By RoboForex Analytical Department

The EUR/USD pair is trending downward, approaching 1.0829 on Friday as investors evaluate the latest developments in US Federal Reserve monetary policy.

Key drivers behind EUR/USD movement

On Wednesday, the Federal Reserve held its current interest rate and overall monetary policy framework unchanged. However, the central bank signalled that two rate cuts could be expected later this year. In its commentary, the Fed highlighted growing risks to economic recovery, employment stability, and inflation trends.

Fed Chair Jerome Powell downplayed concerns about the inflationary impact of tariffs imposed by the Trump administration, describing them as temporary. Powell also emphasised that the Fed would not rush into further rate cuts, reinforcing a cautious approach to monetary easing.

Adding to market uncertainty, Trump’s retaliatory tariffs – targeting countries that have imposed duties on US goods – are set to take effect on 2 April. Over the past 24 hours, the US dollar has strengthened amid fears of slowing global economic growth and escalating trade tensions. These factors have reinforced risk-averse sentiment among investors.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Technical analysis of EUR/USD

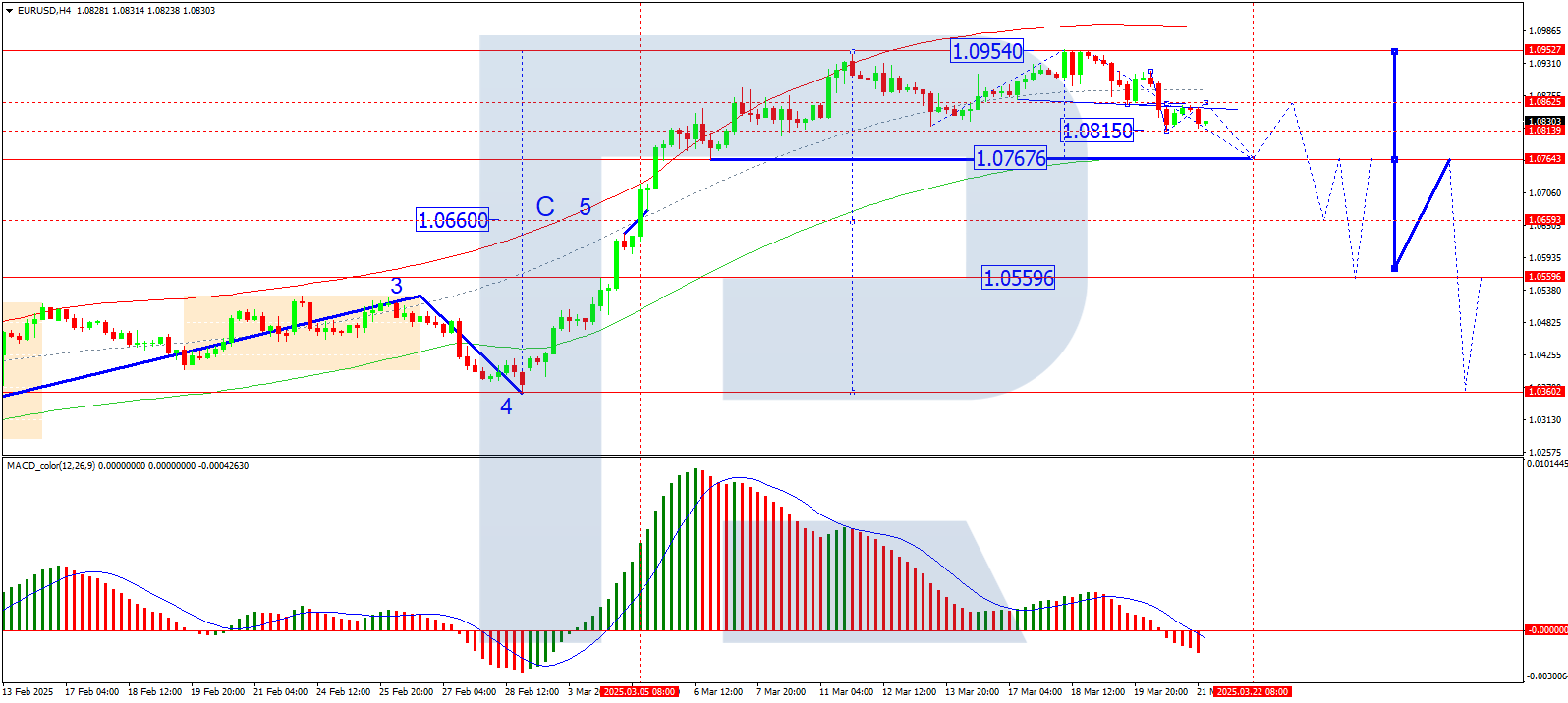

On the H4 chart, EUR/USD declined to 1.0815, followed by a correction to 1.0860. A further decline towards 1.0765 is highly likely, with this level remaining the primary target. The MACD indicator supports this scenario. Its signal line is below zero, sloping sharply downward, indicating potential new lows.

