By RoboForex Analytical Department

Brent crude oil’s price increased to 76.88 USD per barrel on Wednesday, continuing to rise for the second consecutive session. This rebound helps mitigate previous losses, which were part of a broader market risk aversion phase.

Current market dynamics

Investor concerns about energy supply disruptions are heightening due to political developments in Hamas and ongoing unrest affecting Libya’s Sharara oil field. These factors contribute to apprehensions about potential threats to oil supply from the Middle East.

Additionally, the latest data from the American Petroleum Institute (API) indicated a modest rise in US oil inventories, less than market forecasts, which had anticipated a more considerable increase. This was the first inventory build in five weeks, adding a layer of complexity to market dynamics.

Broader economic concerns, including fears of a US recession and weak Chinese demand, continue to exert downward pressure on oil prices.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

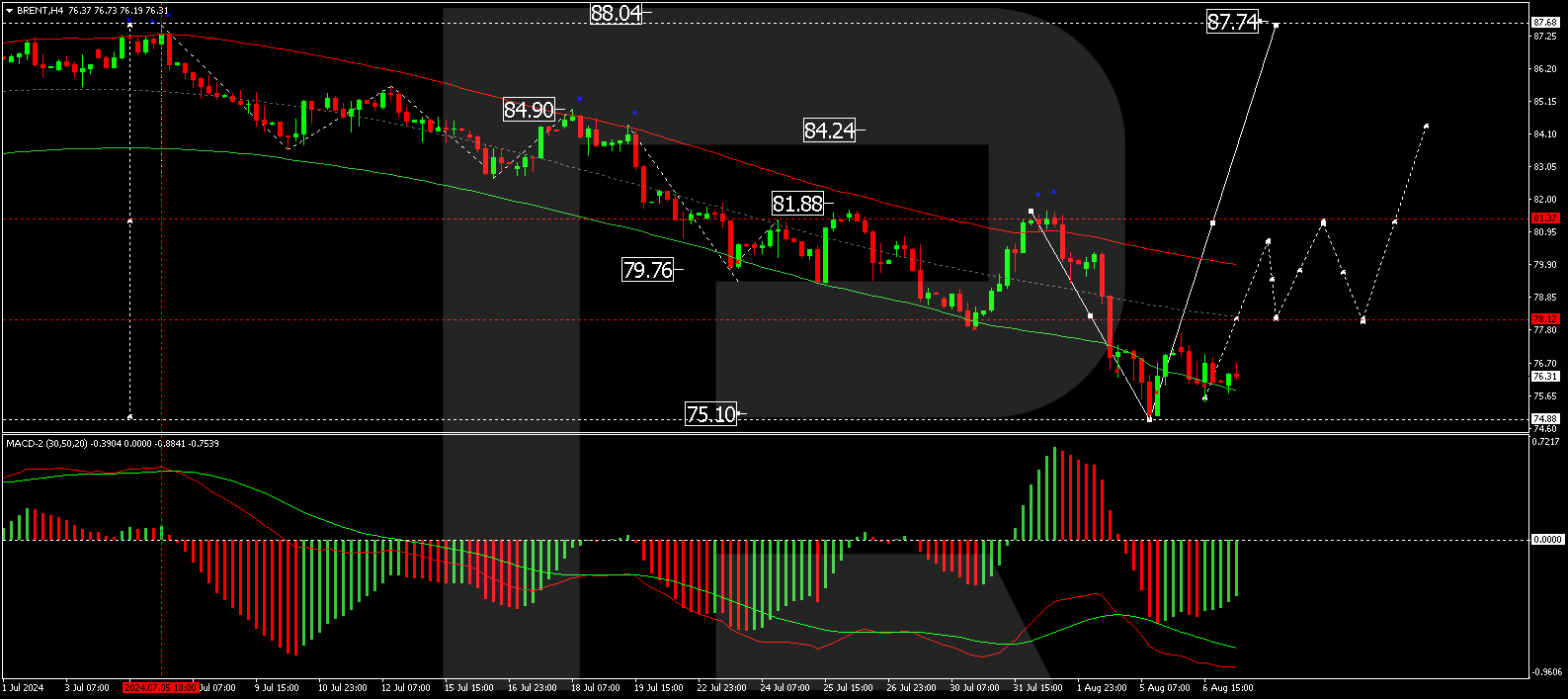

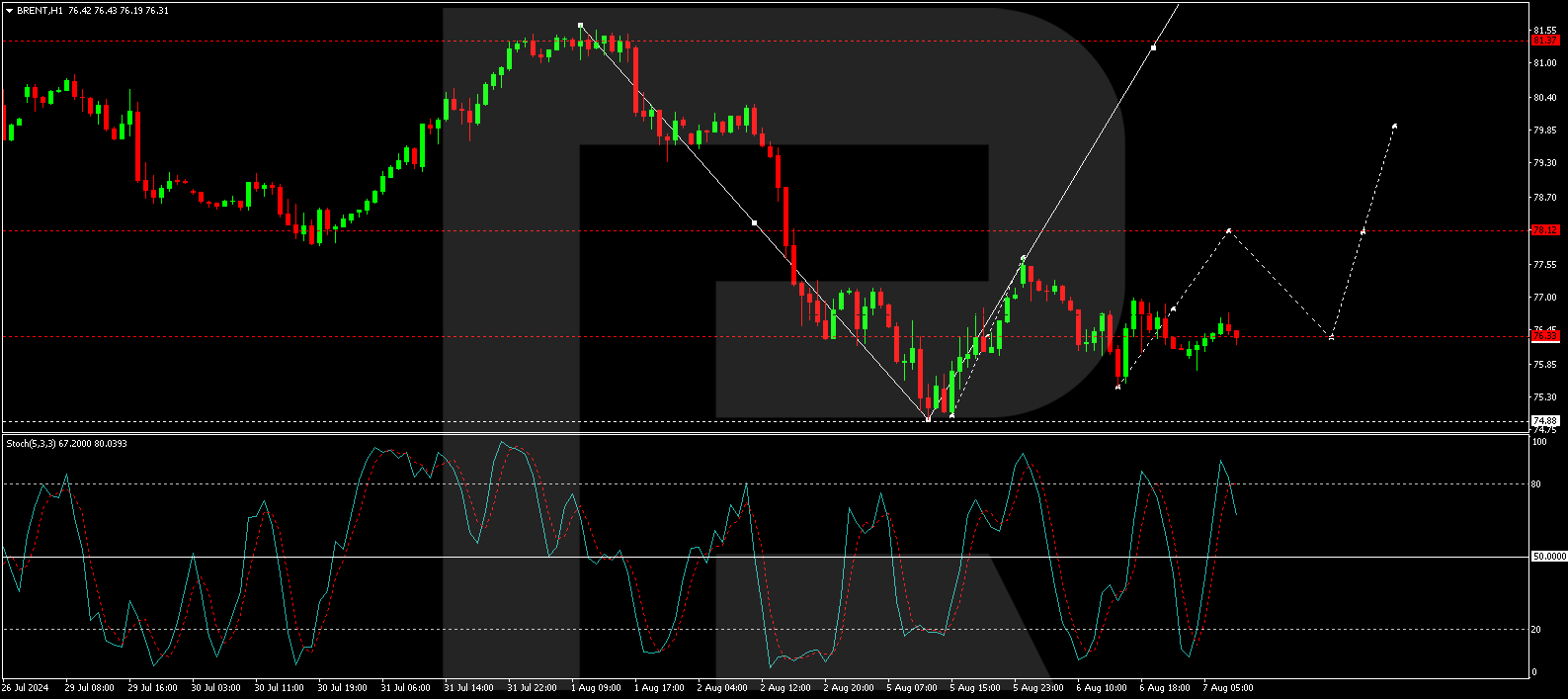

Technical analysis of Brent

The H4 chart suggests that Brent is progressing towards the 78.12 USD level. After reaching this target, a pullback to 76.33 USD could occur, potentially setting the stage for another upward movement towards 79.85 USD and extending to 81.37 USD. The MACD indicator supports this bullish scenario, with the signal line positioned for upward momentum from current lows.

