By RoboForex Analytical Department

Gold prices have surged, reaching $2430 per troy ounce on Tuesday, flirting with historic highs. The recent spike in gold prices is largely attributed to comments made by Federal Reserve Chairman Jerome Powell, which have bolstered expectations of an impending interest rate cut.

In his latest address, Powell highlighted that recent U.S. economic indicators are encouraging, suggesting that inflation is moving towards the target. Importantly, he indicated that the Federal Reserve might initiate monetary easing before inflation strictly hits the 2% target mark.

Market anticipation for rate adjustments is palpable, with consensus almost fully expecting a rate cut as early as September, with a potential second cut before year-end. Such monetary policy adjustments typically bolster gold prices, making it an attractive investment in times of lower interest rates.

Concurrently, the political landscape in the U.S. could influence market dynamics. Increasing prospects of Donald Trump’s success in the upcoming presidential race could strengthen the U.S. dollar and uplift Treasury yields, potentially tempering gold’s rally.

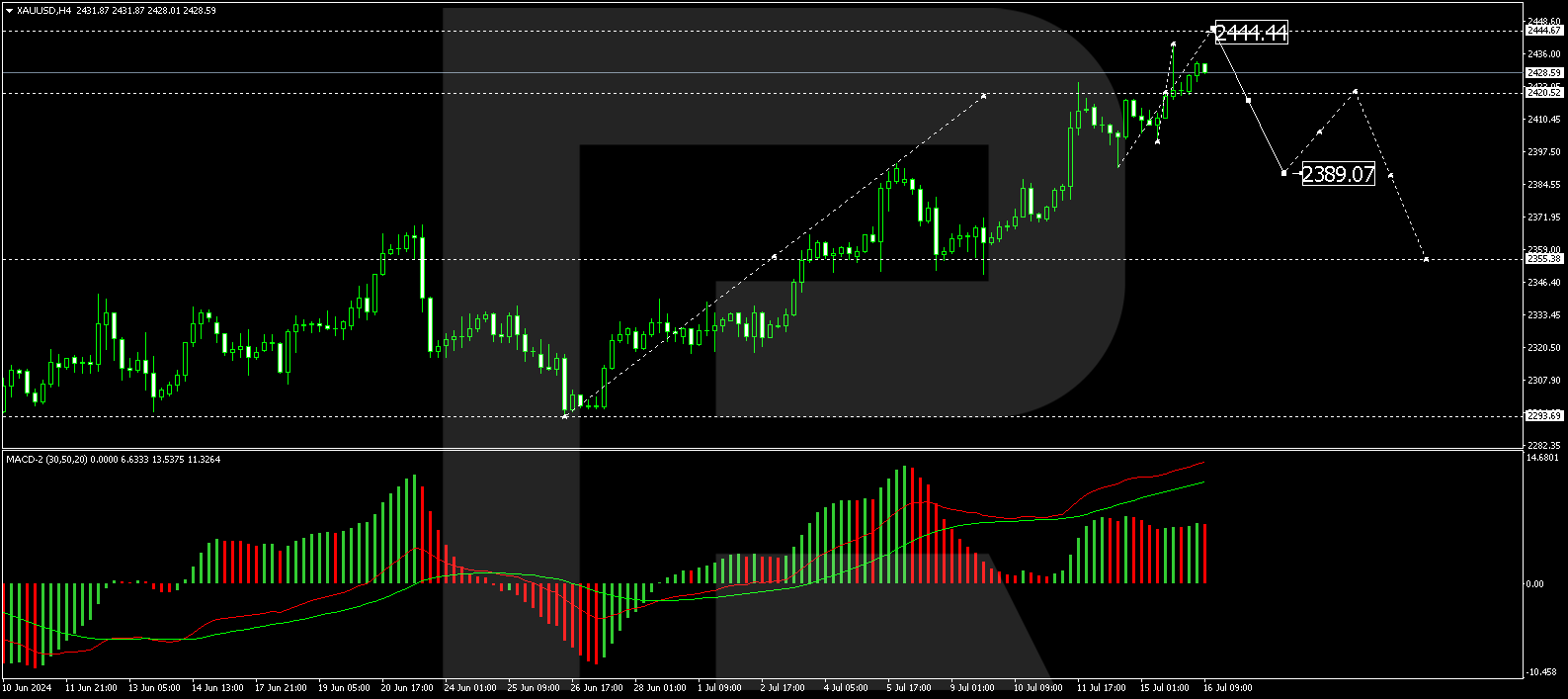

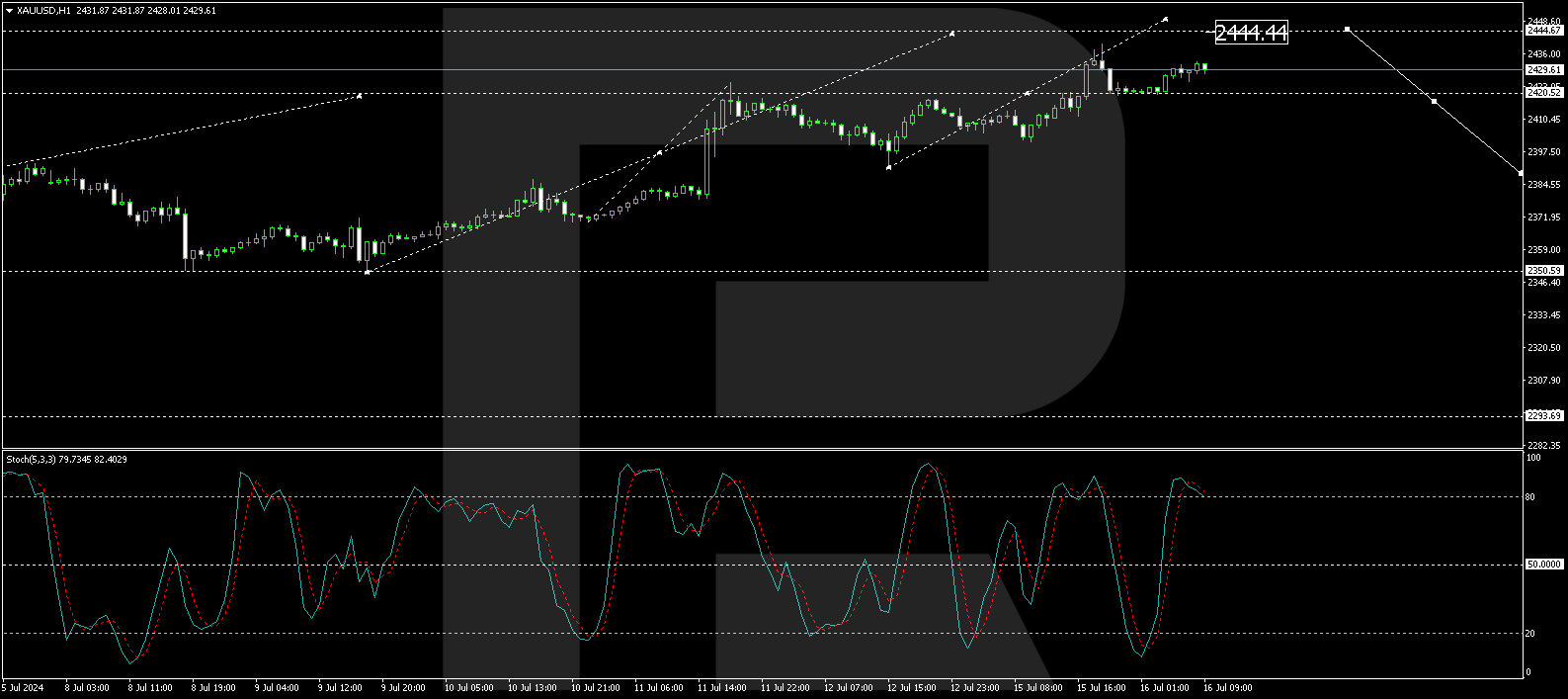

Technical analysis of XAU/USD

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The XAU/USD pair has recently executed a significant upward move to $2420.50 and is now oscillating within a consolidation range near this level. We might see an extension of this range up to $2444.44. Should this level be reached, a corrective pullback to $2350.50 could ensue. This scenario is technically supported by the MACD indicator, which shows a strong upward trend.

