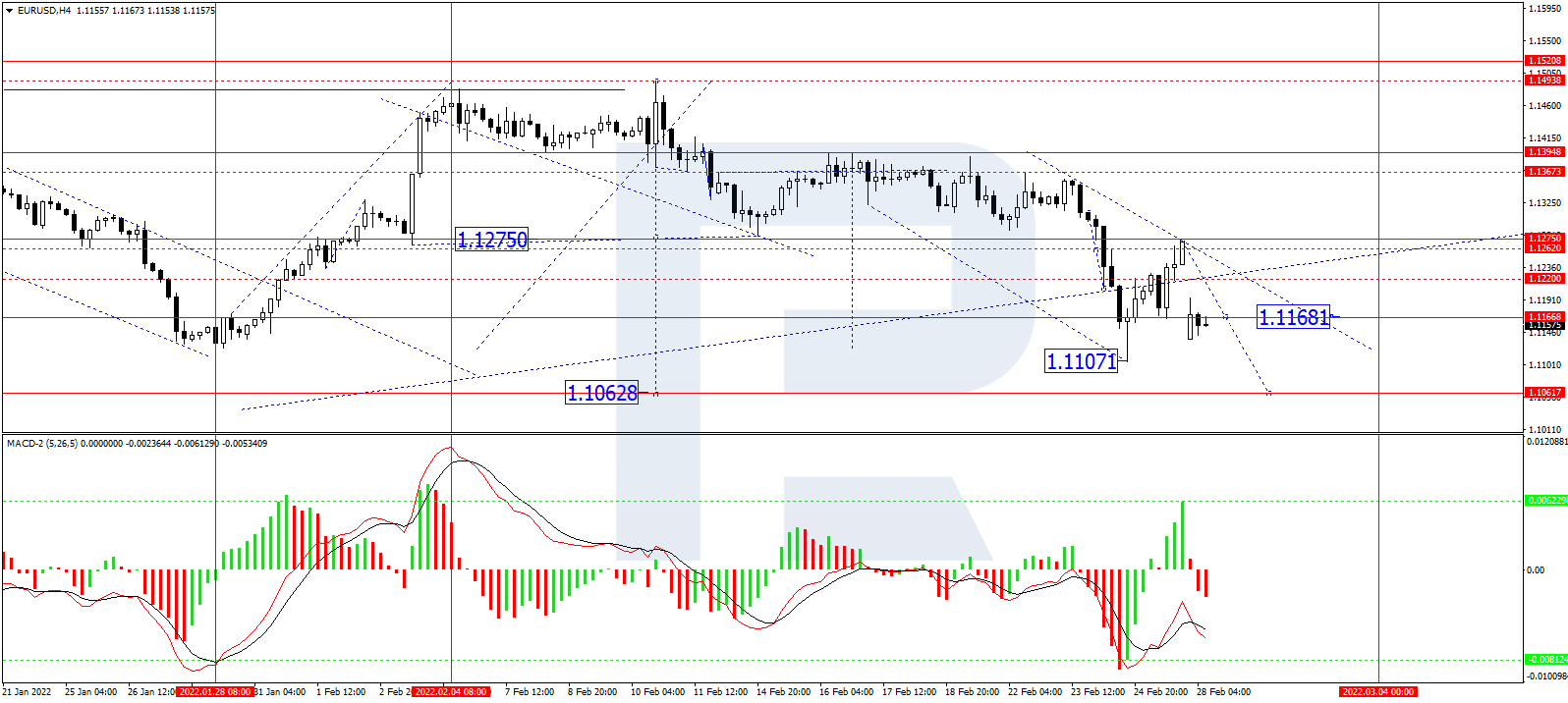

In the H4 chart, having finished another correctional wave at 1.1270 along with the descending structure towards 1.1168, EUR/USD is consolidating around the latter level. If later the price breaks this range to the downside, the market may resume falling with the target at 1.1060 and then grow to reach 1.1400; if to the upside – start another growth towards 1.1230 and then form a new descending structure to reach the above-mentioned target. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is falling towards new lows.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

