By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Early in another week of October, the oil market continues growing steadily and updating its highs. Brent is trading at $85.80 and doesn’t seem to slow down.

The key factor that supports this active and extreme rally in the oil sector is the demand for energies, which is maintained not only by the global economic recovery and its need for raw materials but also by the start of a heating season and switch to more available and affordable heating agents, for example, fuel oil. In contrast with the surge in natural gas and coal prices, the above-mentioned agent is getting more and more trending.

As a result, the demand for oil in the fourth quarter of 2021 may add 500K barrels per day to the current volume. At the same time, OPEC+ hasn’t revised the oil output parameters yet, thus creating some “vacuum” in the demand, which makes oil prices go up.

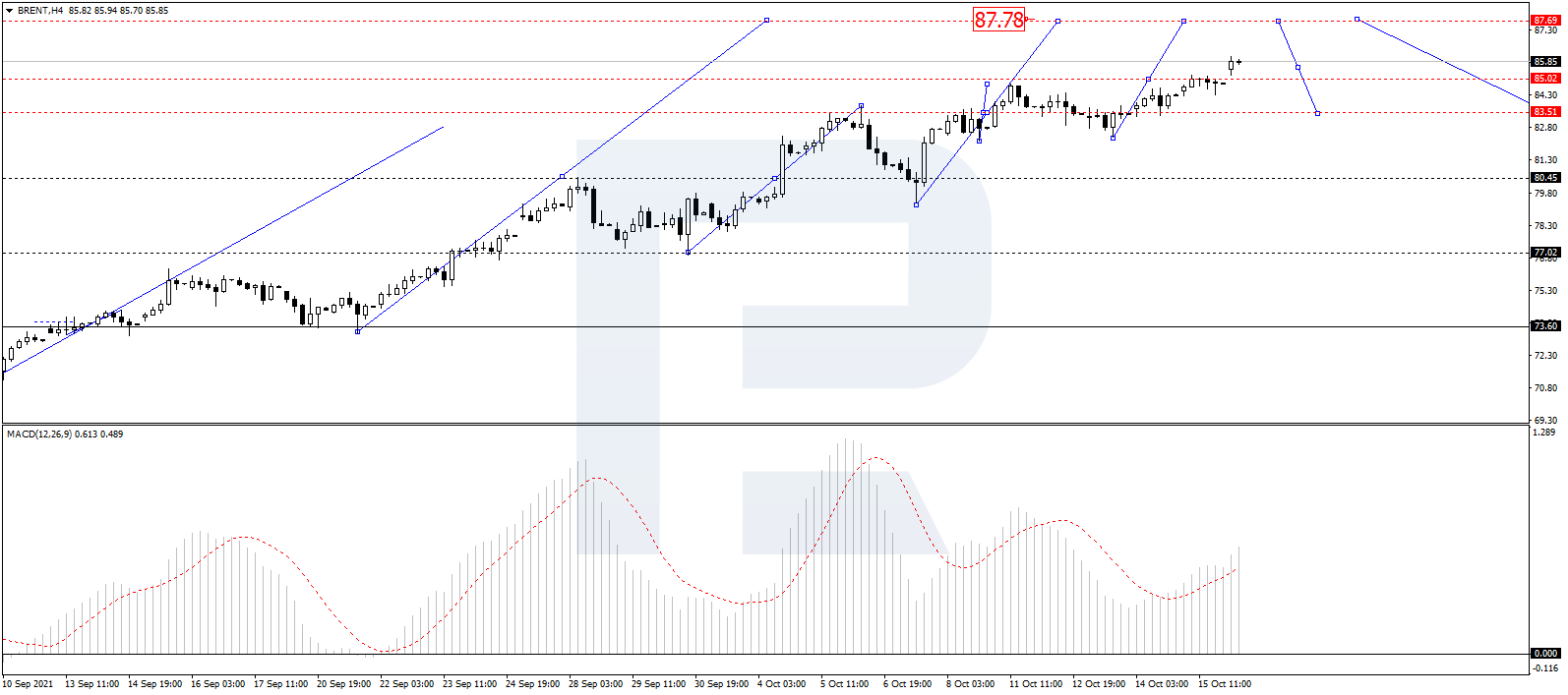

In the H4 chart, after breaking 85.20 to the upside, Brent is expected to continue growing with the short-term target at 87.78. Later, the market may correct to test 85.00 from above and then one more ascending towards 90.00. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving above 0 within the histogram area and may continue growing towards new highs.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

