By Lukman Otunuga Research Analyst, ForexTime

Despite a disappointing non-manufacturing Chinese PMI reading, Asian bourses are holding up today with eyes on US jobs data and the latest Eurozone inflation print. The Chinese composite PMI unexpectedly fell from 54.2 to 52.9 earlier this morning with details showing a stabilisation of the manufacturing gauge but a setback in the non-manufacturing reading. New restrictive measures in Gaundong to contain a regional Covid outbreak are mainly responsible for this with waning external demand contrasting with rising domestic orders.

Risk mood improved

Markets took comfort in Moderna saying that its vaccine is effective against the Delta variant of the virus with the S&P500 marginally higher and closing at all-time highs. The tech-laden Nasdaq also notched another record peak rising for a sixth day in seven with Facebook pulling back after hitting the magical $1 trillion market cap level. Also adding to more positive sentiment was the US Consumer confidence which jumped with a bounce both in expectations and the current situation.

The dollar went bid breaking out of its recent range and is heading towards the post-Fed highs.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

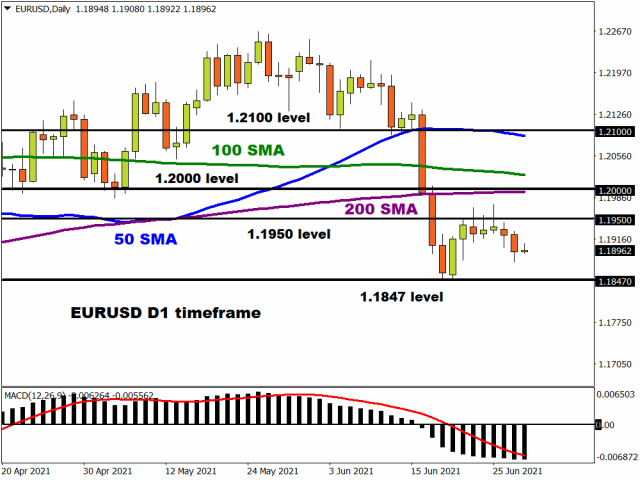

In EUR/USD, this means we are trading below 1.19 again with eyes on the recent cycle lows at 1.1847.

With the monthly US labour market report out on Friday, focus will be on US ADP data today which will be monitored for any signs that private sector hiring has quickened. Although not a great predictor of the NFP headline number, a big beat or miss today can cause near-term volatility. Expectations are for a punchy 600k reading with many analysts hopeful that jobs data comes in strong going forward.

Eurozone inflation subdued

Consensus expects headline and core Eurozone inflation prints to remain relatively subdued at 1.9% y/y and 0.9% y/y respectively when the data is released this morning. Country figures already pointed to a slowdown and these are fairly tame readings compared to those elsewhere. With the outlook remaining muted, the ECB will continue to be one of the last remaining dovish central banks on the block.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Trump signals de-escalation in the Middle East; China’s trade surplus hits a new record Mar 10, 2026

- EUR/USD in Turbulence: Market Questions When Conflict Over Iran Will End Mar 10, 2026

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026