Big Tech is next off the US earnings conveyor belt, amid rate decisions out of the ECB, BOJ, and the Bank of Canada this week:

Monday, October 25

Tuesday, October 26

- CAD: PM Trudeau to announce new cabinet?

- USD: US September new home sales, October consumer confidence

- Twitter Q3 earnings

- Alphabet Q3 earnings

- Microsoft Q3 (fiscal Q1) earnings

Wednesday, October 27

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

- CNH: China September industrial profits

- EUR: Germany November consumer confidence

- GBP: UK government’s autumn budget released

- CAD: Bank of Canada rate decision

- US crude: EIA crude oil inventory report

Thursday, October 28

- JPY: Bank of Japan decision

- EUR: Germany October CPI

- EUR: European Central Bank decision, October economic confidence

- USD: US Q3 GDP, weekly initial jobless claims

- Amazon Q3 earnings

- Apple Q3 (fiscal Q4) earnings

Friday, October 29

- AUD: Australia September retail sales

- EUR: Eurozone October CPI, Q3 GP

- USD: US September personal income and spending, PCE price index, October consumer sentiment

The ongoing US earnings season has already helped the likes of the S&P 500 and the Dow Jones indexes to close at fresh record highs this past week. Over the coming days, with the likes of Facebook, Twitter, Alphabet (Google’s parent company), Microsoft, Amazon, and Apple all due to release their respective earnings, could Big Tech’s earnings help push the Nasdaq 100 index to a fresh record high as well?

Note that the tech behemoths listed above have a combined value of over US$ 9 trillion, which is about 52% of the Nasdaq 100’s total market cap. In other words, given the sheer size of these stocks (except for Twitter which is not a member of the Nasdaq 100 index), they should have a major say on how the broader index performs.

Given that the Nasdaq 100 is just some 2% from its highest-ever closing price, which was registered on 7th September, one would think that a fresh peak is within reach. However, those who have been following global markets would know of the major headwinds facing tech stocks. From the looming prospects of Fed rate hikes (overall, tech stocks do not perform well as US interest rates rise), to global supply chain issues, to heightened regulatory scrutiny, there are enough reasons on the table currently to warrant caution surrounding tech stocks. Recall how the share prices of social media platforms such as Facebook and Twitter were dragged lower by Snap’s dismal outlook after reporting its own earnings last week.

In short, it might be a bigger ask for the Nasdaq 100 to climb to a new summit relative to the S&P 500 and the Dow, given the challenges for tech companies.

As for the economic calendar, the Bank of Canada, European Central Bank, and the Bank of Japan are all not expected to adjust their respective benchmark rates this week nor make any policy adjustments. However, it’s their commentary surrounding their next policy move which could move their respective currencies. Should any of these central bankers harp on concerns over potentially out-of-control inflation, that might suggest that they’d have to raise rates earlier than expected. Such an outlook could push their currency higher; so watch the CAD, EUR, and JPY pairs.

The GDP prints out of the US and the Eurozone, as well as China’s latest industrial profits, will all be closely monitored amidst fears that the global economy risks entering a period of stagflation (higher consumer prices amid sluggish economic growth). If the US, Europe, and China combined can show that these major economies have enough growth momentum, despite concerns over the Delta variant and supply chain bottlenecks during the third quarter, that could be conducive for risk appetite.

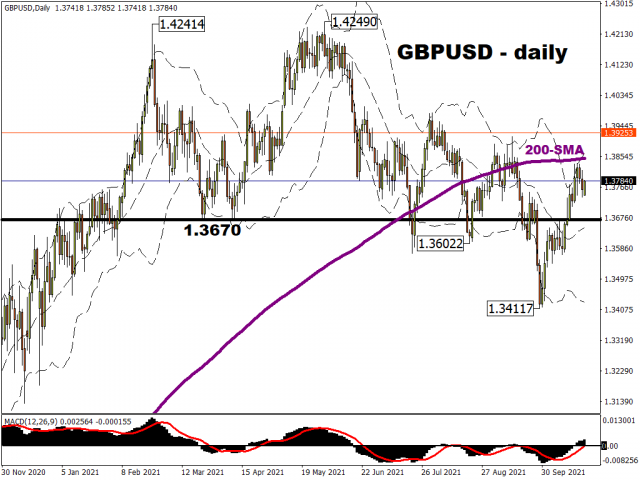

The UK government’s autumn budget release is also set to be a key event for the Pound. If markets take positively to a budget that solidifies the UK’s post-pandemic recovery, that might cheer Sterling bulls into helping cable launch another attempt to breach its 200-day simple moving average.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026