By Orbex

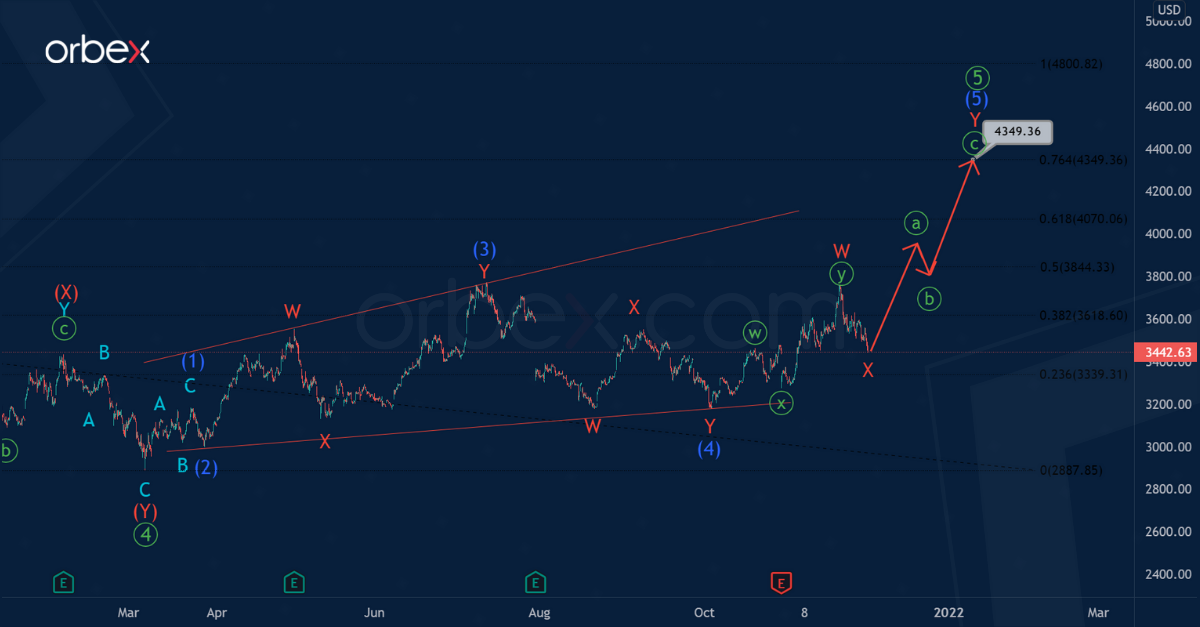

The current AMZN structure shows a bullish impulse. This includes the formation of a deep fourth wave of the primary degree.

The primary correction wave ④, apparently, takes the form of an intermediate triple combination (W)-(X)-(Y)-(X)-(Z). Let’s pay attention to the last wave (Z), which is not enough to complete the correction pattern.

Wave (Z) most likely takes the form of a triple zigzag W-X-Y-X-Z. The minute ending diagonal could have finished the development of the minor intervening wave X. So, the price could fall in the minor wave Z in the direction of the price level of 2867.82 soon.

At that level, wave Z will be at 161.8% of wave Y.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Then bulls could enter the market and push the price in the primary fifth wave above the level of 3772.99, marked by an intermediate intervening (X), as shown on the chart.

However, the formation of the primary correction ④ could have ended. And now the primary fifth wave is developing, taking the form of an ending diagonal (1)-(2)-(3)-(4)-(5) of the intermediate degree.

It seems that correction (4) in the form of a minor double zigzag W-X-Y has come to an end not so long ago. An intermediate wave (5), taking the form of a double zigzag W-X-Y, is currently under construction.

In the near future, market participants can expect the construction of a minute zigzag ⓐ-ⓑ-ⓒ, which forms the final minor wave Y. Growth in this zigzag is possible near 4349.36. At that level, wave ⑤ will be at 76.4% of primary impulse wave ③.

Article by Orbex

Article by Orbex

Orbex is a fully licensed broker that was established in 2011. Founded with a mission to serve its traders responsibly and provides traders with access to the world’s largest and most liquid financial markets. www.orbex.com

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026