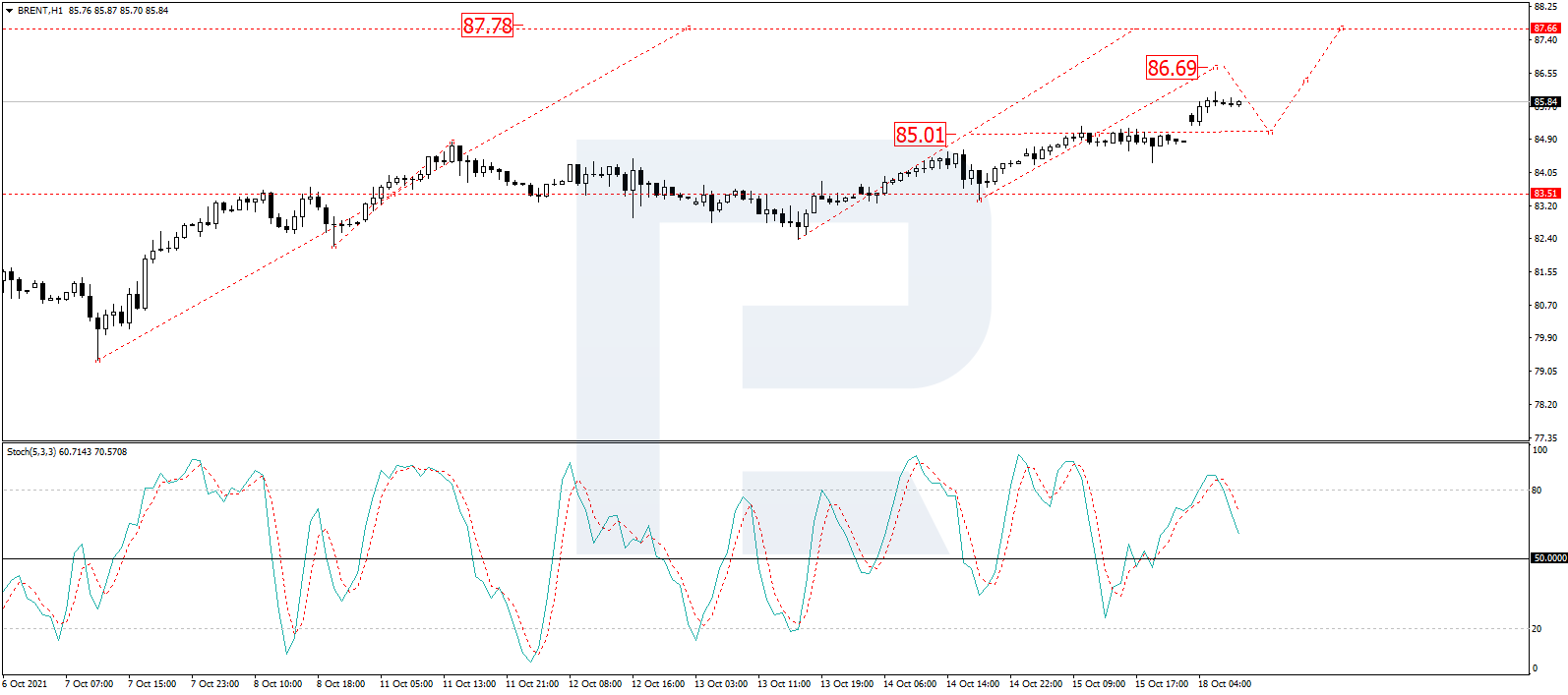

As we can see in the H1 chart, after forming a new consolidation range below 85.00 and breaking it to the upside, Brent is expected to trade upwards with the short-term target at 86.69. After that, the asset may start a new correction towards 85.00 and then resume growing to reach 87.78. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving below 80 and may fall a little bit to reach 50. After that, the line may rebound from the latter level and start another growth towards new highs.

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026