On the H1 chart, Brent has established a consolidation range of around 76.33 USD. An upward breakout towards 78.12 USD is anticipated. Once this target is achieved, a retracement to 76.33 USD might follow. The Stochastic oscillator is poised near the 80 level, suggesting an impending downturn, which aligns with the expected corrective phase following the initial rise.

Market outlook

Investors should monitor further geopolitical developments and additional inventory reports, which could significantly influence oil price movements. The upcoming Federal Reserve communications and economic indicators will also be crucial in shaping market sentiment, especially concerning the potential for economic slowdowns, which could impact oil demand.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & 10-Year Bonds Dec 21, 2024

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Palladium Dec 21, 2024

- COT Soft Commodities Charts: Speculator Bets led by Live Cattle, Lean Hogs & Coffee Dec 21, 2024

- COT Stock Market Charts: Speculator Bets led by S&P500 & Russell-2000 Dec 21, 2024

- Riksbank and Banxico cut interest rates by 0.25%. BoE, Norges Bank, and PBoC left rates unchanged Dec 20, 2024

- Brent Oil Under Pressure Again: USD and China in Focus Dec 20, 2024

- Market round-up: BoE & BoJ hold, Fed delivers ‘hawkish’ cut Dec 19, 2024

- NZD/USD at a New Low: The Problem is the US Dollar and Local GDP Dec 19, 2024

- The Dow Jones has fallen for 9 consecutive trading sessions. Inflationary pressures are easing in Canada. Dec 18, 2024

- Gold Holds Steady as Investors Await Federal Reserve’s Rate Decision Dec 18, 2024