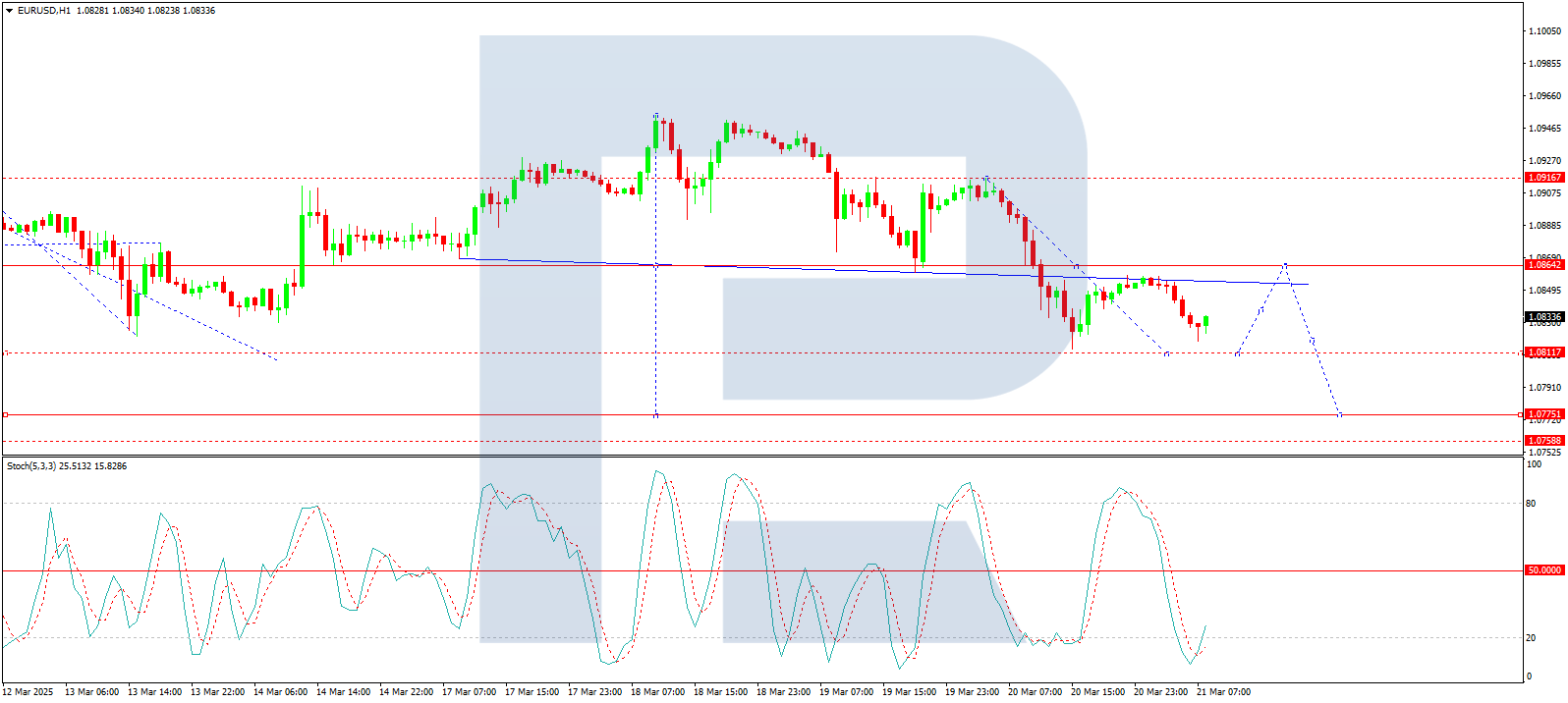

On the H1 chart, EUR/USD broke through the 1.0864 level and formed a bearish wave structure, reaching 1.0815. Today, a corrective move towards 1.0860 (testing from below) is likely. Once this correction concludes, the pair could resume its downward trajectory, targeting 1.0811. This movement marks the third wave of the downtrend. After reaching this level, another retracement towards 1.0864 is possible. The Stochastic oscillator supports this outlook, with its signal line below 20 and trending upward towards the 50 level.

Conclusion

The EUR/USD pair remains under pressure as the Fed’s cautious stance and global trade tensions bolster the US dollar. Technical indicators suggest further downside potential, with key support levels at 1.0765 and 1.0811. Investors should monitor upcoming economic data and trade developments for additional insights into the pair’s direction.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- It Looks Like Its a Good Time To Buy This Gold Stock Mar 28, 2025

- Copper Co. Should Be Up Way Higher Mar 28, 2025

- Banxico cut the rate by 0.5%. The global auto market is under pressure from the introduction of tariffs. Mar 28, 2025

- The Pound Stands Strong Amid Global Trade Tensions Mar 28, 2025

- Uncertainty over the scope and impact of tariffs increased market volatility Mar 27, 2025

- EUR/USD Faces Further Decline Amid Market Jitters and Trump’s Tariff Threat Mar 27, 2025

- Australia’s inflation rate is at a 3-month low. Oil prices are approaching $70 again Mar 26, 2025

- USD/JPY Rises Again: Yen Lacks Support as Bulls Take Control Mar 26, 2025

- Oil prices rise amid a new OPEC+ plan to cut production. Inflation in Singapore continues to weaken. Mar 24, 2025

- SNB cut the interest rate to 0.25%. Inflationary pressures are easing in Hong Kong and Malaysia Mar 21, 2025