Author: Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On the final September Monday, the major currency pair is sticking to its two-month lows and trading around 1.1634.

The start of this week is anticipated to be calm for EUR/USD but there will be a lot of news later.

As usual, at the beginning of every month, the USA is going to report on its labor market and September readings may raise a lot of questions. The first of them is whether the positive impulse, which helped to eliminate the spring crisis with jobs and labor force, is still strong or on the decline and may start consolidating? If the employment indicators do not steadily improve, there will be talks about additional stimulus packages, which is a serious problem.

This week, the USA will publish the final report on the country’s GDP for the second quarter of 2020. If the actual readings are not worse than expected, the USD may find some support because all problems in this area have already been included in prices.

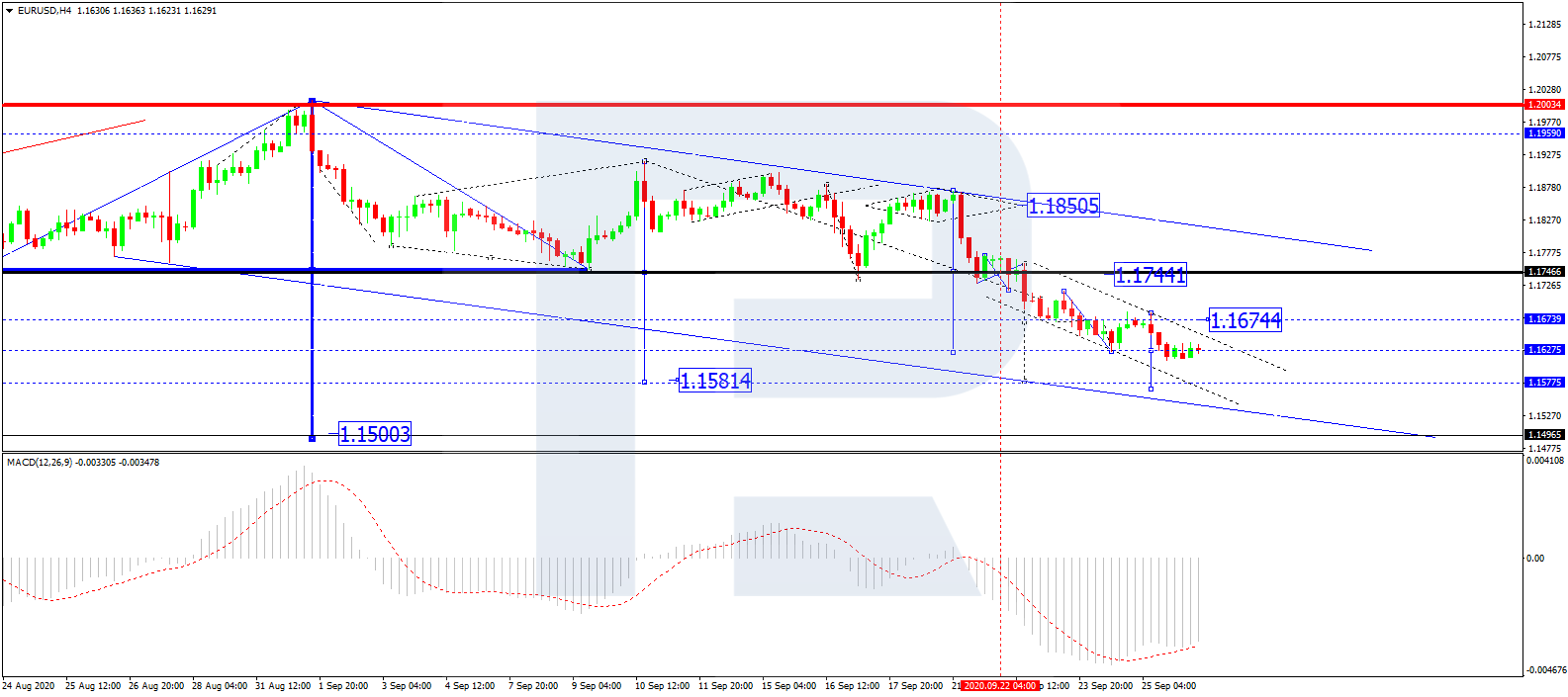

In the H4 chart, EUR/USD is forming the third descending wave with the target at 1.1600. Later, the market may correct towards 1.1744 and then continue trading inside the downtrend with the target at 1.1500. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is no longer moving inside the histogram area. However, taking into account that on the price chart the instrument may yet continue falling, the line is not expected to rise towards 0 until the price reaches the target. If later the line breaks 0, there might be a new correction on the price chart.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

