Article By RoboForex.com

EURUSD, “Euro vs US Dollar”

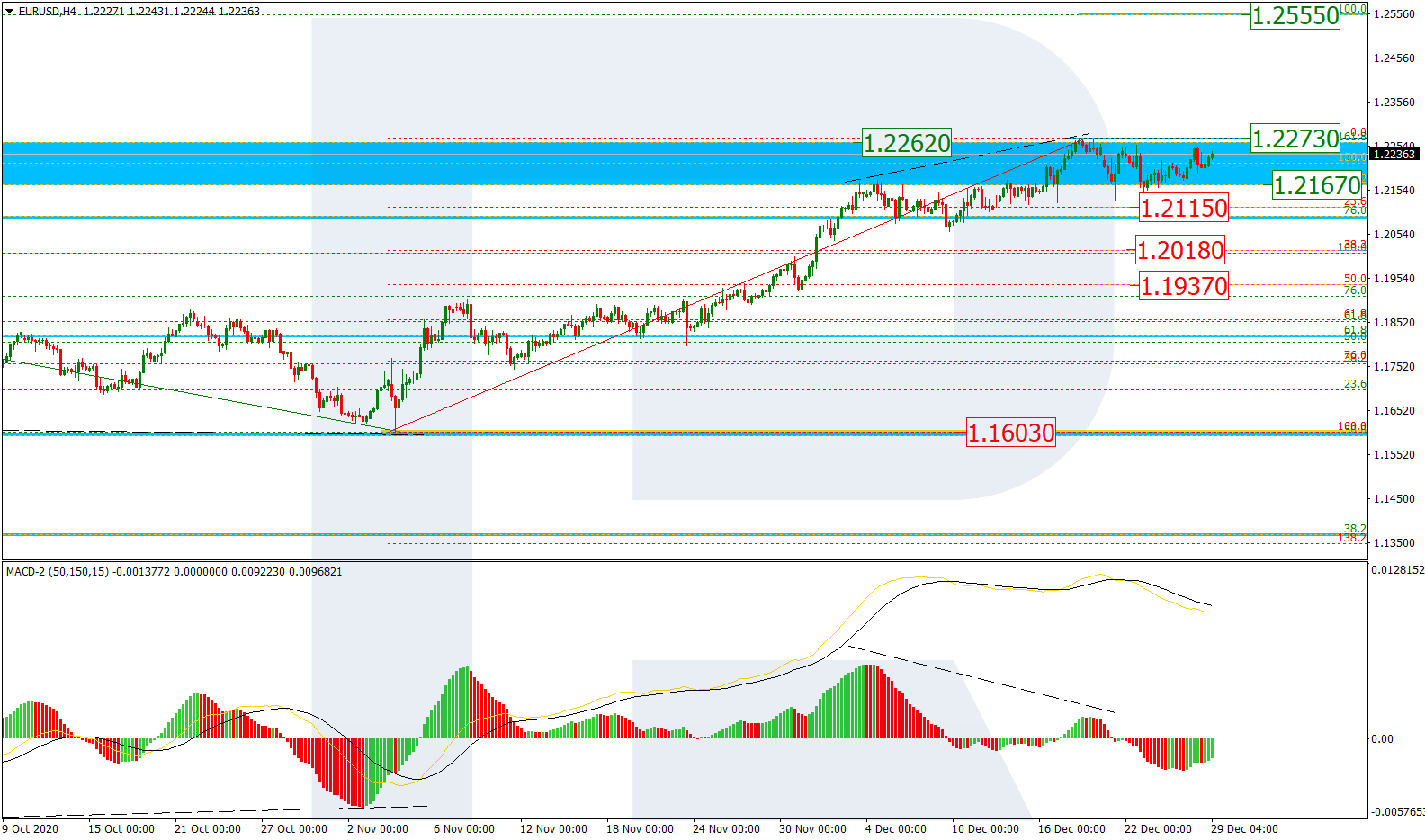

As we can see in the H4 chart, after a divergence on MACD, EURUSD is stuck within the post-correctional extension area between 138.2% and 161.8% fibo at 1.2167 and 1.2262 respectively. The first descending impulse tried to reach 23.6% fibo at 1.2115 but failed. If the asset fails to break the high at 1.2273, it may start a new decline towards 38.2% and 50.0% fibo at 1.2018 and 1.1937 respectively. However, if the price does break the high, the pair may continue growing to reach the long-term fractal high at 1.2555.

