There’s no rest for market participants with volatility set to stay elevated for the foreseeable future.

A cocktail of Russia-Ukraine tensions and the outlook for a more hawkish Fed underlay a busy week of central bank meetings and the monthly US jobs data. Wall Street’s fear gauge, the VIX volatility index, is set to remain above its long-term average, having hit one-year highs last week.

Before we take a deep dive into the key themes and developments investors should keep an eye on, here are the scheduled economic data releases and events that could spark more volatility in the week ahead:

Monday, January 31

AUD: Australia January inflation gauge

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

EUR: Eurozone 4Q GDP and Germany Jan. CPI

Tuesday, February 1

AUD: RBA policy decision

EUR: Eurozone Jan. manufacturing PMI and Dec. unemployment

Wednesday, February 2

EUR: Eurozone January CPI

Brent: OPEC+ meeting

US crude: EIA crude oil inventory report

Thursday, February 3

GBP: BOE rate decision

EUR: ECB rate decision

USD: US weekly initial jobless claims

Friday, February 4

EUR: Eurozone Dec. retail sales, Germany Dec. factory orders

USD: US January nonfarm payrolls

Dollar strength to get tested

The greenback has regained its throne as “king dollar” with USD marching higher as the Fed got serious about dealing with rampant inflation. With a minimum of four interest rate hikes now expected by markets this year, the US data during this week has a lot to live up to. Many analysts expect some downside risks for both the January ISM releases and the monthly non-farm payrolls data. Gains of under 200k for the latter are forecast, with the latest pandemic developments potentially set to slow the pace of hirings.

That said, the Fed has made its intentions clear about tightening monetary policy. Its new playbook involves being “nimble” and refusing to rule out a string of aggressive rate rises to bring US consumer prices down. With Covid cases now falling in many states, consumers are expected to re-engage with the economy with jobs data picking up in the next few months.

Big week for the eurozone

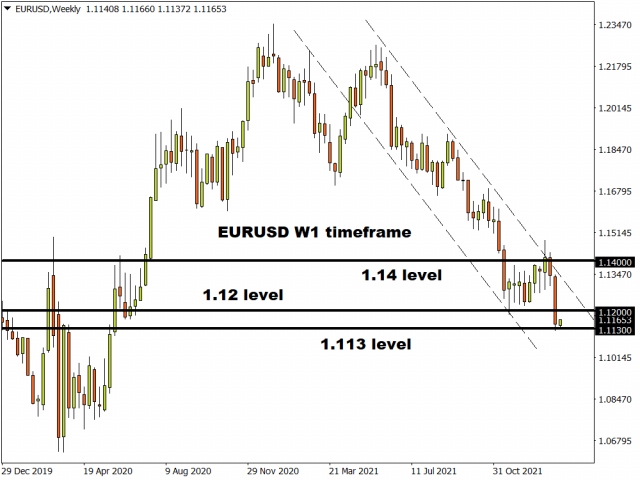

The jump higher in US rates most correlated to near-term Fed action has given the dollar a strong bid and pushed EUR/USD down to new cycle lows. Ahead of the ECB meeting on Thursday, data comes thick and fast including GDP figures and the January CPI print. Consensus expects +0.4% q/q with the spread of Omicron and ensuing restrictions weighing on growth.

The latest inflation data for the region is forecast to turn the corner and show a drop to 4.5% from the potential 5.0% peak hit in December. The recent surge in inflationary pressures is seen as temporary by the ECB and most central bank watchers see President Lagarde sticking to this narrative at its meeting on Thursday. Any hint that policymakers could emphasise it is ready to act if inflation shows signs of becoming more entrenched would support the euro, but judging by recent ECB speakers, this may not be forthcoming.

Bank of England expected to hike to tame inflation

Markets have virtually priced a 25bp rate hike into “super Thursday’s” meeting where they will get to see the latest forecasts by the MPC. Another four rate rises are expected this year, which many analysts see as too aggressive. The key question is whether the bank still expect to see inflation above the 2% target in 2 to 3 years’ time?

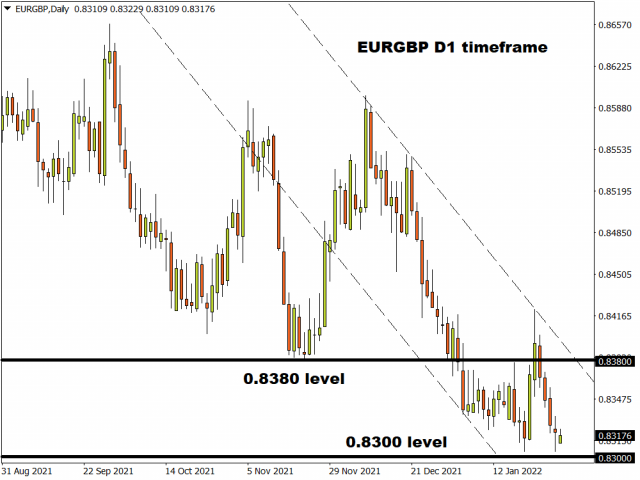

Traders will be watching the EUR/GBP cross during Thursday after it fell near to the recent low around 0.83 last week. Domestic political issues around PM Johnson and “party gate” may cause some near-term volatility.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026