By Orbex

Gold

The yellow metal has come under significant selling pressure this week with the market falling 5.5% as of writing.

Gold is now down more than 10% from the 2073.48 highs posted last month.

The main driver behind the acceleration in gold’s decline is the recovery underway in the US dollar. The greenback has seen firm buying over the week as safe-haven flows move into the dollar and away from gold.

The dollar has also been supported by better US data across the week, with the flash manufacturing PMI showing a firm rise.

The Fed recently announced a shift in its inflation targeting strategy whereby it will now allow inflation to run hotter than its 2% target.

However, despite this, some fed members this week have suggested that the bank could still hike rates as inflation hits 2%. This is, of course, depending on how the economic recovery progresses.

Speaking on Thursday, Fed Chairman Powell said:

“Economic activity has picked up from its depressed second-quarter level, when much of the economy was shut down to stem the spread of the virus.

Many economic indicators show marked improvement.

Household spending looks to have recovered about three-fourths of its earlier decline, likely owing in part to federal stimulus payments and expanded unemployment benefits.”

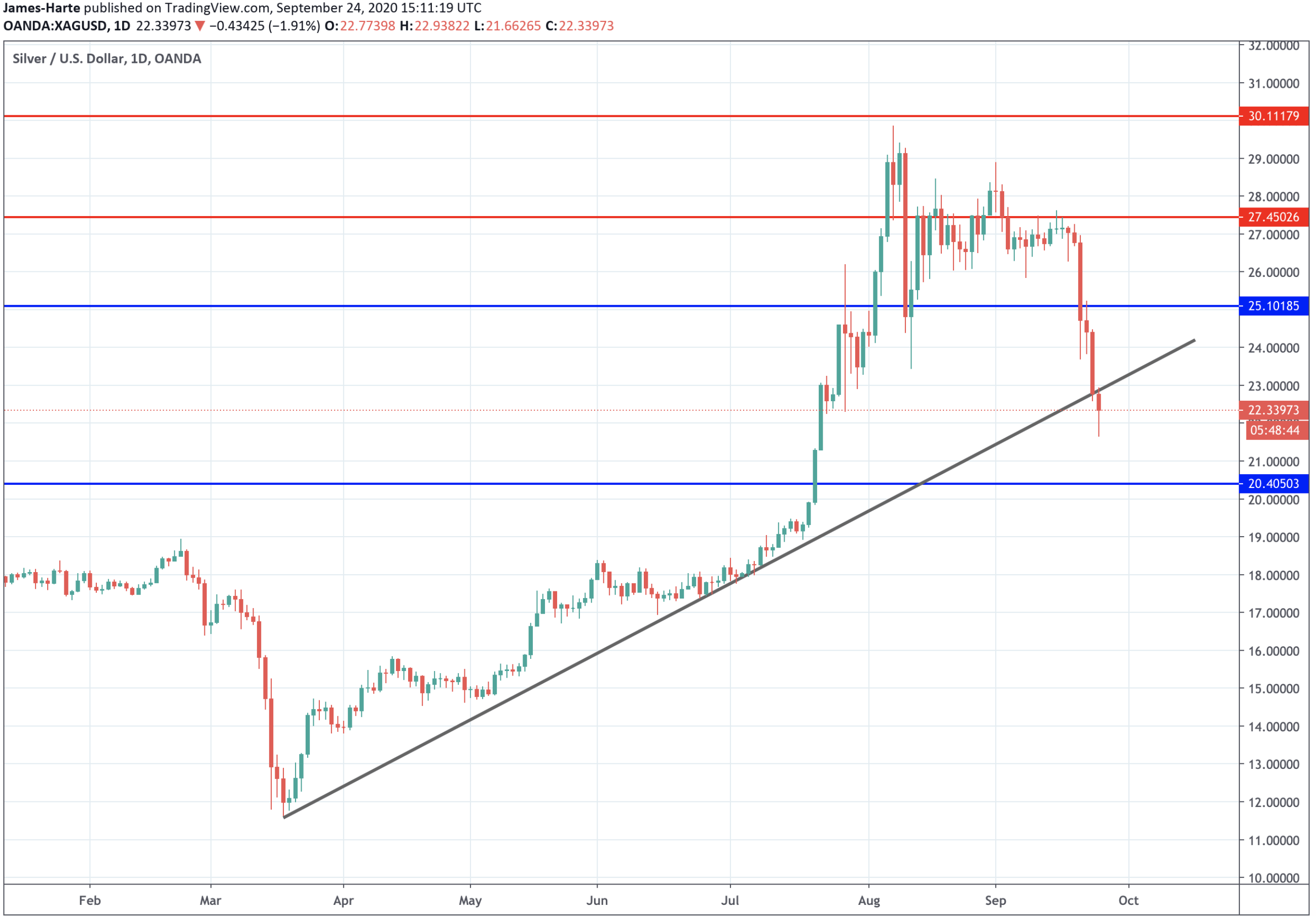

Gold Breaks Through Bullish Trendline

The sell-off in gold prices this week has seen price breaking down below the rising trend line from 2020 lows and also the 1919.92 level. Price is now sitting just above the 1826.71 level support level.

