Article By RoboForex.com

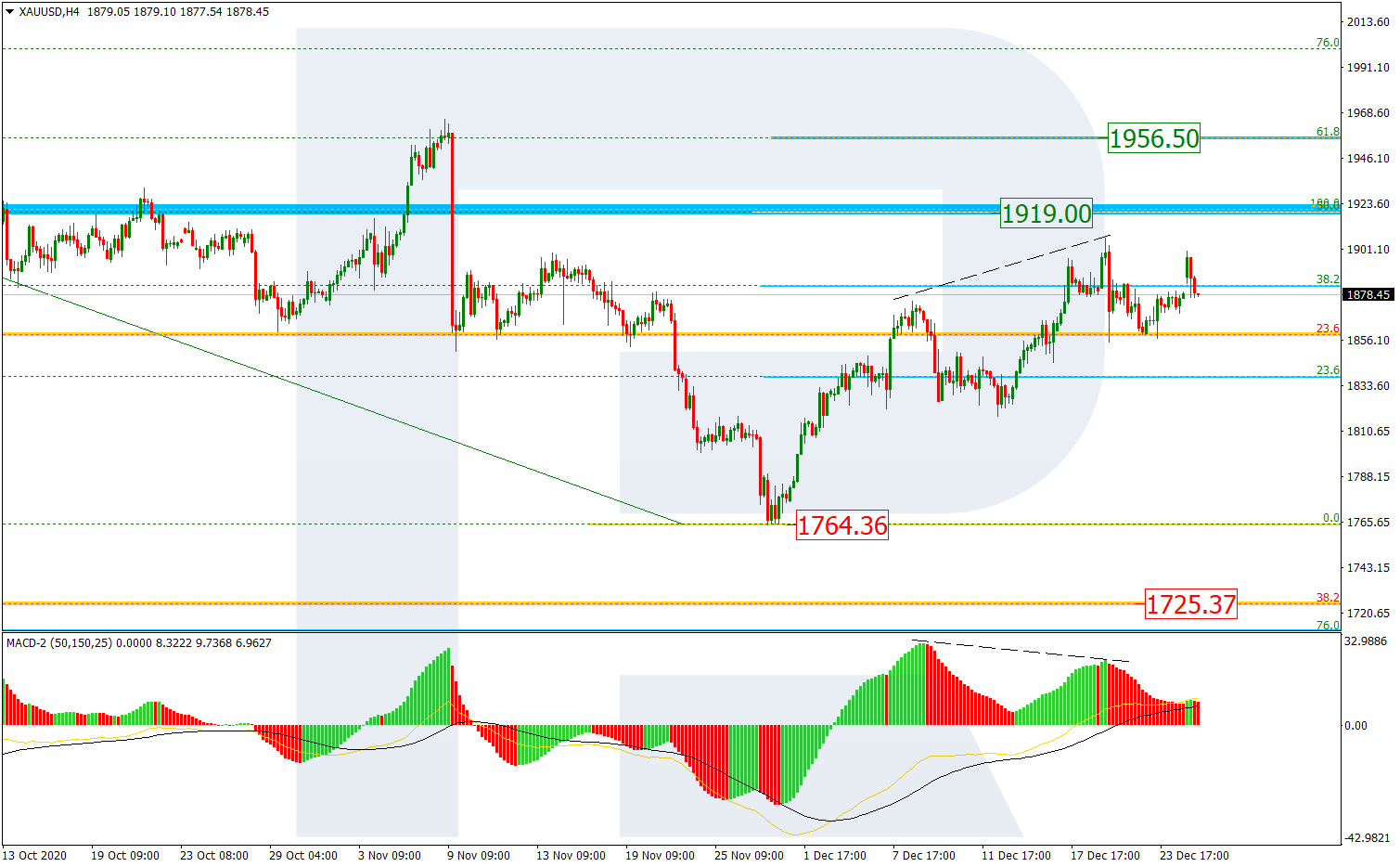

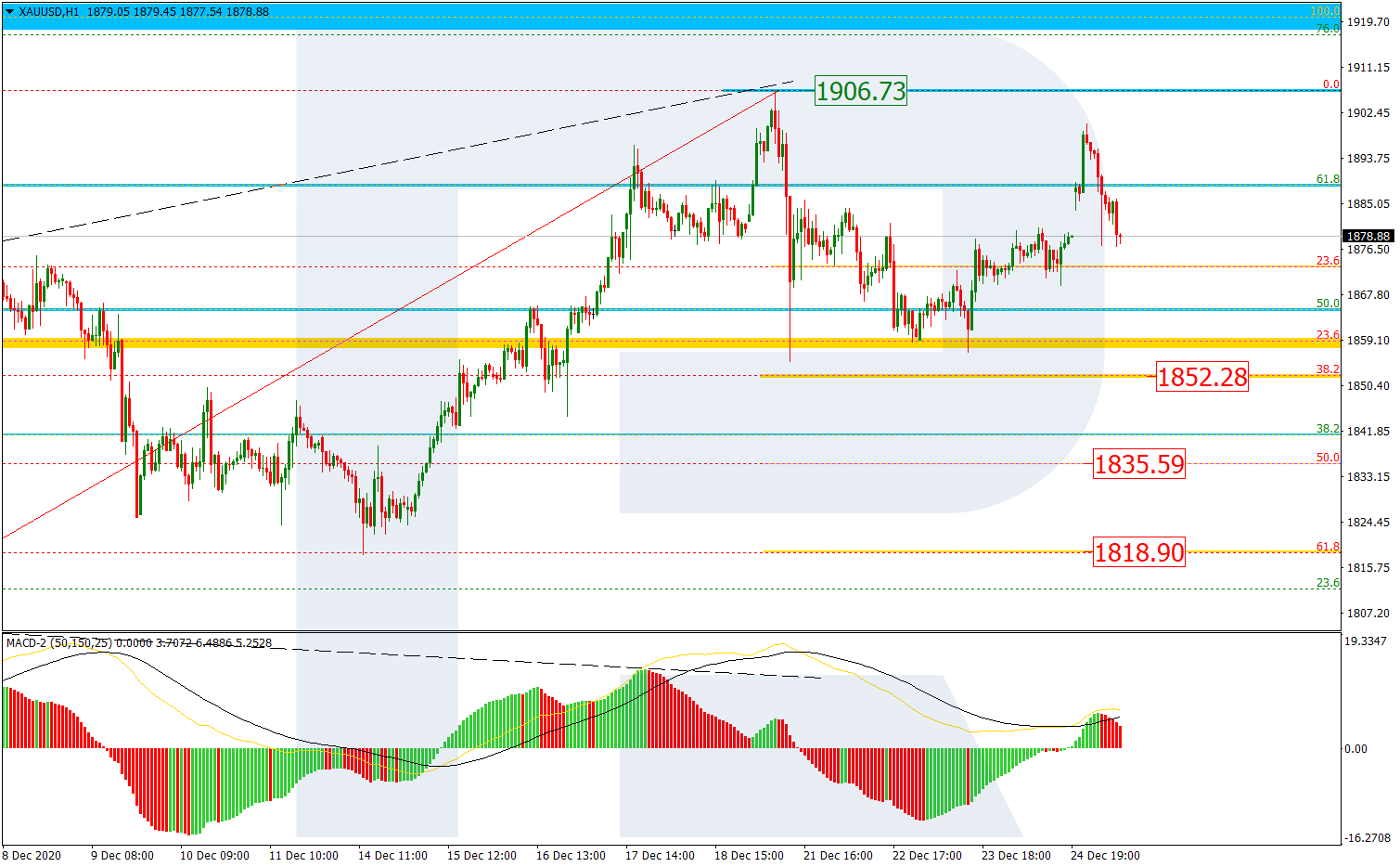

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, after completing the descending impulse, the asset started growing and has already tested the previous local high. If XAUUSD isn’t strong enough to start a new decline, then the price may continue growing to reach 50.0% and 61.8% fibo at 1919.00 and 1956.50 respectively. However, one shouldn’t disregard a divergence on MACD, which may hint at further mid-term decline towards the low at 1764.36. If the pair breaks this level, it will continue falling to reach the target at 38.2% fibo (1725.37).

The H1 chart shows a more detailed structure of the current correction after a divergence on MACD. After breaking 23.6% fibo, it has yet failed to reach 38.2% fibo at 1852.28. The next downside targets may be 50.0% and 61.8% fibo at 1835.59 and 1818.90 respectively. However, a breakout of the local high at 1906.73 will result in further trend to the upside.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

