Source: Michael Ballanger (10/7/24)

Michael Ballanger of GGM Advisory Inc. takes a look at the energy market, and shares his thoughts on junior miners.

Last week, I decided to write about the fiscal bazooka engaged by Chinese President Xi Jinping that sent Chinese equities into a vertical moon rocket with relative strength for the major indices, hitting an all-time record at 91. From David Tepper to Louis Gave, the China bulls are now stampeding with the ferocity of the spooked herd while short sellers bleeding from the eye sockets and hair ablaze are covering with unfathomable urgency.

The move by the Chinese central bank to dive headlong into an easing cycle follows the past two years of pain as the real estate market has stagnated under the weight of oversupply and bubbly consumer attitudes. Overproduction in the EV sector has left inventories overflowing in both unsold units and the age of the fleet, as vast numbers of rotting vehicles are sitting in car lots around the country. Something had to be done, and it was as if Xi Jinping took aim and pulled the trigger.

Initially, the advance in Chinese equities was celebrated by only the bravado-laden diehard contrarians who had been buying large-cap Chinese companies at eight times cash flow with 75% of market cap in cash, similar to January 2023 when the Japanese equity markets suddenly caught a bid on the basis of their valuations relative to the over-owned, over-priced U.S. counterparts that have benefitted from a constant, never-ending combination of fiscal and monetary stimulus all designed to juice stock prices and maintain the asymmetrical wealth-effect so critical for sustained economic growth.

However, what few were talking about was the ancillary impact the Chinese stimulus move had on a number of other sectors. Copper, which I identified in early August as a “Buy” under $4.00/lb. (after exiting in May) was well on its way to test the 100-dma at around $4.40, but it received an enormous shot of adrenalin with the news that China had suddenly gone “full-Draghi,” deciding to do “whatever it takes” to get the economy back on track.

Copper is now ahead over 20% from those “carry trade crash” lows now cruising with a gale force Chinese tailwind behind it.