If broken, this could pave the way for a much fuller reversal lower in gold prices.

Silver

The silver market has seen heavy selling this week also.

Tracking the moves in gold, silver prices have moved lower. This week, the resurgent strength in USD has weighed on the metals market as well as on the broader commodities market.

Better manufacturing data releases this week for the eurozone, the US, and the UK are positive for silver. However, the main story has been the USD rebound.

With further upside in the greenback looking likely, the near term picture looks bearish for silver.

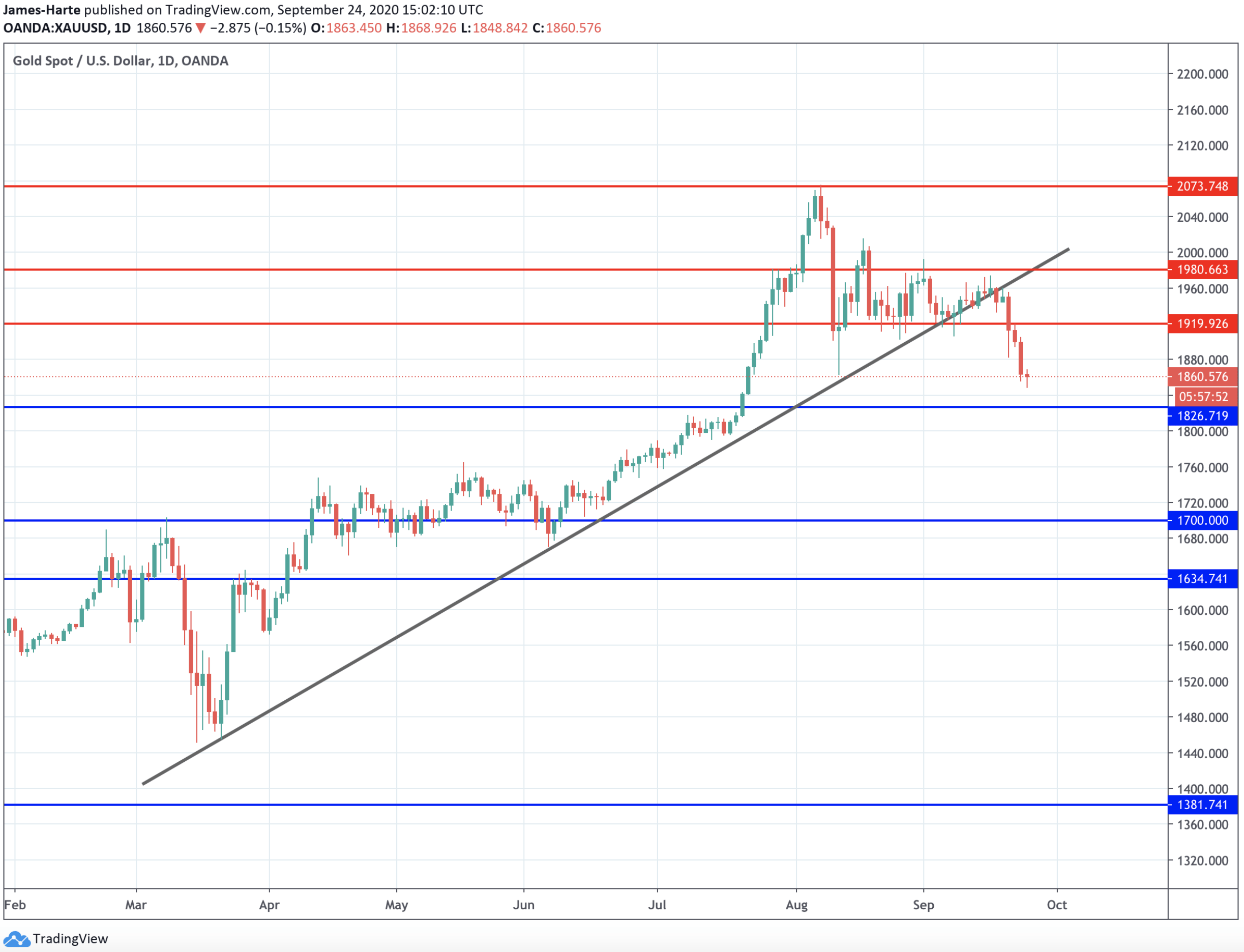

Silver Breaks Through Bullish Trendline Also

The sell-off in silver this week has seen price breaking down below the 25.1018 level and now also the rising trend line from 2020 lows. While price holds below here, the outlook remains bearish.

We will likely see a test of the 20.4050 level in coming sessions

By Orbex