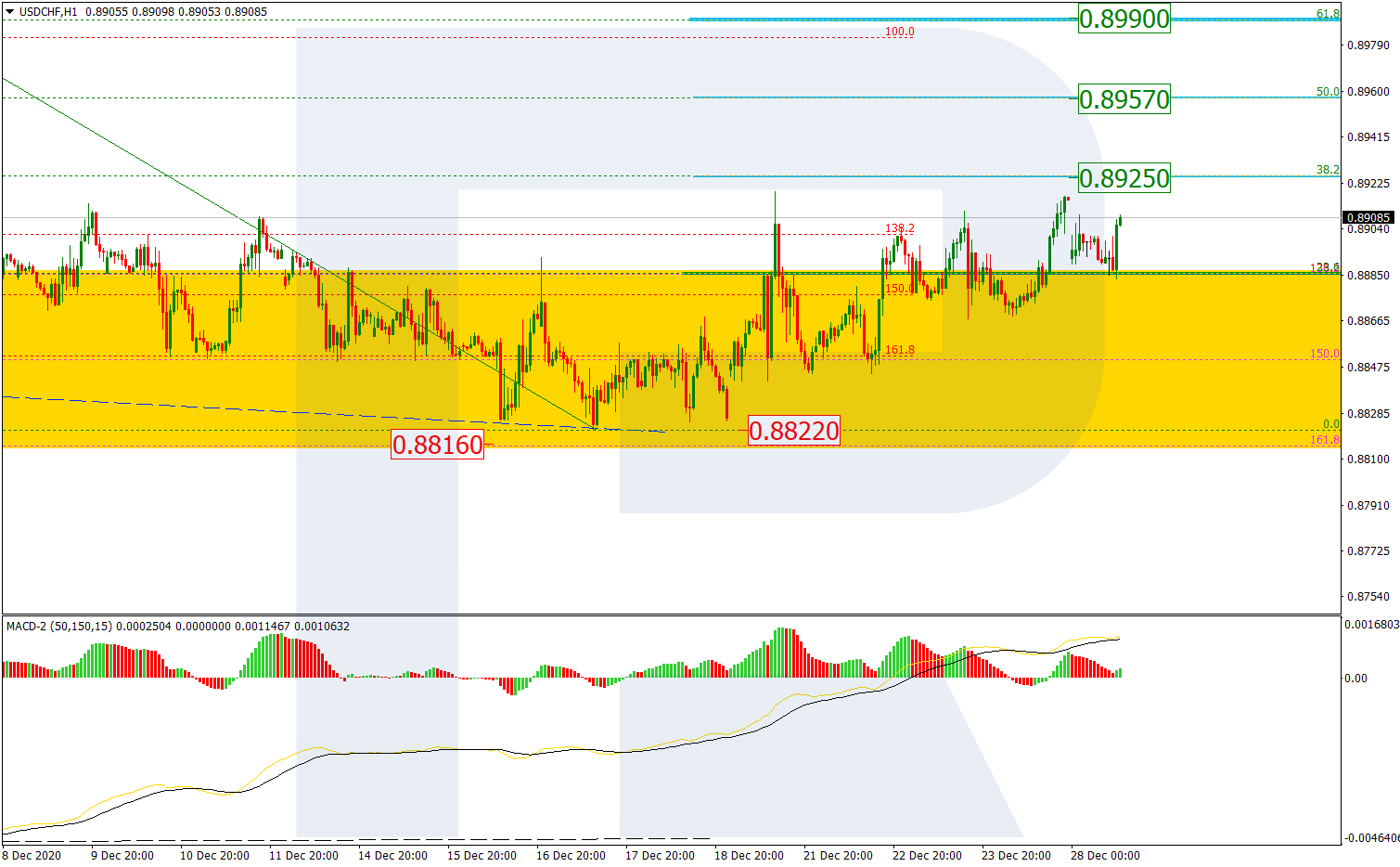

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, the situation hasn’t changed much. After leaving the post-correctional extension area between 138.2% and 161.8% fibo at 0.8886 and 0.8816 respectively to the upside, USDCHF is moving upwards and this growth can be considered as a correction after a long-term convergence on MACD. The correctional target remains at the resistance at 0.8999.

In the H1 chart, the pair is correcting upwards after a convergence on MACD. Judging by the price movement in this area, it is trying to fix above 23.6% fibo before further growth towards 38.2% fibo at 0.8926. Later, the market may continue growing towards 50.0% and 61.8% fibo at 0.8957 and 0.8990 respectively. A breakout of the support at 0.8822 will complete this correction.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- RoboForex Receives Best Introducing Broker Programme Award Nov 18, 2024

- The hawkish attitude of FOMC representatives puts pressure on stock indices. Oil is growing amid escalation in Eastern Europe Nov 18, 2024

- AUD/USD Stabilises Amid RBA’s Hawkish Outlook Nov 18, 2024

- COT Metals Charts: Speculator Changes led lower by Gold & Platinum Nov 17, 2024

- COT Bonds Charts: Large Speculator bets led by 2-Year & Ultra Treasury Bonds Nov 17, 2024

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024