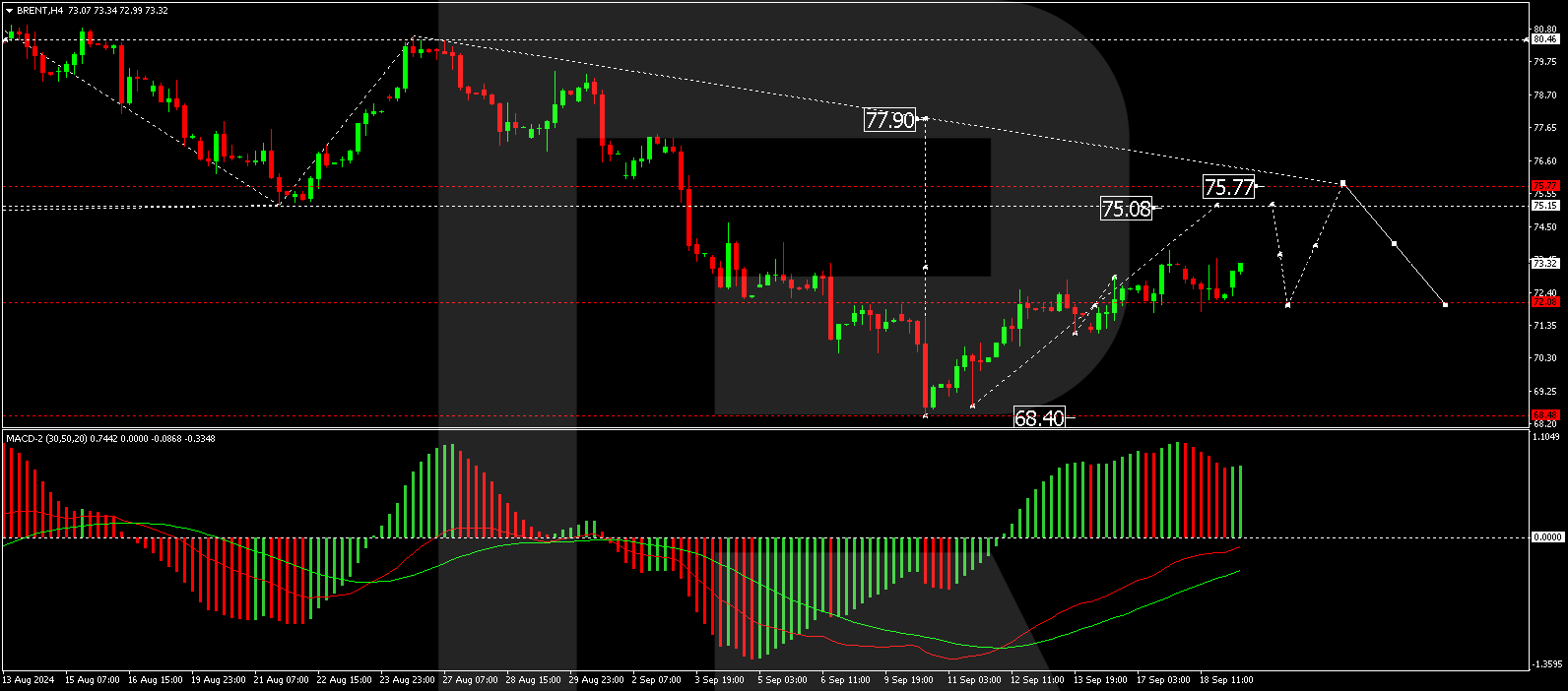

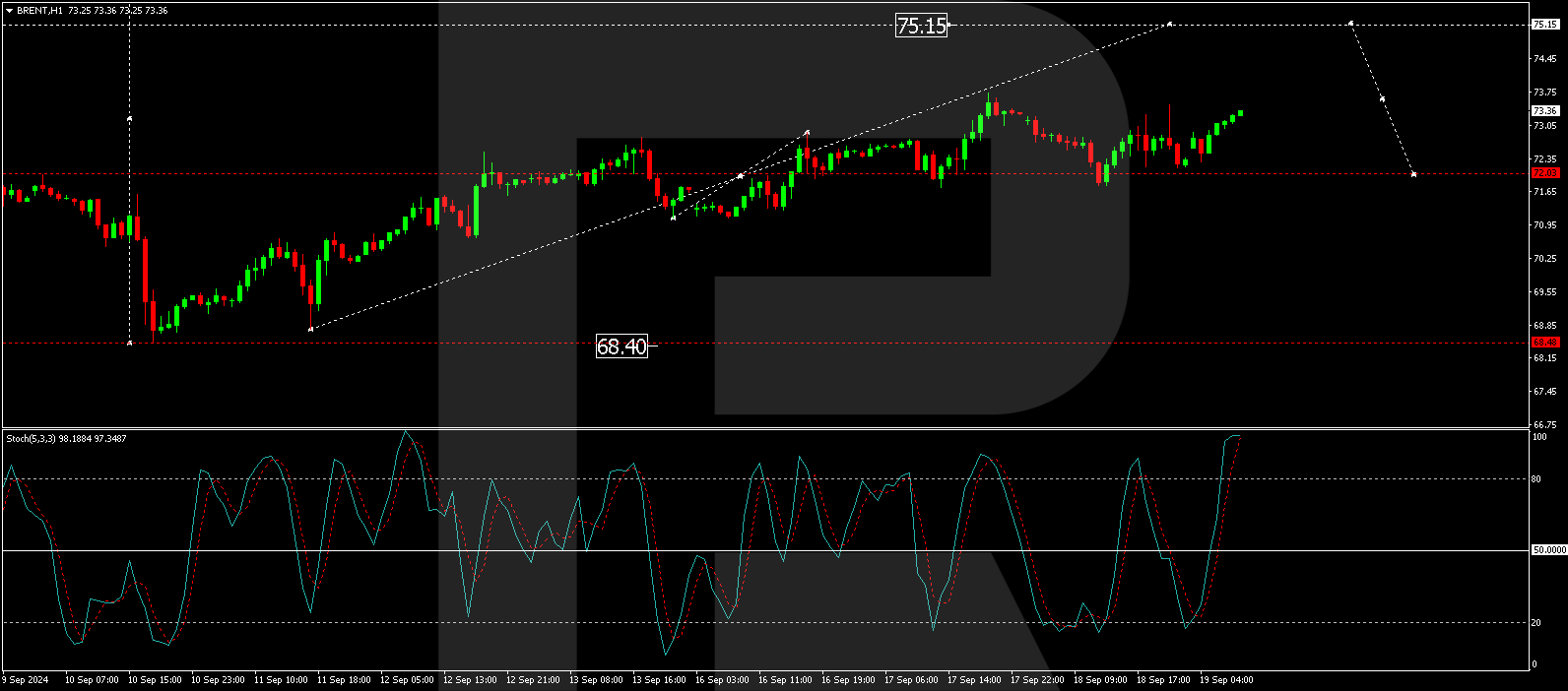

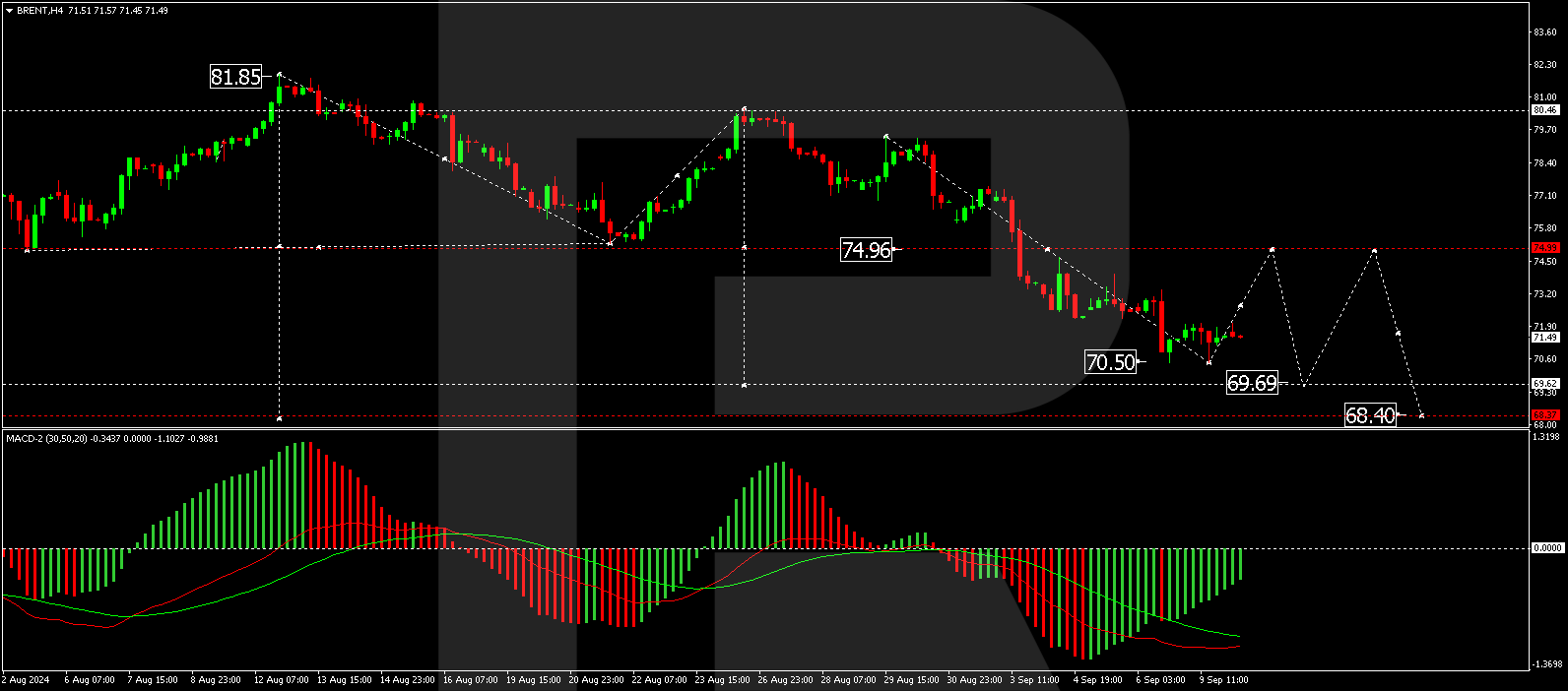

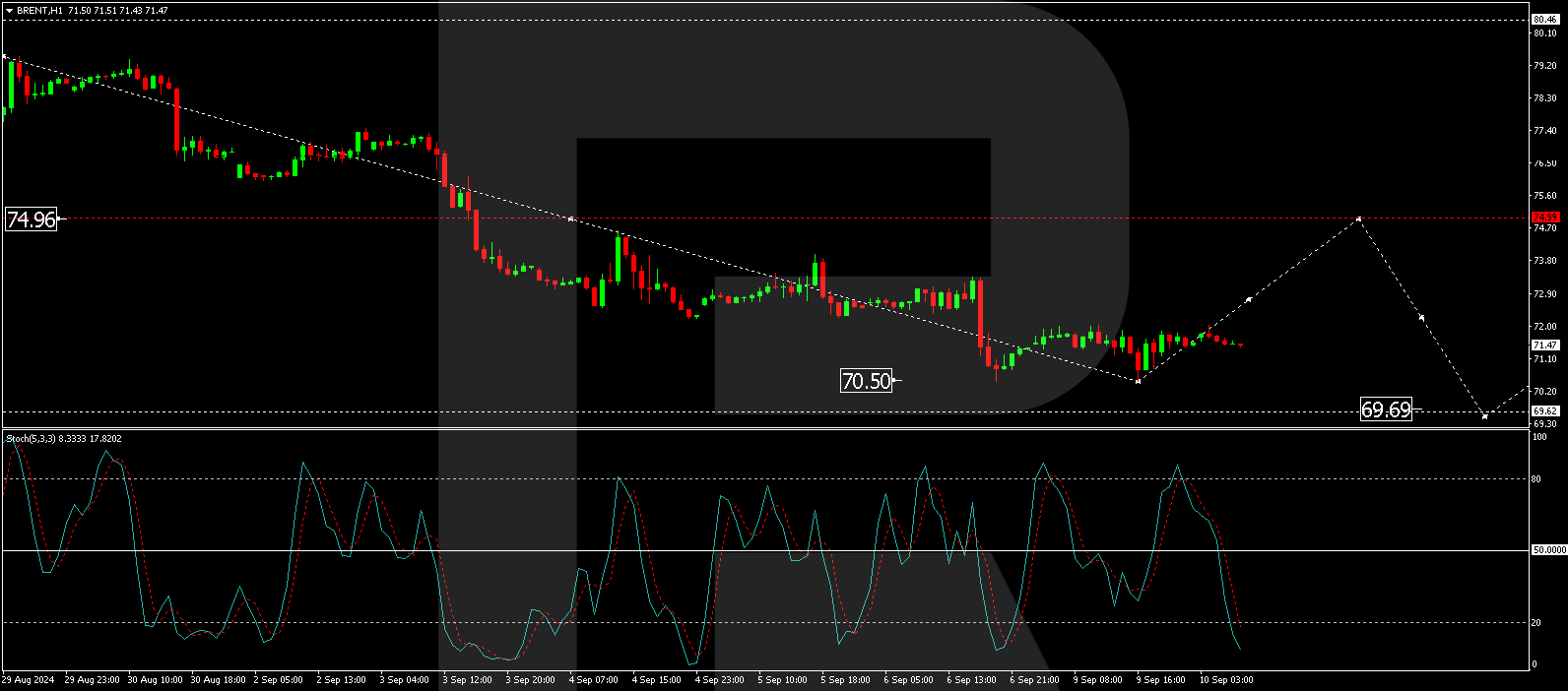

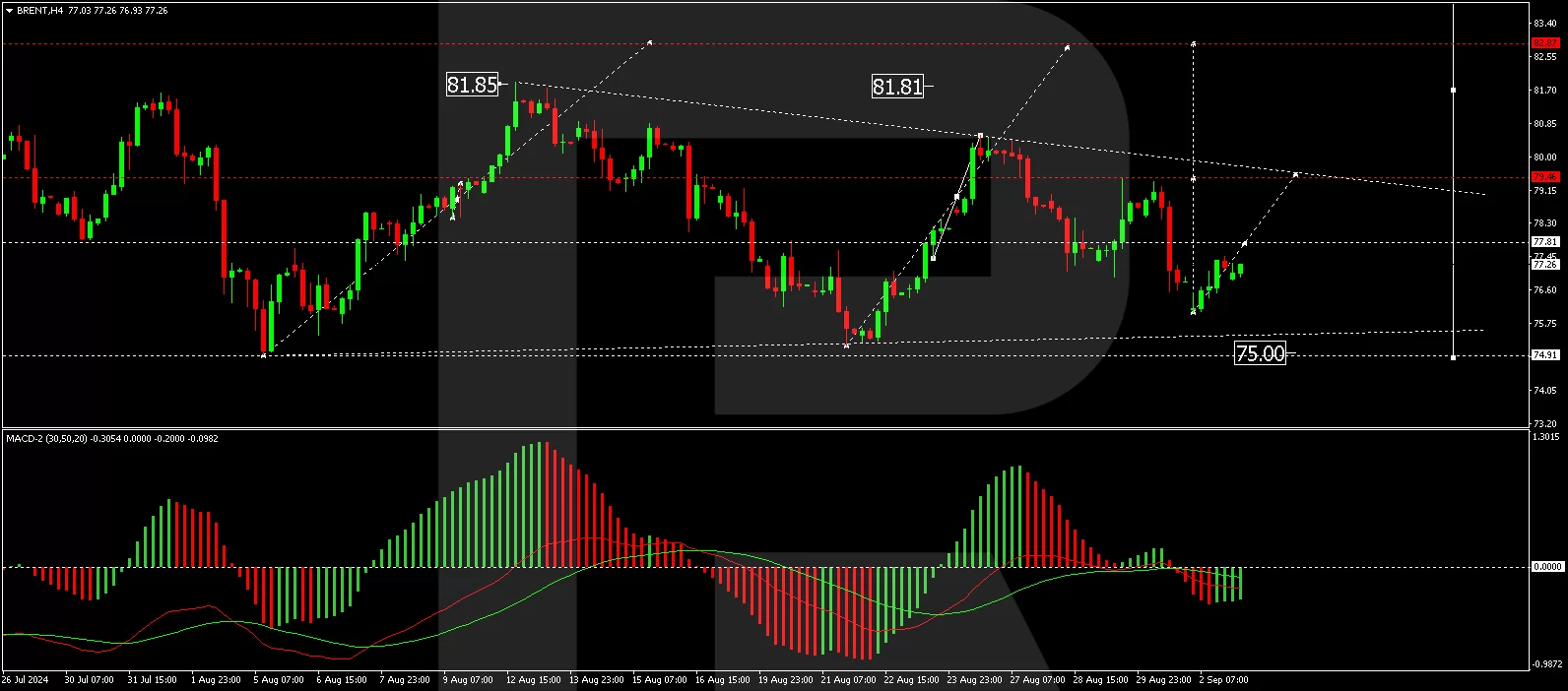

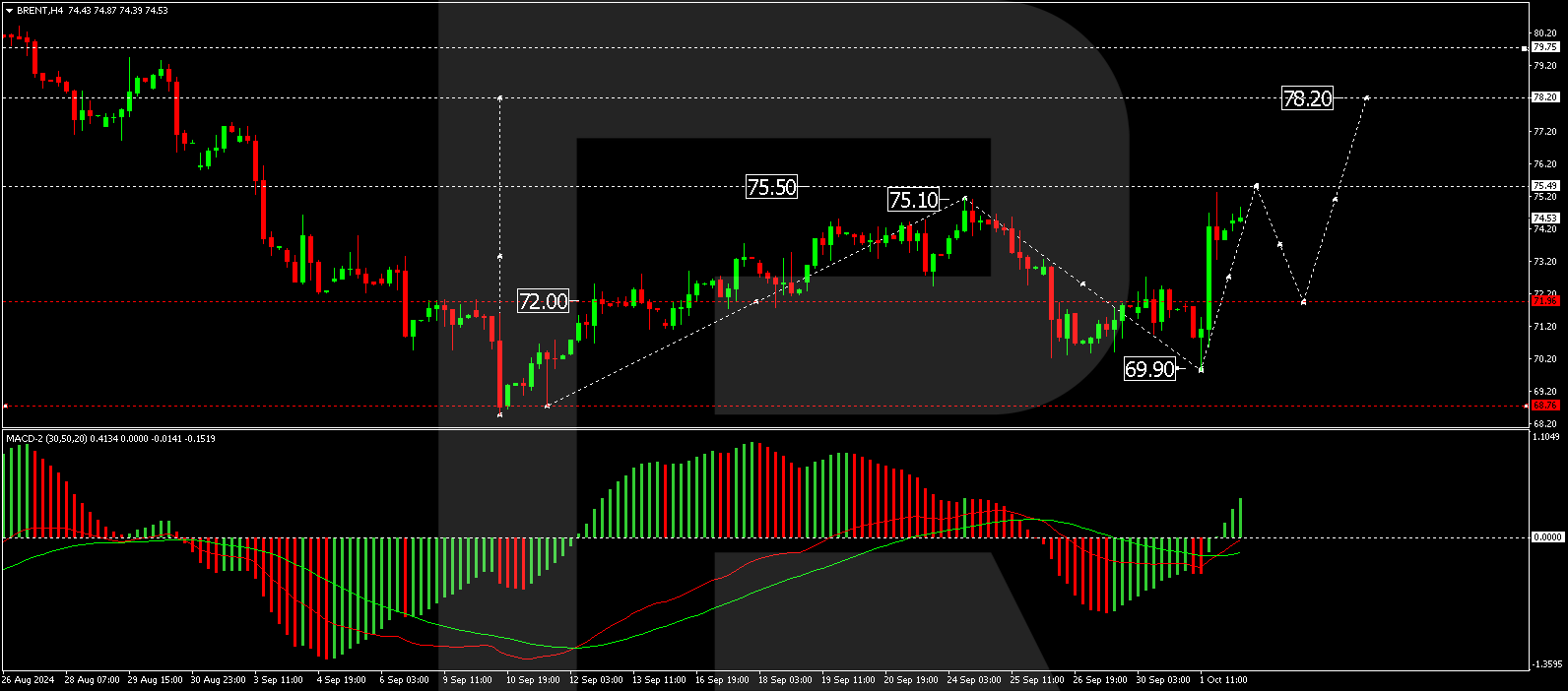

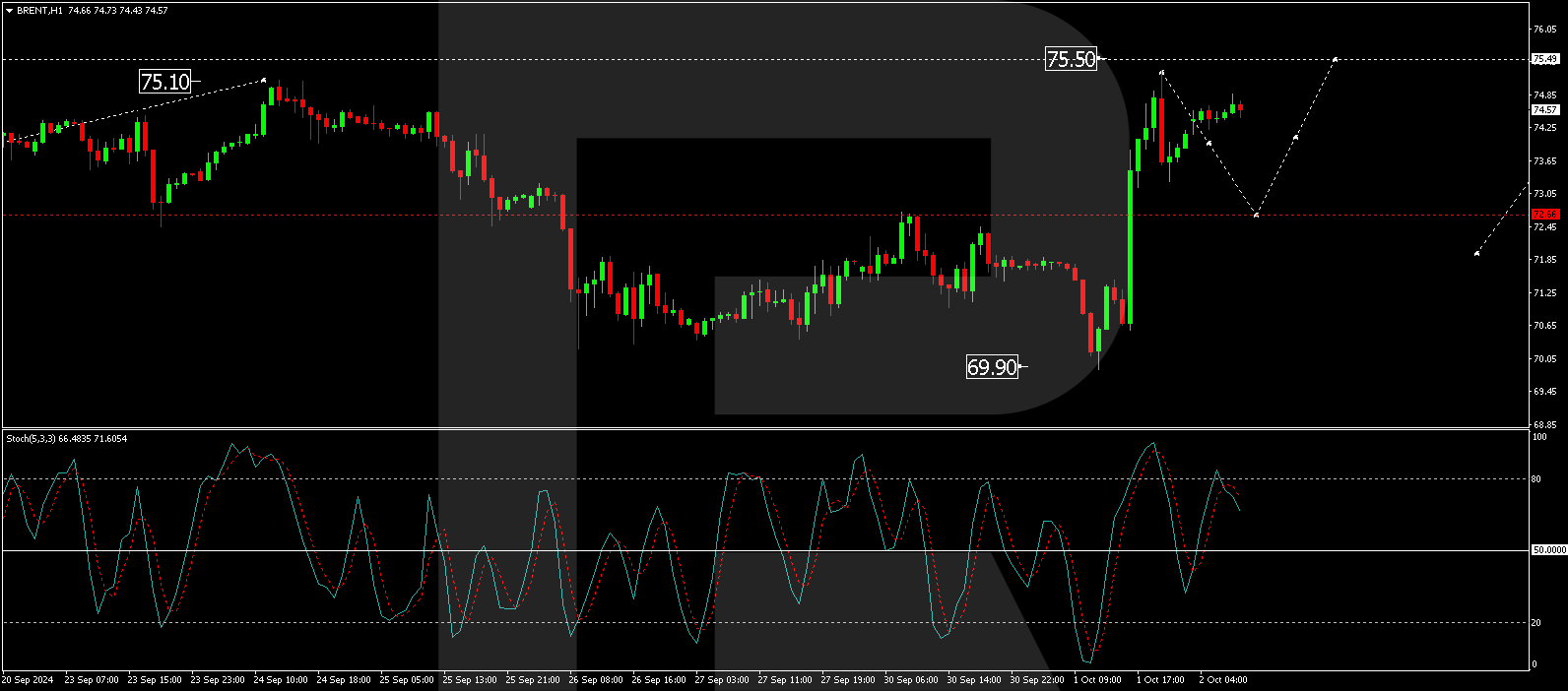

However, the sleeper in the China stimulus narrative is the one commodity that drives all economic growth — oil — and whether or nor it is politically correct, it is not going away anytime soon. Subscribers were sent an email alert last Tuesday before the opening suggesting that I was revisiting the “energy trade.”

In that email alert, I wrote:

“The ETF that covers the big multinational oil & gas producers is the Energy Select Sector SPDR Fund (XLE:NYSEARC) that has traded as low as $78.98 last January and at USD $82.34 a couple of weeks ago. As can be seen from the chart, there have been three major “buy signals” since the lows of last month, with MACD, MFI, and now TRIX all kicking into gear. Accordingly, I want to take advantage of today’s pullback and take a starting position in the XLE. I have traded this ETF before, and when it moves, it moves fast with big gaps in price, and while it is not always easy to nail down the exact lows, sentiment numbers and trader positioning are about as dismal as one can get for any specific sector.”

The chart shown below was from the Monday close at $87.80, and my instructions were that bids at $87.00 might be successful since oil was called lower for the Tuesday opening. The XLE opened at $87.03, traded down to $86.90 after which oil executed a massive reversal to the upside taking XLE to a closing price of $89.80.