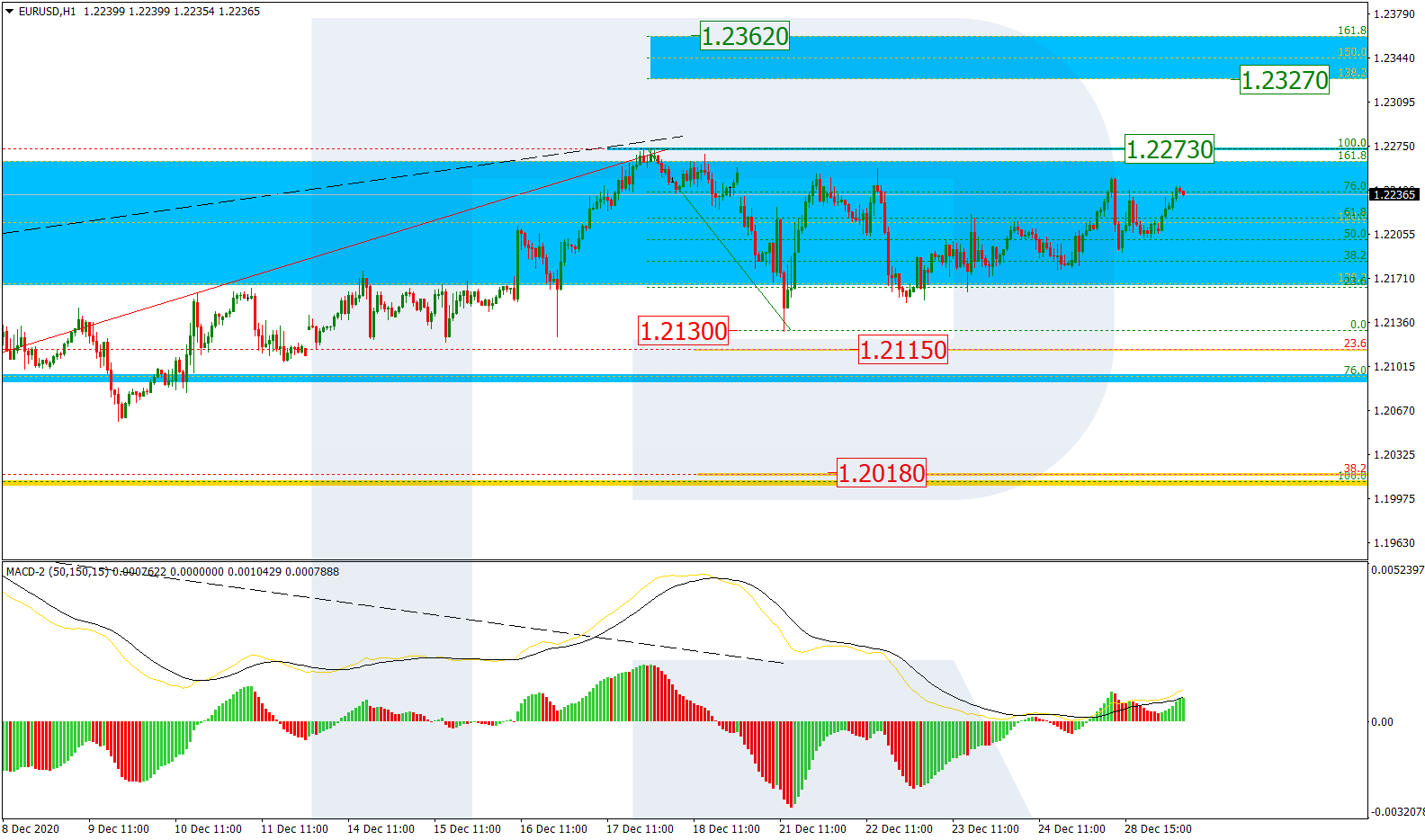

The H1 chart shows potential upside targets. The asset has already reached 76.0% fibo. If the price breaks the high at 1.2273, it may move upwards to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1.2327 and 1.2362 respectively. On the other hand, if EURUSD breaks the local low at 1.2130 again, the asset may continue the mid-term correction to the downside.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, the pair is trying to start a new correction to the upside after a convergence on MACD. The correctional targets may be 23.6%, 38.2%, and 50.0% fibo at 104.95, 106.25, and 107.28 respectively. After breaking the low at 102.87, USDJPY may continue falling towards the fractal low at 101.18.

In the H1 chart, the pair is consolidating around 23.6% fibo; this movement may be considered as a correction. If the price breaks this range to the upside, the market may resume trading upwards to reach 38.2%, 50.0%, and 61.8% fibo at 103.94, 104.28, and 104.61 respectively.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Oil continues to fall in price. The Australian dollar reached the maximum for 5 weeks Jan 24, 2025

- Japanese Yen Strengthens as Interest Rate Reaches Highest Level Since 2008 Jan 24, 2025

- Oil down 4 consecutive sessions since Trump’s inauguration. Natural gas prices rise again due to cold weather Jan 23, 2025

- The threat of tariffs by the US against Mexico, Canada, and China is adding uncertainty to financial markets Jan 22, 2025

- Gold Reaches 11-Month High as Global Demand for Safe Assets Surges Jan 22, 2025

- Hong Kong index rises for the 6th consecutive session. Oil declines amid Trump’s statements to increase production Jan 21, 2025

- Japanese Yen Strengthens to a Monthly High as Markets Anticipate a Bank of Japan Rate Hike Jan 21, 2025

- COT Metals Charts: Speculator Changes led higher by Gold, Copper & Silver Jan 19, 2025

- COT Bonds Charts: Weekly Speculator Changes led by 10-Year & 5-Year Bonds Jan 19, 2025

- COT Soft Commodities Charts: Weekly Speculator Wagers led by Soybeans & Soybean Oil Jan 19, 2025