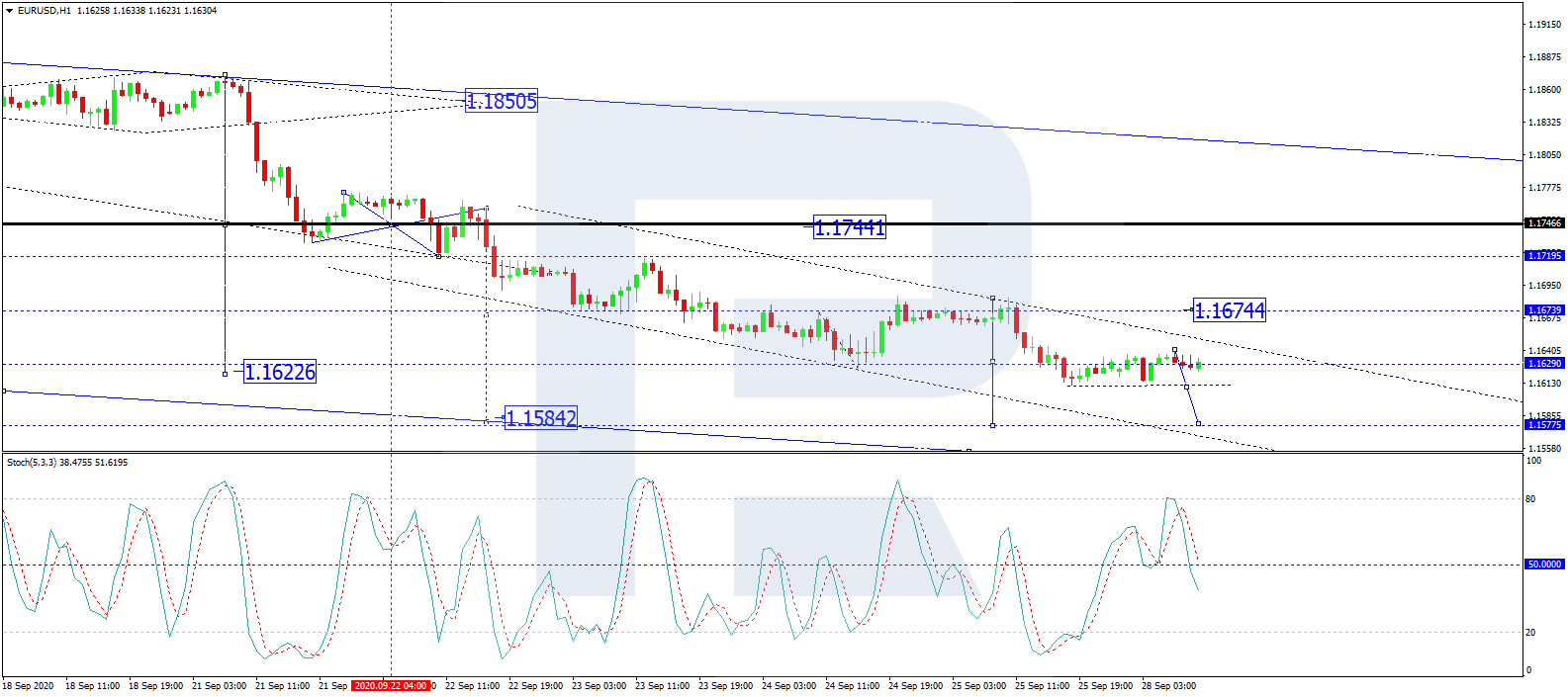

As we can see in the H1 chart, after breaking 1.1640, EUR/USD is consolidating below it. Possibly, the pair may test this level from below and then resume falling to break 1.1612. After that, the instrument may continue trading downwards to reach 1.1600 at least. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line is moving downwards and has already broken 50. Later, it may continue falling to reach 20. Only after the line leaves the area of 20, the asset may start a correction on the price chart.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- As expected, the RBNZ cut the rate by 0.5%. Australia’s inflation rate remained at its lowest level since the summer of 2021 Nov 27, 2024

- EUR/USD Steady Ahead of Major US Data Releases Nov 27, 2024

- NZD/USD Hits Yearly Low Amid US Dollar Strength Nov 26, 2024

- Trump plans to raise tariffs by 10% on goods from China and 25% on goods from Mexico and Canada Nov 26, 2024

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024