There are a great many oil bears out there that want to see fossil fuels outlawed and ICE’s outright banned. I consider those attitudes as archaic and ill-sighted as the electrification transition will take decades to complete. Thinking that the world can survive and grow without the use of oil is delusional.

I am not a moralist; I am a financial opportunist. I pore over charts and essays and financial statements day after day to try to find what I believe are legitimate chances to profit, with not even the slightest consideration of what the company may or may not be doing to “save the planet.” I recall one afternoon driving home from hockey practice in 1962, listening to the CBC newscaster discussing relations between JFK and Soviet premier Nikita Khrushchev regarding nuclear disarmament.

Frightened by what I was hearing, I asked my dad if “mankind” was going to bring about the end of the world. My dad responded with an answer I can never forget. He said, “Son, “mankind” will never bring about the end of the world. It might bring about the end of “mankind“ but it will never cause the end of the world.”

The egotism of these moralists who preach about carbon credits, global pollution, and every imaginable ecological sin committed by Big Oil or Big Nuclear, or the military-industrial complex is beyond maddening. Watching the student body of a university lying in front of cars, trucks, and buses as a protest to the petroleum industry takes me to a place that I won’t even mention.

I was one of those poor slobs during the Arab oil embargo of 1973-1974, sitting behind the wheel of a 1965 Ford Custom while in a 30-car line-up waiting for a chance to fill the tank up, which was running on fumes. It was not a fun time.

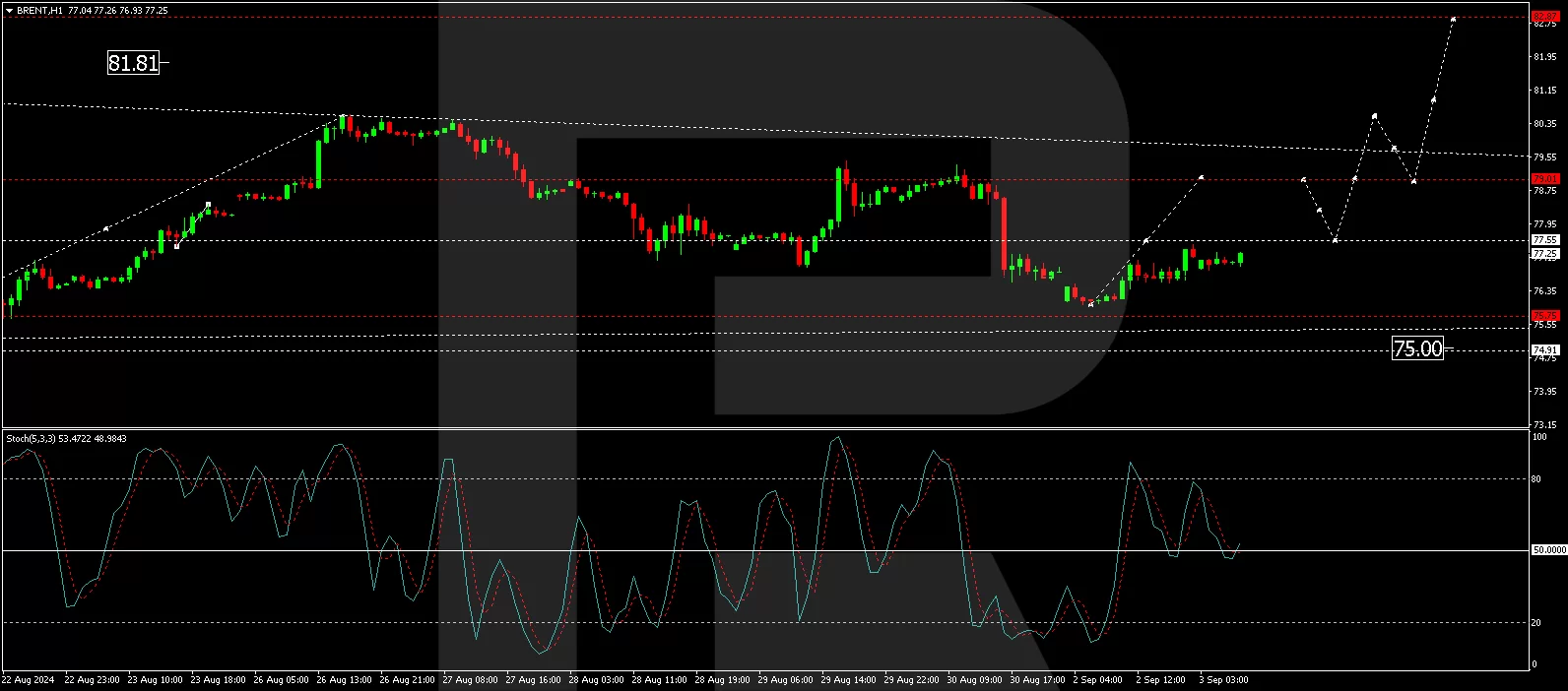

Another name I now own is a fascinating little junior from the Alberta oil patch called HHemisphere Energy Corp. (HME:TSX.V), which I bought last Tuesday. Paying a 5% dividend, the company uses a Polymer-flooding technique to enhance oil recovery from pools in Alberta and Saskatchewan.