On the hourly chart, gold has breached the $2420.50 mark and is stabilizing above this threshold. We anticipate further growth towards $2444.44. Upon achieving this peak, a potential reversal towards $2350.50 may occur, marking the commencement of a bearish phase. The Stochastic oscillator, currently positioned above 80, suggests a downward adjustment is likely following the climb.

Investors and traders are advised to monitor these levels closely, especially in light of upcoming economic data and Fed communications which could further sway gold’s price trajectory.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Today, investors focus on the Non-Farm Payrolls labor market report Apr 4, 2025

- USD/JPY collapses to a 6-month low: safe-haven assets in demand Apr 4, 2025

- GBP/USD Hits 21-Week High: The Pound Outperforms Its Peers Apr 3, 2025

- Most of the tariffs imposed by the Trump administration take effect today Apr 2, 2025

- EUR/USD Declines as Markets Await Signals of a Renewed Trade War Apr 2, 2025

- “Liberation Day”: How markets might react to Trump’s April 2nd tariff announcement? Apr 2, 2025

- The RBA expectedly kept interest rates unchanged. Oil rose to a one-month high Apr 1, 2025

- World stock indices sell off under the weight of new tariffs Mar 31, 2025

- COT Metals Charts: Speculator Bets led by Copper & Palladium Mar 30, 2025

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds, Fed Funds & 2-Year Bonds Mar 30, 2025