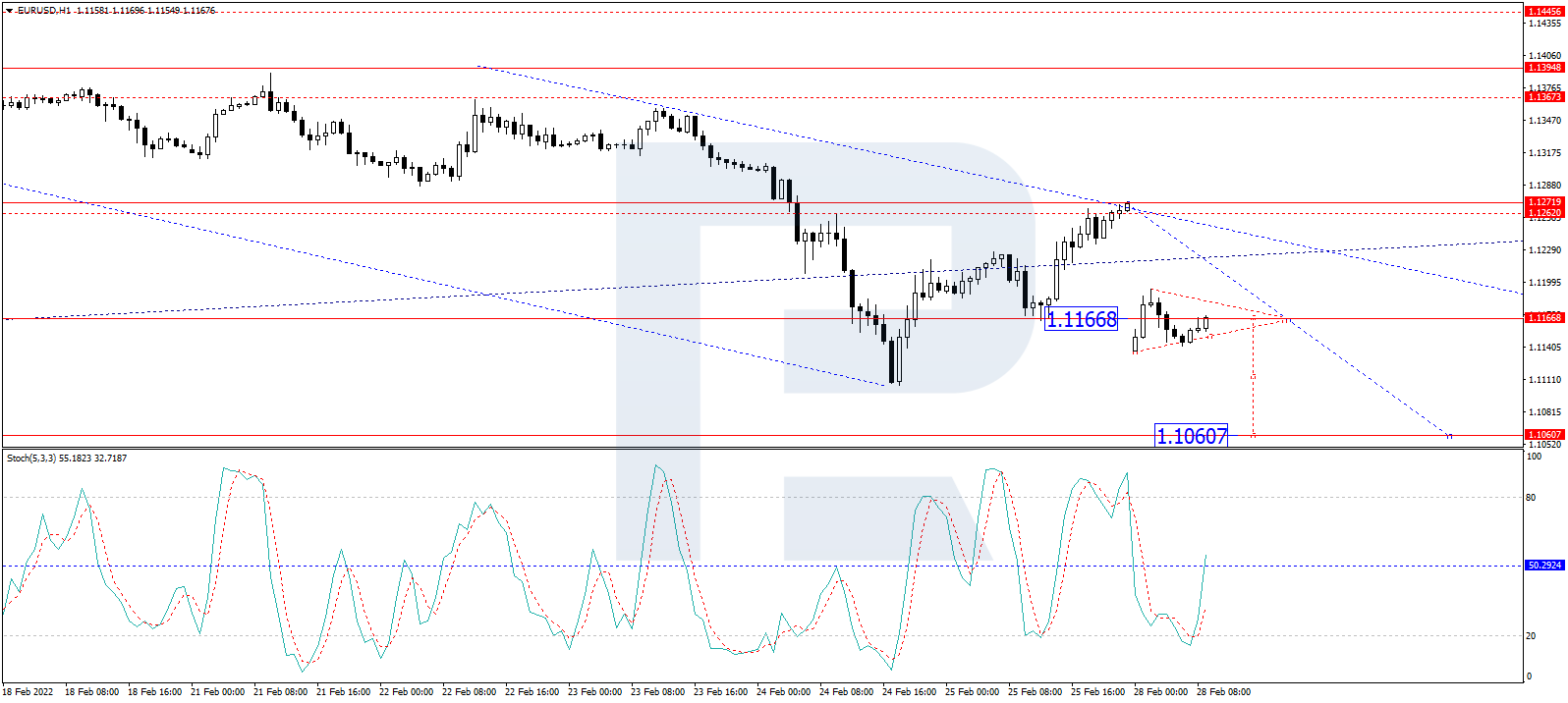

As we can see in the H1 chart, after rebounding from 1.1270, EUR/USD is forming a new descending impulse and has already reached 1.1160; right now, it is consolidating around the latter level. Possibly, the pair may correct towards 1.1200 and then start a new decline to reach 1.1070. Later, the market may grow to test 1.1170 from below and then resume trading downwards with the target at 1.1060. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving above 20 and may continue growing to reach 50. Later, the line may rebound from 20 and start a new decline to return to 20.

Disclaimer

Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026