They have been growing production systematically since 2017 and had a record year in 2023 and expect even better for 2024.

It is a perfect addition to a mining-centric portfolio and delivers diversification with an enviable income stream.

Gold and Silver

Gold put in a decent week, and up until around 11:00 am this morning, after the traders had a couple of hours to mull over the jobs report, silver made a very brief sojourn into the new 52-week high ground before coming under the merciless wrath of the bullion bank behemoths that decided to crush the breakout with undeniable conviction and send it down from an $.80 advance to a $0.07 loss on the day.

The silver bugs were collectively disheartened and summarily vanquished as they always are whenever they start to trot out the champagne flutes, cymbals, and pompoms. I am positive about the inevitability of a silver breakout, but it will be led by gold and copper, the two primary drivers of the bull market in the metals. While gold is being driven higher by that constant and persistent central bank bid, copper is being driven by a rapidly approaching structural deficit that is going to disrupt the global flow of everything because copper is found in everything.

Housing, electronics, medicine, and a myriad of other products and industries that rely on copper for its universal application. Silver, while also used in a broad spectrum of industrial applications, is primarily driven by the retail crowd ever seeking a “poor man’s gold” and, as such, rarely winds up being owned but rather rented with an ownership horizon far shorter than either gold or copper.

That explains the volatility in the silver market and why it is that the bullion bank traders find it so much easier to bat silver around whenever they choose while rarely daring to try the same with gold and never trying it with a market as wide and expansive as copper. That said, there will be a point in time and soon when silver will overtake both gold and copper and assume a leadership role, which will make the silver bugs giddy with “I-told-you-so” excitement as it grabs the reins and vaults into the lead, grabbing headlines in every financial publication and two-bit tout sheet across the globe.

The silver bugs will all rejoice in their final and ultimate vindication of owning one of the worst-acting metals of the past four years, and while I will be an owner of silver when that occurs, I shall not be mired in self-adulation because, at the point in the metals cycle where silver grabs all of the headlines, it is also the terminus of the move in the metals.

Every metals bull market ends with the silver bugs shaking their fists at the world, and when that occurs, as happened in 1980 and 2011, I want to be in full liquidation mode of the more speculative pieces in my metals portfolio and moving to hedge the “never-sell” portions that are intractable items for the financial future.

This is why I have always wanted gold to lead the pack slowly, quietly, and methodically, as it has since 2020, correcting and advancing with higher highs and higher lows. I never want to see CNBC “Guest Commentators” voicing their opinions on a gold market that has been “LIMIT UP” for three straight days because once the prey comes out of the brush and into the broad daylight, it becomes an enviable target.

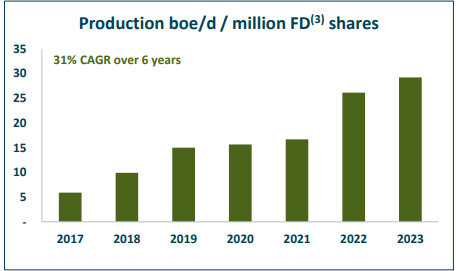

Near-term, gold prices are due for a correction. The bearish indicators all line up after RSI moved into overbought extremes in late September. Unlike last April when I tried to trade the correction, I will simply stand aside and let the market work off the overbought condition and try to time the pullback so I can be leveraged properly into new highs by year-end.

For now, no new buys in the bigger names, but the juniors are still ridiculously “cheap.”

Stocks

Friday’s NFP report showed a blow-out increase in the number of new jobs, sending the CNBC cheerleaders into a full-on feeding frenzy as the stocks took aim at all-time highs. The cheering centered around “good news” on the economy being “good news” for stocks, and despite the bond market taking it on the chin, when one lifted the hood and looked into the engine room, all one saw was a bunch of new government jobs and a “wages paid” number that set off the inflationary alarm bells with vigor.

However, the bulls are carrying the day but with the Middle East on fire and the REPO and SOFR markets starting to sweat bullets (i.e. liquidity drying up), I will remain fully-hedge until at least the end of the month.

Rising wages, rising oil, rising gold and rising 10-year yields are never earmarks of a risk-free equities environment. Caution is warranted.

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Article by

Article by